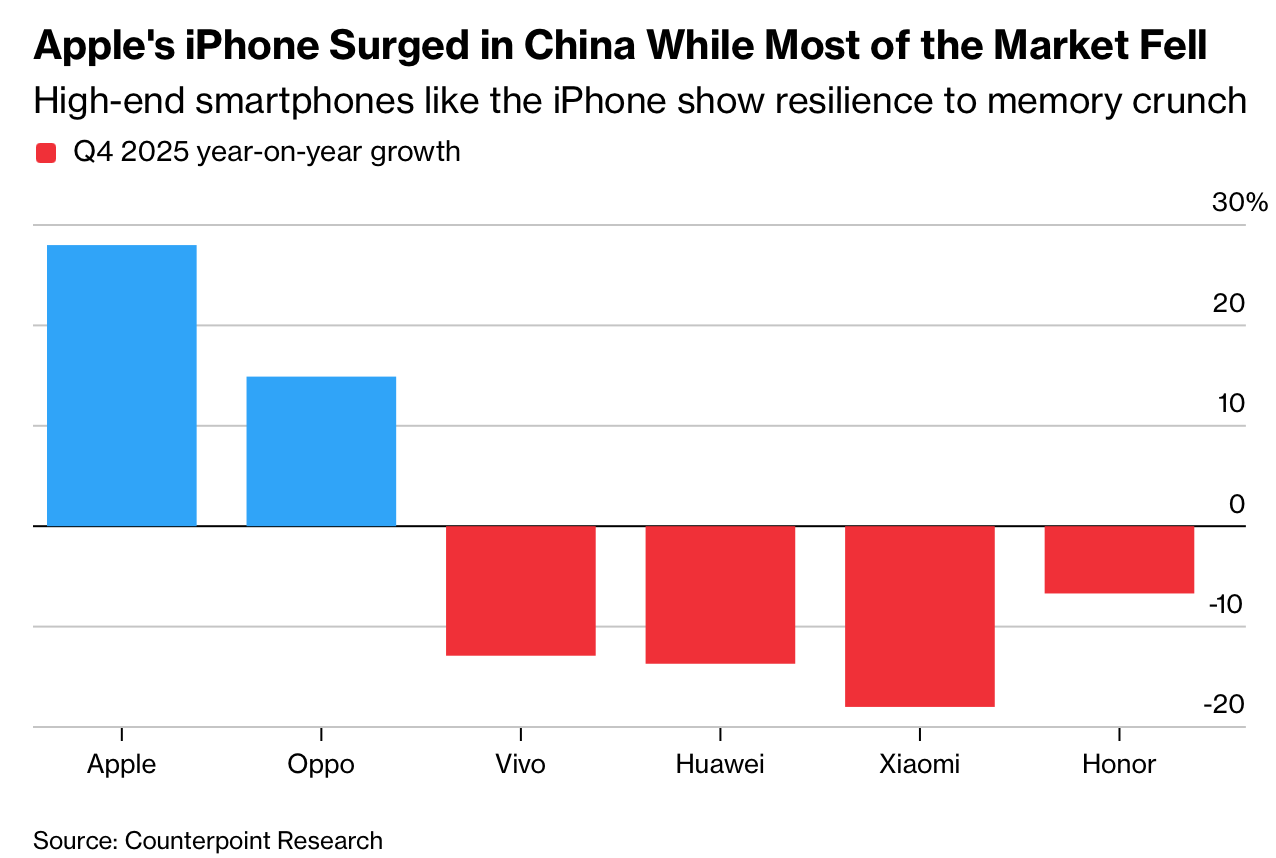

苹果在2025年假日季度重夺中国智能手机市场出货量第一,iPhone出货同比增长28%,尽管关键存储芯片短缺加剧。研究显示,iPhone 17系列在12月季度占到中国市场每五部出货中的一部。同期,中国整体智能手机出货量下降1.6%,而华为和小米的出货量均出现两位数百分比下滑,增长主要由苹果贡献。

存储芯片供需失衡成为行业关键变量。由于芯片厂商将更多产能转向支持英伟达AI芯片的高端存储,设备端用于数据存储的半导体出现短缺,推高价格并挤压小厂商。Counterpoint预计,存储价格将在2026年第一季度上涨40%–50%,第二季度再上涨约20%。在此背景下,手机厂商将通过压缩低端机型来维持利润率。

高端机型受影响相对有限。台积电CEO指出,内存紧张对高端智能手机冲击较小,而苹果全线产品位于高端区间,韧性最强。全年维度看,苹果与华为在中国市场份额均约17%,苹果2025年出货量增长7.5%。不过,iPhone Air因在中国上市较晚且在轻薄与功能取舍上不被认可,销售表现不佳,成为其少数短板。

Apple reclaimed the top spot in China’s smartphone market during the 2025 holiday quarter, with iPhone shipments jumping 28% despite worsening shortages of key memory chips. The iPhone 17 lineup drove demand, accounting for one in every five devices shipped in the December quarter. Overall smartphone shipments in China fell 1.6%, while Huawei and Xiaomi both recorded double-digit percentage declines, leaving Apple as the primary source of growth.

Memory shortages have become a central industry constraint. Chipmakers redirected capacity toward high-end memory used in Nvidia’s AI chips, tightening supply for device storage, lifting prices, and squeezing smaller manufacturers. Counterpoint forecasts memory prices to rise 40%–50% in the first quarter of 2026, followed by about a 20% increase in the second quarter. As a result, smartphone OEMs are expected to scale back low-end models to protect margins.

High-end devices remain relatively insulated. Taiwan Semiconductor Manufacturing Co.’s CEO noted that premium smartphones are largely unaffected by the memory crunch, and Apple’s lineup sits entirely in this segment, showing the greatest resilience. For the full year, Apple and Huawei each held roughly a 17% share of China’s market, with Apple’s 2025 shipments up 7.5%. One weak point was the iPhone Air, which launched later in China and underperformed due to trade-offs between thinness and features.