在德国科隆,Ford 的工厂自 1931 年起运营,但 Ford 在 9 月表示将再削减 1,000 个岗位——约占员工总数的四分之一——并在 1 月降为单班制,同时伴随更广泛的欧洲收缩。与之相对,CATL 在 Arnstadt 附近那座建成两年的 $2 billion 电池工厂雇用了接近 2,000 名德国员工,体现出与中国相关的 EV 投资在海外扩张,而与美国相关的产能在回撤。

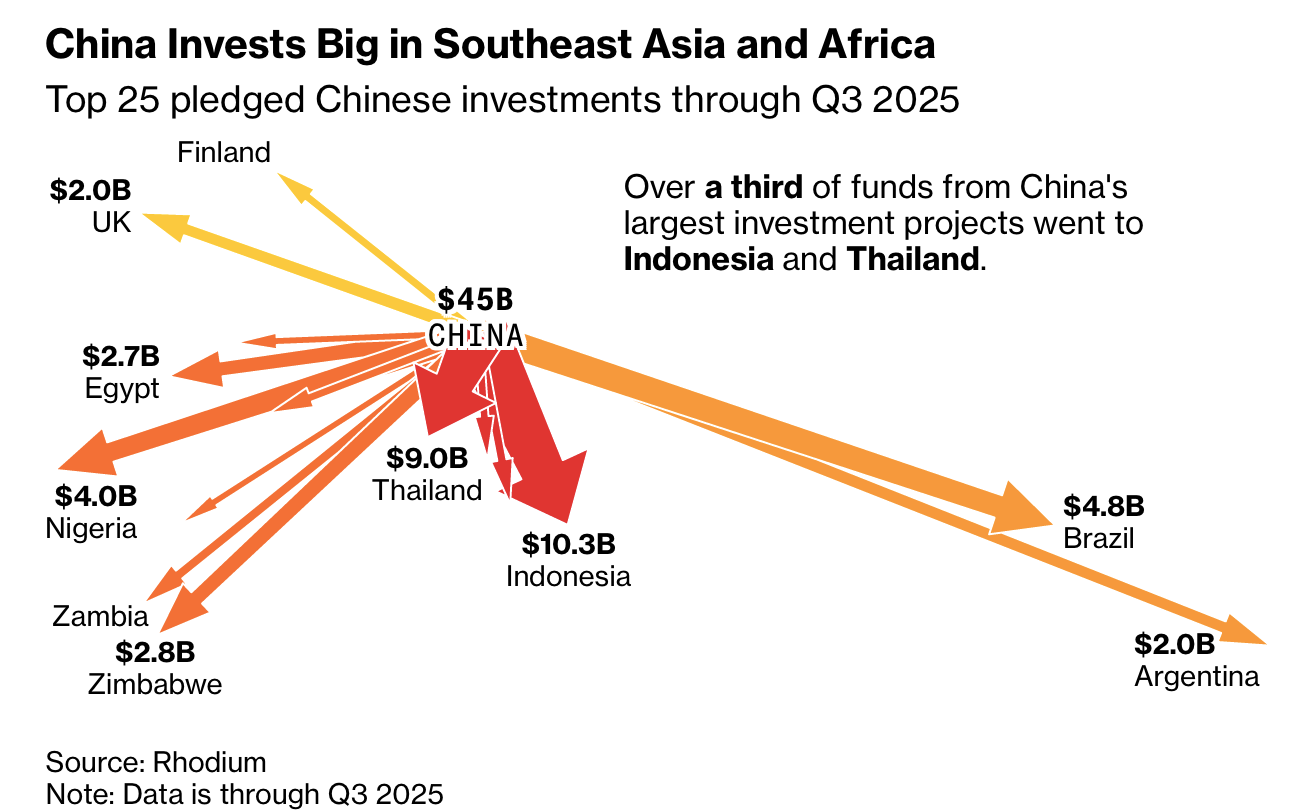

数据才刚开始反映这种逆转。2025 年上半年,中国对外投资流向世界其他地区的规模超过美国,并达到全球总量的 10%,而美国吸收了全球入境投资的大约五分之一,欧盟则较六个月前下降 45%。Rhodium Group 估计,已宣布的中国对外绿地投资在 2025 年创下纪录;在 2025 年前三季度宣布的 $106.6 billion 中,绿地项目超过 85%,其中包括 ByteDance 在巴西的 $38 billion 数据中心,以及 Tongkun Group 在印度尼西亚的 $5.9 billion 化工厂。Trump 声称美国入境投资承诺达到 $21 trillion,但 Bloomberg Economics 认为有记录的承诺充其量约为其三分之一。

尽管发生转向,投资“存量”仍然不同:截至 2024 年底,美国企业在海外持有约 $6.8 trillion 的长期实体投资(其中接近 $4 trillion 在欧洲),而中国报告的对外 FDI 存量为 $3.1 trillion,Rhodium 在剔除 Hong Kong 扭曲后估计约为 $1.7 trillion。欧洲正在讨论如何在管理安全风险的同时接纳能创造就业的中国项目;Macron 提到欧盟在中国的投资存量约 €240 billion,而反向不到 €65 billion。其他地区的政策摩擦也在上升,从墨西哥对 1,400 多种产品征收最高 50% 关税(1 月 1 日起),到瑞典更严格的审查促使 PTL 取消了计划中的 $1.4 billion 工厂,尽管 Volvo 承诺其新电池工厂将新增 3,000 个岗位。

In Cologne, Germany, Ford’s plant has operated since 1931, but Ford said in September it will cut another 1,000 jobs—about a quarter of the workforce—and drop to a single shift in January, alongside wider European pullbacks. By contrast, CATL’s two-year-old $2 billion battery factory near Arnstadt employs almost 2,000 German staff, illustrating China-linked EV investment expanding abroad as US-linked production retrenches.

