斯蒂格利茨指出“无监管资本主义”导致财富极端集中,并使经济权力转化为政治不平等,从而与民主原则直接冲突。他强调全球不平等已呈结构性上升趋势,并以“95% 科学家共识”类比指出经济学界对财富极端化的认知虽未达气候科学一致性,但趋势无可否认。他主导创建“国际不平等委员会”(IPI),效仿 IPCC,通过识别不平等驱动因素来制定针对性政策。他支持纽约市长 Mamdani 的冻结租金与加税方案,强调住房市场的“地主市场力”与生活成本危机,并认为更平等的政策能提高劳动力健康与生产率,打破“平等必损增长”的旧范式。

他批评特朗普政府通过高关税与反移民政策“利用民粹愤怒”,指出美国 GDP 虽稳,但长期工资停滞、医疗与教育失能造成结构性不满。他警告限制移民将在食品、农业、建筑与护理等行业制造劳动力短缺,推动工资与价格上涨;当前投资几乎只集中于 AI、数据中心与能源,并呈现泡沫特征,可能维持 1–3 年。他称降息“不会创造工人或稀土”,无法解决供给限制,主张更多财政刺激与理性政策应对“非典型放缓”。

在国际体系上,他重申对“伪自由贸易协定”的批评,如 TPP 的药品条款过度满足大型制药企业利益。他预计美元储备地位将因全球多元化而下降,指出“美元储备持有量显著减少、黄金持有显著上升”,尤其中国动作突出。他主张新的全球储备体系,以凯恩斯提出的 Bancor 为蓝本,替代对美元的依赖。

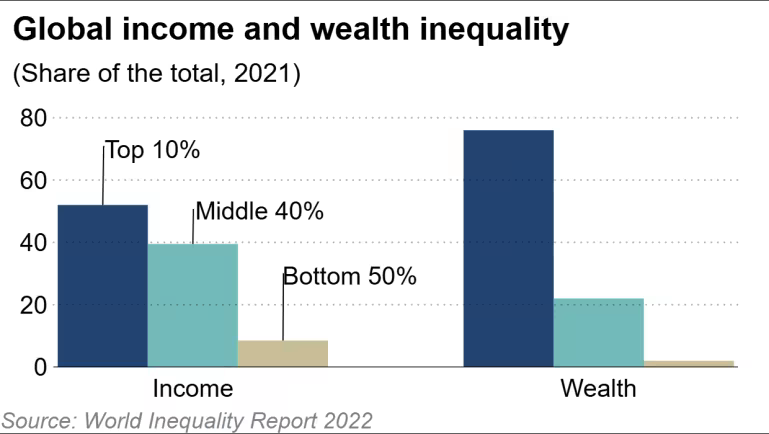

Stiglitz argues that “unfettered capitalism” drives extreme wealth concentration and converts economic power into political inequality, placing it at odds with democratic principles. He notes a clear global rise in inequality—analogous to a “95% consensus” pattern—despite less unanimity than climate science. He promotes the creation of the International Panel on Inequality (IPI), modeled on the IPCC, to identify systemic drivers. Supporting New York mayor Mamdani’s rent freezes and higher taxes, he highlights landlord market power and affordability crises, asserting that egalitarian policies raise labor-force health and productivity, challenging the old trade-off between equality and growth.

He criticizes the Trump administration’s tariffs and immigration limits as exploiting public anger, arguing that despite stable GDP, long-term wage stagnation and institutional failures fuel discontent. He warns that immigration cuts will create labor shortages in food, agriculture, construction and elder care, pushing wages and prices upward. Current investment is narrowly concentrated in AI, data centers and energy—“a bubble” that may last 1–3 years. Rate cuts, he argues, “do not create workers or rare earths,” and cannot solve supply constraints; he calls for stronger fiscal stimulus and rational policy in a “nonstandard slowdown.”

On global systems, he reiterates critiques of “managed trade” deals like the original TPP, shaped by pharmaceutical interests. He predicts declining reliance on the dollar as reserves diversify, citing “marked decreases in dollar holdings and increases in gold,” with China acting aggressively. He advocates a new global reserve framework, endorsing Keynes’s Bancor proposal as an alternative to the dollar-centered order.