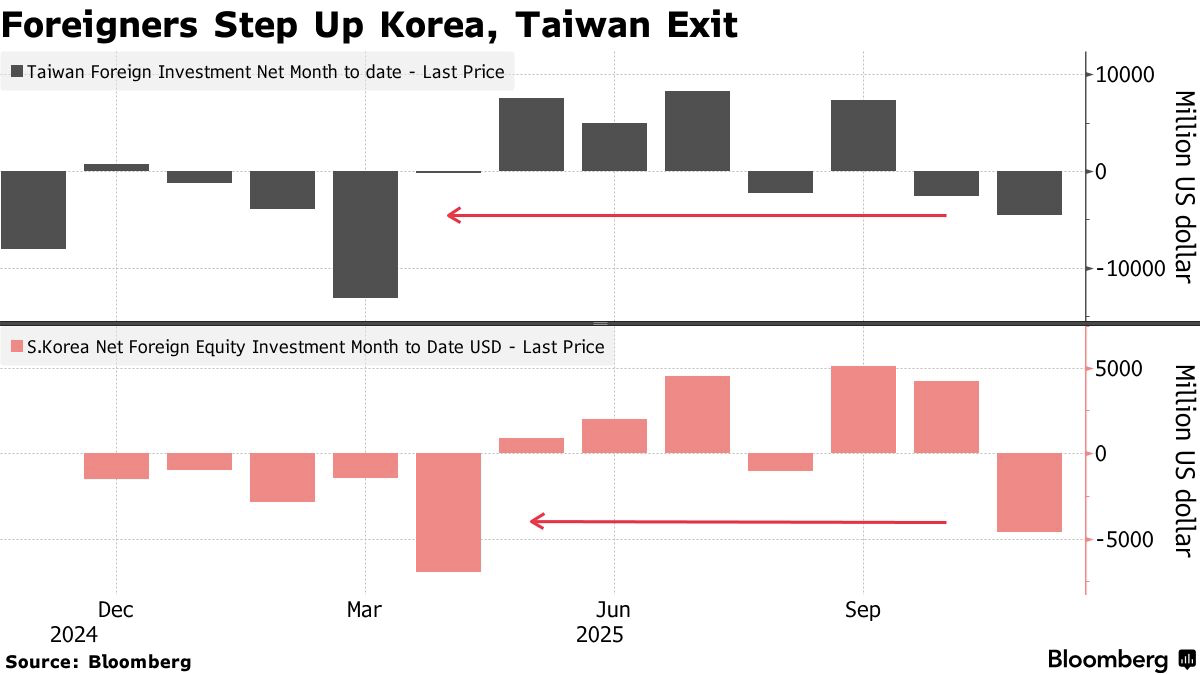

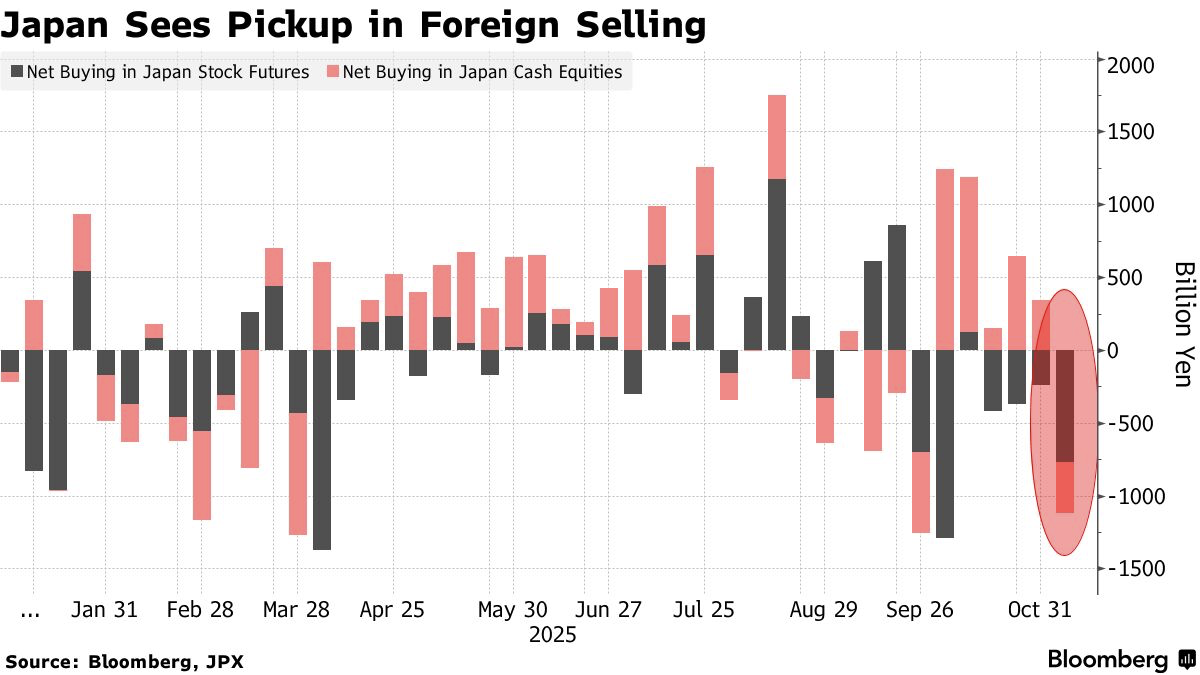

外资正以至少七个月来最快速度撤出亚洲主要 AI 市场:本月台湾与韩国股市各被净卖出约 46 亿美元,若延续将创下分别自 3 月与 4 月以来最大月度流出。日本也受波及,截至 11 月 7 日外资净卖出 23 亿美元股票,连同期货总额达 73 亿美元。恒生科技指数持续下跌进入技术性修正区间。多重指标显示区域估值过高与获利预期错配正触发避险与获利了结。

韩国 Kospi 自 4 月以来累计上涨 84%,但 11 月初高点后出现回落;台湾加权指数亦在本月回吐部分涨幅。市场对包括芯片与硬件供应链在内的“镐头与铁锹”类企业的免疫假设开始动摇,因投资人重新检视 AI 需求是否被高估。同时,循环交易现象上升,引发收入与估值被人为抬升的疑虑。

科技龙头财报进一步削弱情绪。腾讯下调 2025 年资本支出指引,百度最新 AI 模型展示未能满足市场预期,两者股价均于周五大幅下跌。随着美联储 12 月降息预期消退与风险偏好减弱,短期情绪回调被部分策略师视为“健康”,但区域跨市场资金流与估值调整显示 AI 主题正在经历明确的现实检验期。

Global investors are withdrawing from Asia’s key AI markets at the fastest pace in at least seven months: Taiwan and Korea each saw about $4.6 billion in foreign equity outflows this month, potentially the largest since March and April. Japan was also hit, with foreigners selling $2.3 billion through Nov. 7, rising to $7.3 billion including futures. The Hang Seng Tech Index has slid into technical correction territory. Elevated valuations and earnings-expectation mismatches are driving risk aversion and profit-taking.

Korea’s Kospi, up 84% since April, has retreated from early-November highs; Taiwan’s Taiex also surrendered part of its gains. Assumptions that “pick-and-shovel” chip and hardware suppliers were insulated from volatility are weakening as investors reassess whether AI demand has overshot. Rising circular-deal activity is amplifying fears that revenues and valuations are being artificially inflated.

Tech-earnings disappointments have compounded the pullback. Tencent cut its 2025 capital-spending outlook, while Baidu’s latest AI-model reveal fell short of expectations, sending both stocks sharply lower. With fading prospects of a December Federal Reserve rate cut and declining global risk appetite, strategists view the sentiment reversal as “healthy,” though cross-market flows and valuation pressure signal a clear reality check for the AI trade.