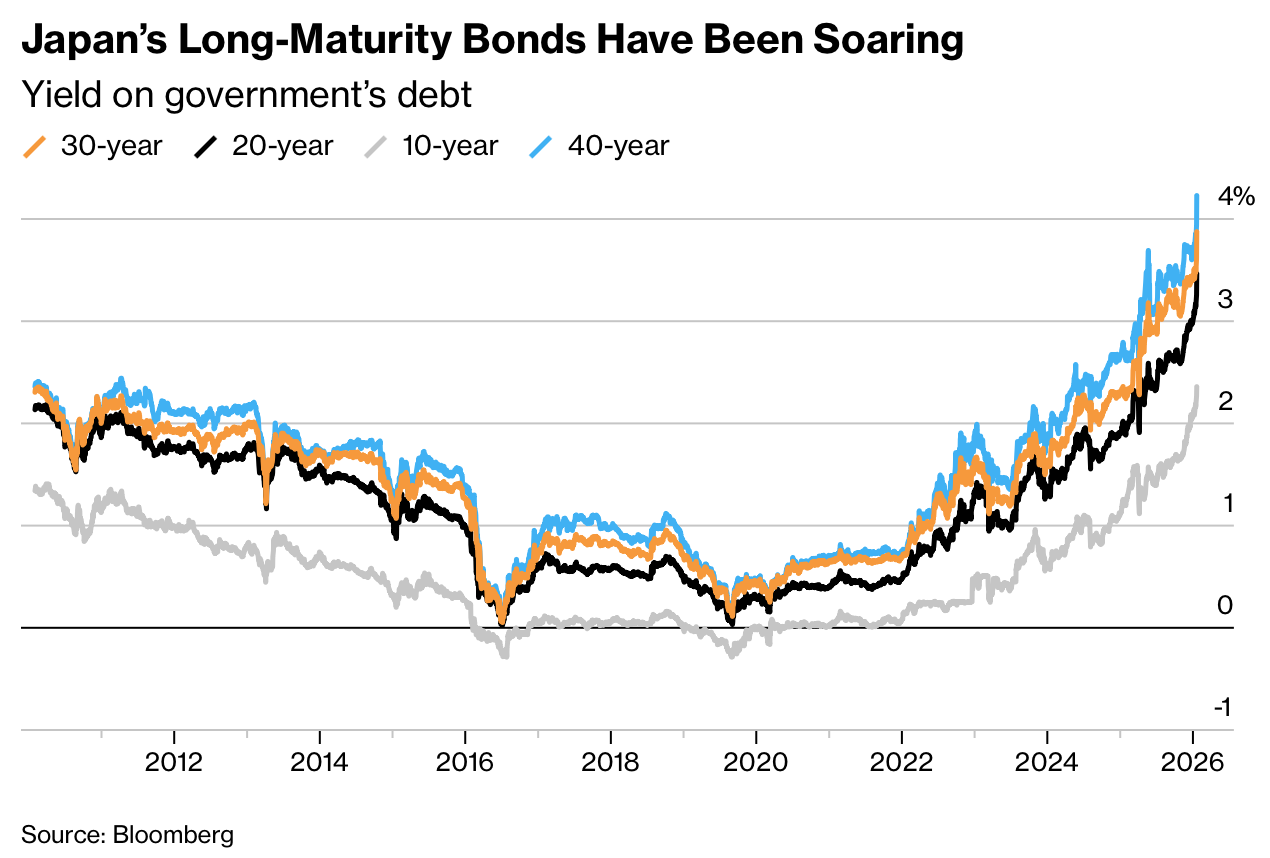

日本7.6万亿美元国债市场出现突然崩盘,收益率在一次被称为近年最混乱的交易日中急剧上升。此前数周持续发酵的财政担忧在周二下午集中爆发,部分长期国债收益率创下历史新高。30年期和40年期国债收益率均上涨超过25个基点,为自去年特朗普“解放日”关税冲击全球市场以来的最大单日波动。

抛售引发连锁反应,对冲基金被迫平仓亏损交易,寿险公司抛售国债,至少一名信用投资者退出了一笔数百万美元的交易。当天稍早,20年期国债拍卖反应冷淡,进一步打击情绪。投资者担忧首相高市早苗提出的减税与扩大支出计划,将加剧全球负债率最高之一的日本财政风险,市场将其比作潜在的“特拉斯时刻”。

财政计划的核心包括暂停食品和饮料销售税,预计每年减少约5万亿日元(316亿美元)财政收入。尽管政府表示不会通过新增发债弥补缺口,市场怀疑为期两年的暂停可能永久化。信用市场同样承压,高评级公司债收益率在此前已创纪录的基础上继续上升。与此同时,部分投资者开始加码长期被称为“寡妇制造者”的做空日债交易,反映出在财政忧虑与利率上行背景下,对日本国债的看空情绪正在增强。

Japan’s $7.6 trillion government bond market suffered a sudden crash, with yields surging during what traders described as the most chaotic session in recent memory. Fiscal concerns that had been building for weeks boiled over on Tuesday afternoon, pushing some long-maturity bond yields to record highs. Yields on 30-year and 40-year bonds jumped by more than 25 basis points, the biggest move since Trump’s “Liberation Day” tariffs rattled global markets last year.

The selloff triggered knock-on effects, forcing hedge funds to unwind losing positions, prompting life insurers to dump bonds, and causing at least one credit investor to exit a multi-million-dollar deal. Earlier in the day, a weak reception for a 20-year bond auction darkened sentiment. Investors are increasingly uneasy that Prime Minister Sanae Takaichi’s tax-cut and spending plans could worsen the finances of one of the world’s most indebted governments, with markets drawing parallels to a potential “Liz Truss moment.”

At the center of the concern is a proposal to suspend sales tax on food and beverages, expected to cost about ¥5 trillion ($31.6 billion) per year. Although the government says it will not issue new debt to cover the gap, investors doubt the pause will remain temporary. Credit markets also felt pressure, with high-grade corporate bond yields climbing further after already hitting records. At the same time, bearish bets such as the long-feared “widowmaker” short on Japanese bonds gained appeal, signaling deepening skepticism toward Japan’s debt amid fiscal strain and rising rates.