具体数字显示资本密度与地理集聚:巴西尔登附近规划兴建 13 亿英镑(17 亿美元)AI 资料中心,周边直接投资估计约 10 亿英镑;谷歌在瑟罗克提出「超大规模」计划,微软与英伟达在劳顿推进超级电脑。与此同时,通勤带白领城镇如圣奥尔本斯距伦敦约 25 英里,绿带限制开发,却更暴露于自动化冲击。

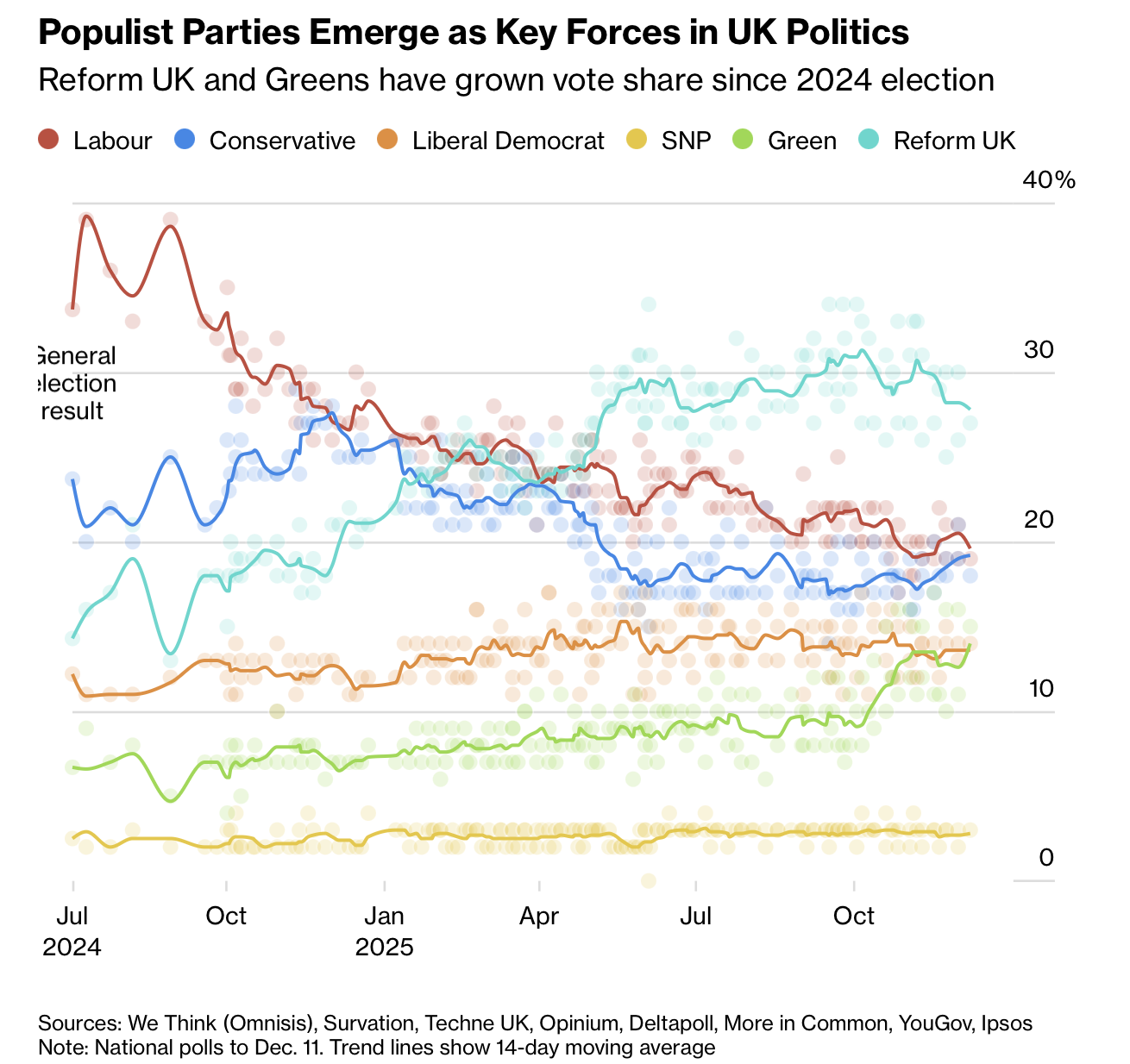

民调与职业暴露交叉分析凸显「领翻转」风险:依 ILO 的 AI 暴露排名与英国普查对照,圣奥尔本斯在高风险选区中列前 20;2021 年当地 51% 劳动人口属管理/专业职,而瑟罗克为 26%、巴西尔登为 30%。论点是:过去 30 年受益的「高学历、高房价」白领区,未来 10 年可能更不安,进一步加速已在约 100 年政治格局中酝酿的民粹转向;不过地方也在从「0 到 100」的变化中寻求转型。

The piece contrasts Essex’s AI boom with commuter-belt white-collar risk to show how AI could reorder Britain’s economy and politics. A region symbolized by the failed 1381 Peasants’ Revolt now leads another disruption, after voting strongly for Brexit in 2016 and becoming a Reform UK stronghold. With adequate power, water, and brownfield land, southern Essex is positioned to capture construction, high-skill jobs, and new capital flows.

The investment numbers are striking: a £1.3 billion ($1.7 billion) AI data center is planned near Basildon, with direct investment around Basildon alone estimated at about £1 billion. Google is proposing a hyperscale site in Thurrock, and Microsoft with Nvidia is building a supercomputer near Loughton. Yet less than an hour away, places like St Albans—about 25 miles from London and constrained by green-belt land—face fewer build-outs but greater exposure to automation.

Using an ILO exposure index cross-referenced with UK census data, James Kanagasooriam ranks constituencies by automation risk and argues for a “collar flip.” St Albans sits in the top 20; in 2021, 51% of its workers were in managerial/professional roles versus 26% in Thurrock and 30% in Basildon. The claim is a class reversal: areas that “had it good” for 30 years may face a tougher next 10, amplifying populist shifts already reshaping roughly a century-old political order as change feels like going from 0 to 100.