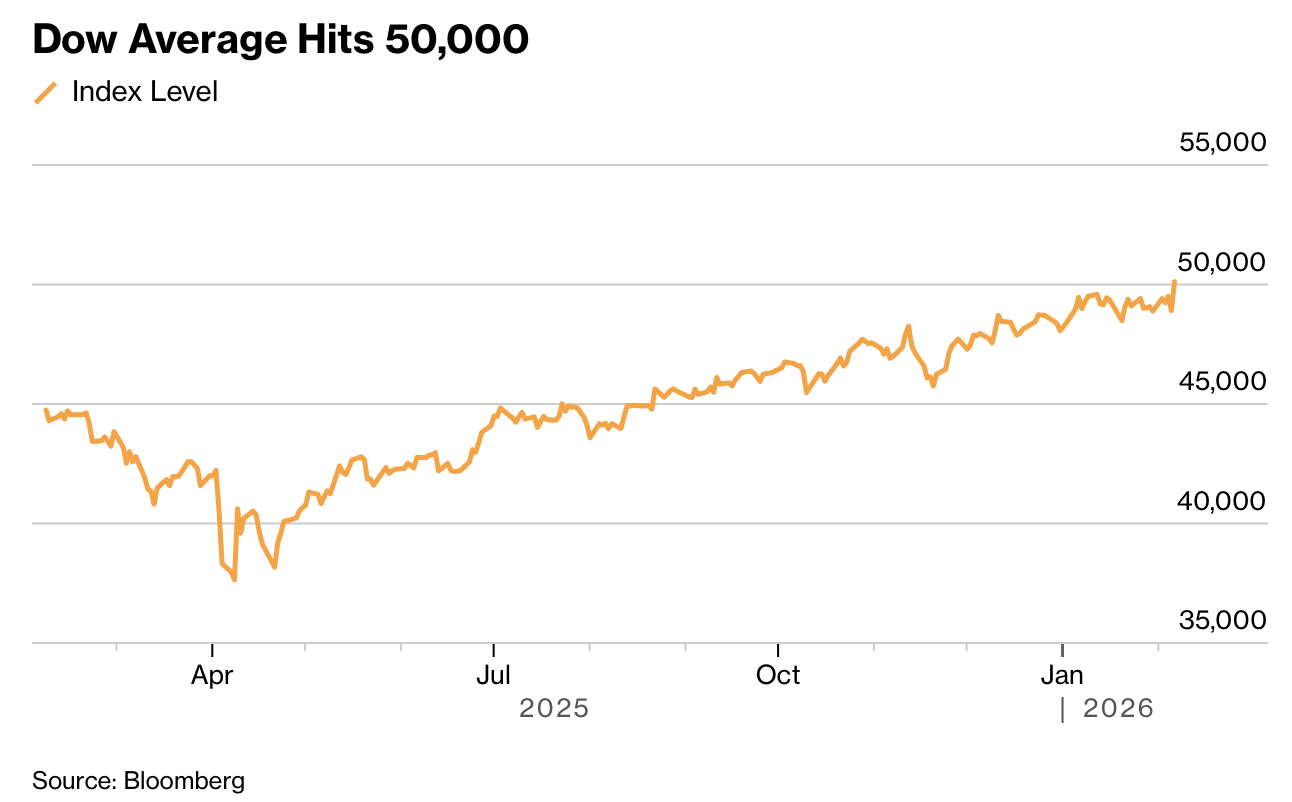

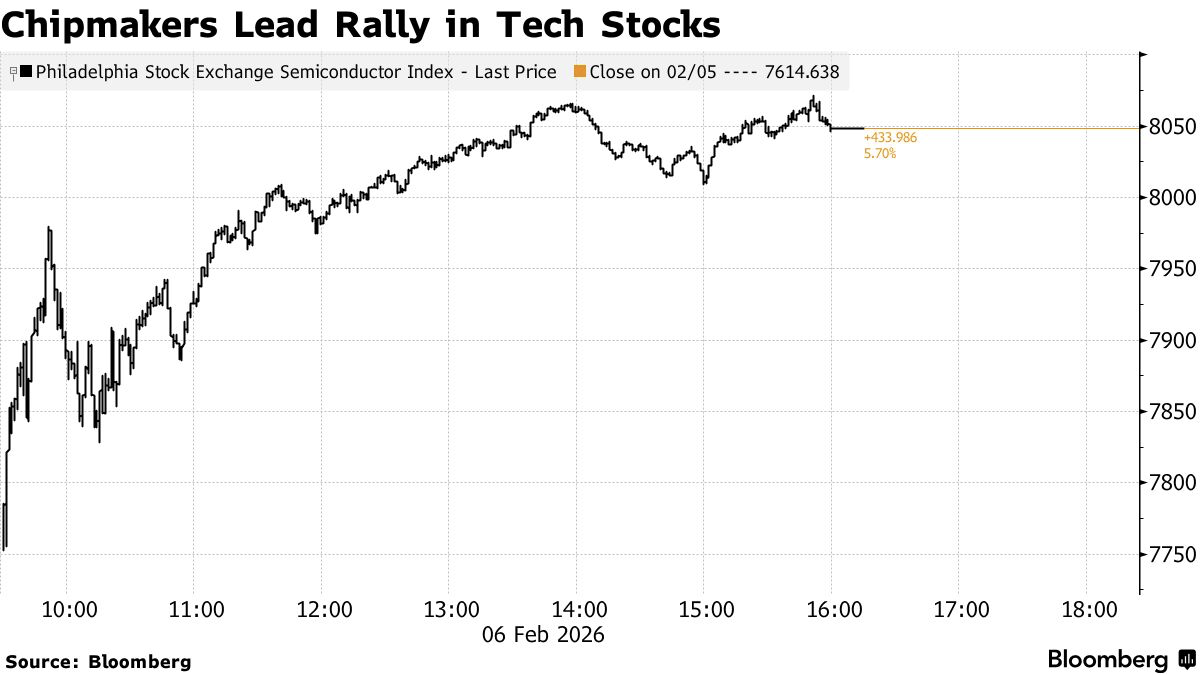

股市在经历科技股抛售后强劲反弹,创下自 5 月以来最佳单日表现。标普 500 指数上涨 2%,道琼斯工业平均指数首次突破 50,000 点,距离 2024 年 5 月站上 40,000 点用时 630 天。芯片股指数飙升 5.7%,软件 ETF 上涨 3.5%,罗素 2000 指数上涨 3.6%,等权重标普指数创历史新高,超过 400 只成分股上涨。比特币在此前从高点回落 50% 后反弹至约 70,000 美元,黄金和白银同步走高。

此次反弹发生在对 AI 投入规模的担忧引发情绪性去杠杆之后。尽管亚马逊因计划在 AI 上投入 2,000 亿美元而下跌 5.6%,市场认为抛售过度。10 年期美债收益率升至 4.21%,美元下跌 0.4%。消费信心升至六个月高点,宏观与盈利环境被视为仍具支撑。分析人士认为这是仓位调整与技术性回撤,而非基本面裂痕。

