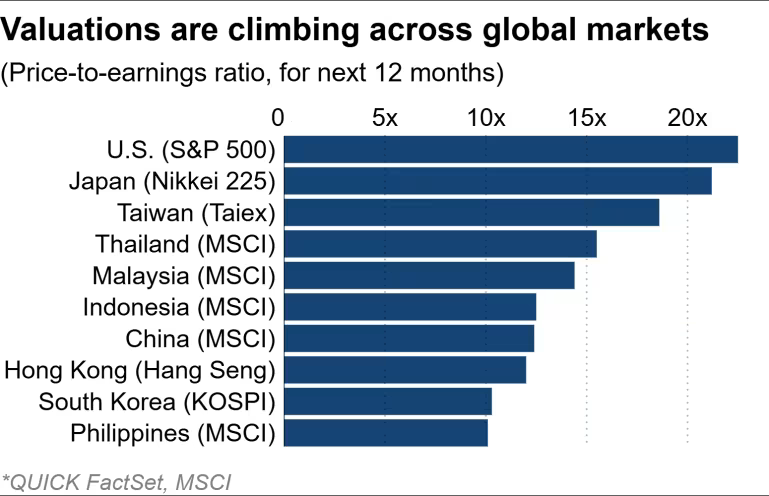

近 3 个多月 Nikkei 上涨逾 9,000 点,约 +20%,整体 P/E 倍数推向 20 左右。相较之下,台湾 Taiex 的 forward P/E 高于 18,而 South Korea 与 Hong Kong 约 10–11,显示 Japan 估值已高于区域同侪但仍有资金流入论点。基本面上,市场共识预期 4 月起的财政年度获利将出现双位数成长;Citigroup 的 Ryota Sakagami 指出 inflation 促进营收并(特别对非制造业)改善利润率。与 U.S. 相比,日本估值仍低于因 AI 热潮使 S&P 500 forward P/E 约 22 的水准;U.S. 过去十年区间中,高点为 2020 年初逾 27、低点为 2018 年末 15。Amundi Investment Institute 的 2026 展望则认为在偏正向宏观、宽松金融条件与 AI 热情下,高估值可能维持更久。

结构性因素被视为支撑估值的另一条线:Corporate Governance Code 修订、buybacks 动能与资本效率导向可能吸引投资人;但 HSBC 认为 Japan 估值扩张空间有限,关键在 ROE「未见有意义改善」。日本企业长期难以稳定突破 ROE 10% 门槛;对照之下,UBS SuMi TRUST Wealth Management 指出 U.S. ROE 由 2015 年 15% 升至近期 21%,同期间 P/E 由 2015 年 15–17x 升至 2025 年约 22x,并称 2026 可能成为 Japan 的转折点:若 ROE 突破既有区间,市场或预期 re-rating 并吸引海外资金。更广泛的 Asian equities 被 Morningstar 的 Lorraine Tan 评为接近 fair value,并预期因部分 AI 与材料股过贵而出现更高波动与 sector rotation;Value Partners 指出 2025 年落后的 ASEAN 仍具相对低估值。Citigroup 亦强调 South Korea 与 Taiwan 虽整体估值较低但结构偏 tech-heavy,若 tech rally 延续表现或更佳,但全球配置上难以只买这两地,因而仍存在增配 Japan 的空间。

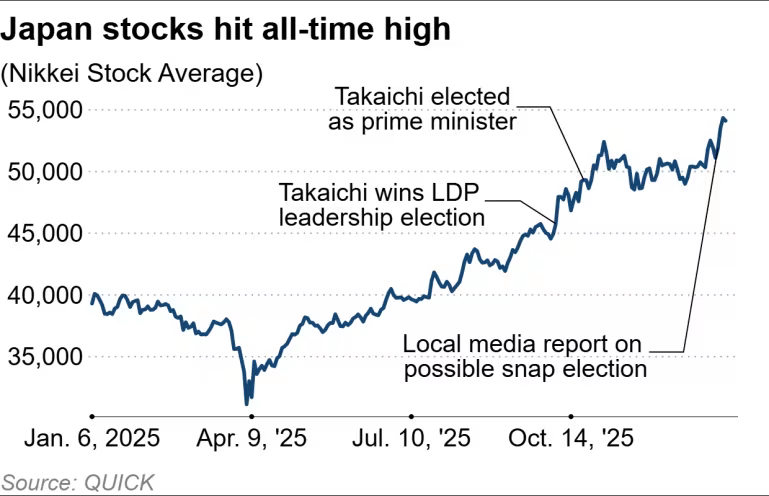

Japan’s equity rally, driven by expectations of more proactive fiscal policy, has reached historic highs and lifted valuations. Last week the Nikkei Stock Average touched 54,341.23 and Topix rose above 3,600, with momentum tied to Prime Minister Sanae Takaichi’s rise and her plan to dissolve the lower house at the start of the Jan. 23 legislative session to trigger a snap election (original: Jan. 23; date-only, no time-of-day to convert to UTC+8). State Street Investment Management’s Masahiko Loo framed the setup as a classic “Takaichi trade”: higher Nikkei, weaker yen, and weaker JGBs.

Over a little more than three months, the Nikkei gained more than 9,000 points, about +20%, pushing the market P/E multiple toward ~20. Japan now screens pricier than regional peers: Taiwan’s Taiex forward P/E is above 18, while South Korea and Hong Kong sit around 10–11, even after large 2025 moves. Earnings are the stated tailwind, with consensus calling for double-digit profit growth in the fiscal year starting in April; Citigroup’s Ryota Sakagami argues inflation is supporting revenue growth and, for non-manufacturers, margins. Versus the U.S., Japan’s valuation remains below the S&P 500’s ~22 forward P/E; U.S. extremes over the past decade ranged from above 27 in early 2020 to 15 in late 2018. Amundi Investment Institute’s 2026 outlook says a positive macro backdrop, easy financial conditions, and AI enthusiasm could keep valuations elevated longer.

Structural change is cited as an additional support: a revised Corporate Governance Code, stronger buybacks, and higher focus on capital efficiency. HSBC counters that Japan has limited room for valuation expansion because ROE has not improved meaningfully; Japan has struggled to sustainably exceed ~10% ROE. UBS SuMi TRUST Wealth Management contrasts this with the U.S., where ROE rose from 15% in 2015 to 21% recently as P/E moved from 15–17x (2015) to ~22x (2025), and argues 2026 could be a turning point if Japan’s ROE breaks above its range and triggers a re-rating and overseas inflows. Broader Asian equities are described by Morningstar’s Lorraine Tan as near fair value, with higher volatility and sector rotation expected as parts of AI and materials look expensive; Value Partners highlights comparatively low ASEAN valuations after 2025 underperformance. Citigroup adds that South Korea and Taiwan look cheaper but are tech-heavy, making “only those markets” difficult for global allocators and leaving room for Japan inflows.