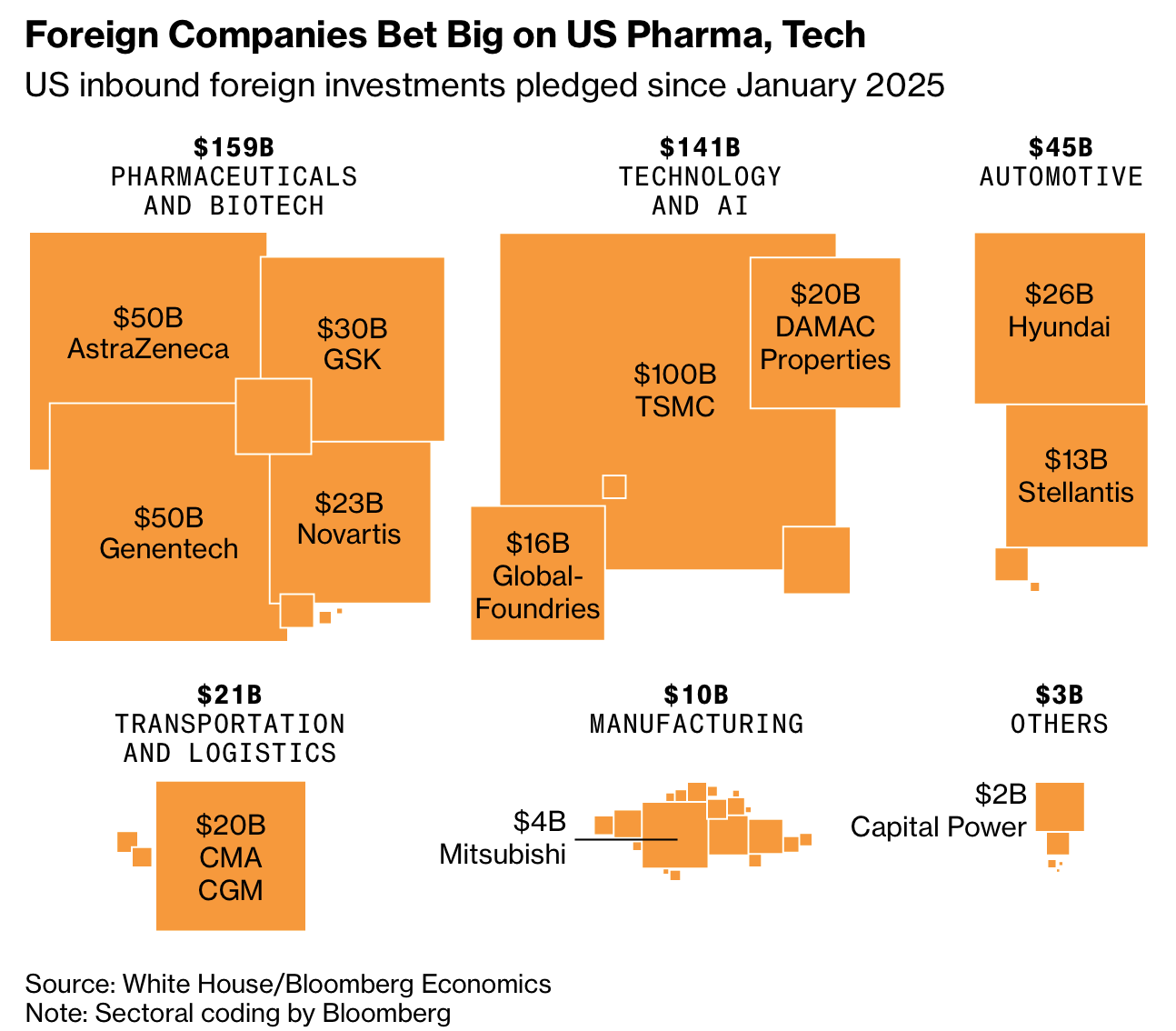

Data are only beginning to reflect the reversal. In the first half of 2025, China’s outbound investment into the rest of the world surpassed the US and reached 10% of the global total, while the US absorbed about one-fifth of global inbound investment and the EU saw a 45% drop versus six months earlier. Rhodium Group estimates announced outbound Chinese greenfield investment hit a 2025 record; greenfield projects were over 85% of $106.6 billion announced in the first three quarters of 2025, including ByteDance’s $38 billion data center in Brazil and Tongkun Group’s $5.9 billion chemical plant in Indonesia. Trump has claimed $21 trillion in pledged US inbound investment, but Bloomberg Economics puts documented pledges at best about one-third of that.

Despite the shift, investment “stocks” still differ: at end-2024, US firms held about $6.8 trillion in long-term physical investment overseas (nearly $4 trillion in Europe), while China reported $3.1 trillion in outward FDI stock, with Rhodium estimating about $1.7 trillion after Hong Kong distortions. Europe is debating how to accept job-creating Chinese projects while managing security; Macron cited EU investment stock in China of about €240 billion versus under €65 billion the other way. Policy frictions are rising elsewhere, from Mexico’s tariffs of up to 50% on more than 1,400 products (Jan. 1) to Sweden’s tighter screening that helped prompt PTL to cancel a planned $1.4 billion factory, even as Volvo promises 3,000 new battery-plant jobs.