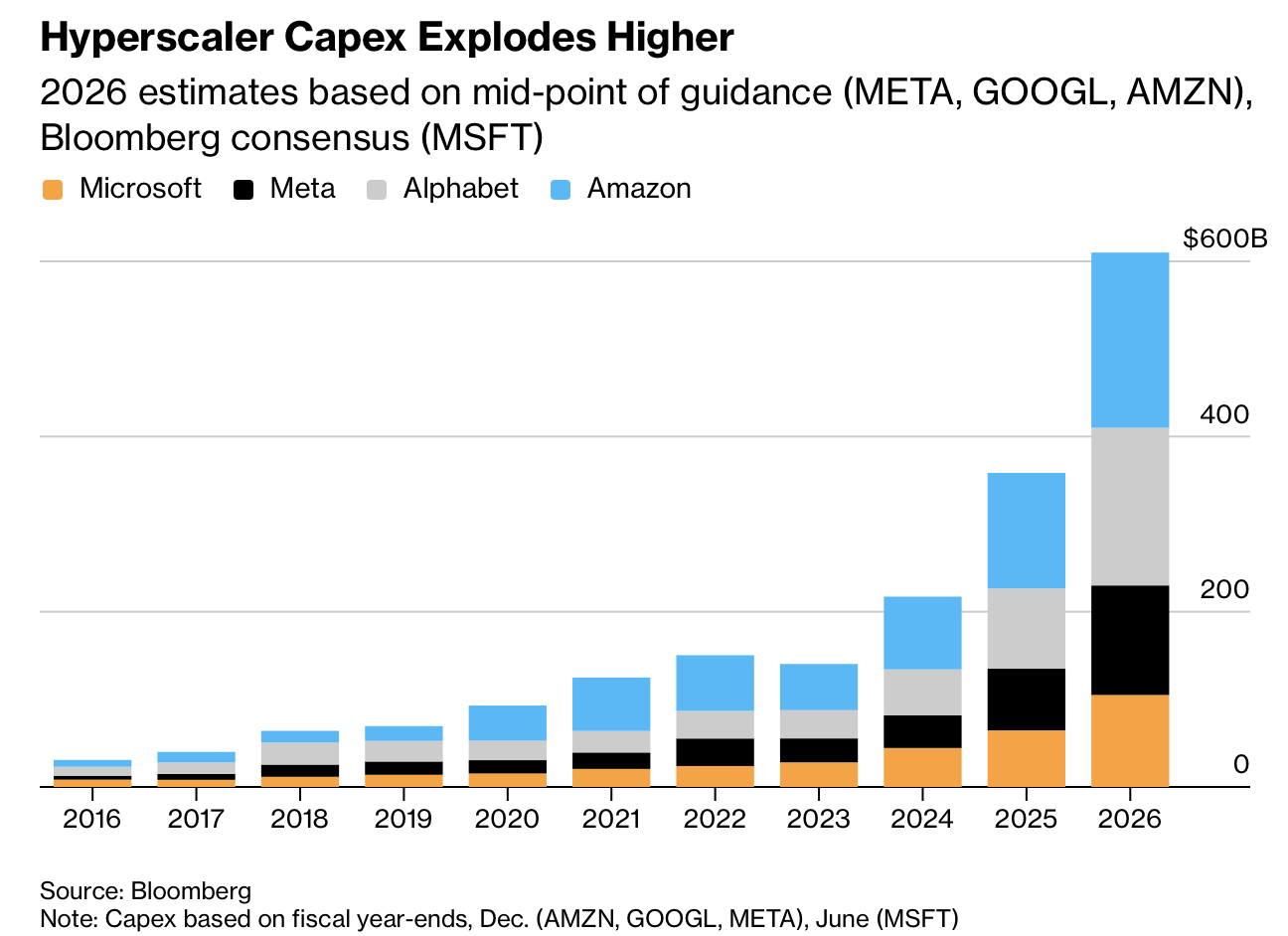

前瞻看,科技板块的资本开支规模巨大。Alphabet、亚马逊、Meta 与微软预计 2026 年资本开支合计约 6,500 亿美元,主要用于 AI 基础设施。纳斯达克公司第四季度盈利增速有望达 20%,较初始预期高 6 个百分点。尽管市场担忧回报周期,机构认为 AI 仍是结构性增长引擎,但轮动将加剧,投资回报将更依赖盈利质量与资本效率。

Stocks roared back after a tech-led selloff, posting the best single-day gain since May. The S&P 500 rose 2%, and the Dow Jones Industrial Average topped 50,000 for the first time, taking 630 days since closing above 40,000 in May 2024. Chipmakers surged 5.7%, a software ETF climbed 3.5%, the Russell 2000 gained 3.6%, and the equal-weighted S&P 500 hit a record, with more than 400 constituents advancing. Bitcoin rebounded to around $70,000 after a prior 50% drop from its peak, while gold and silver also rose.

The rebound followed emotional deleveraging tied to worries about massive AI spending. Even as Amazon fell 5.6% on plans to invest $200 billion in AI, investors judged the selloff overdone. The 10-year Treasury yield rose to 4.21%, the dollar slipped 0.4%, and consumer sentiment reached a six-month high. Strategists said macro and earnings conditions remain supportive, framing the move as positioning and a technical pause rather than a fundamental break.

Looking ahead, capital spending by big tech is enormous. Alphabet, Amazon, Meta, and Microsoft forecast combined 2026 capex of about $650 billion, largely for AI infrastructure. Fourth-quarter earnings growth for Nasdaq companies is tracking near 20%, about six percentage points above initial estimates. While payback timing is debated, institutions see AI as a structural growth driver, with increased sector rotation and returns hinging on earnings quality and capital efficiency.