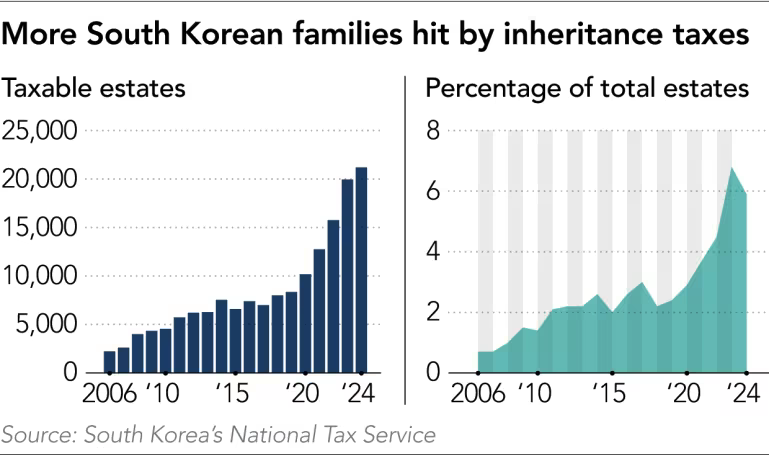

韩国房地产价格在过去十多年大幅上涨,显著推高了家庭账面财富,但遗产税制度长期未随之调整,导致中产阶级税负急剧上升。首尔去年住房成交中位价达 14.3 亿韩元,而现行制度下,超过 10 亿韩元的遗产部分通常适用 40% 税率。由于税阶近 30 年未调整,随着人口快速老龄化,需缴纳遗产税的家庭比例从 2007 年的 0.7% 激增至 2023 年的 6.8%。

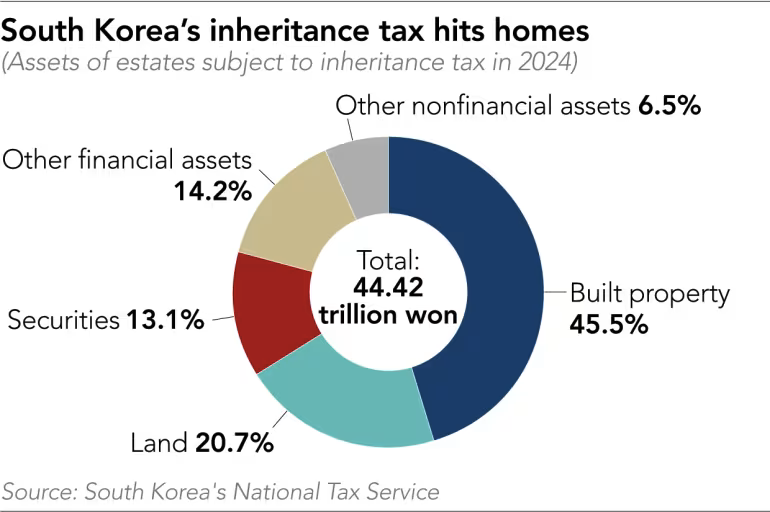

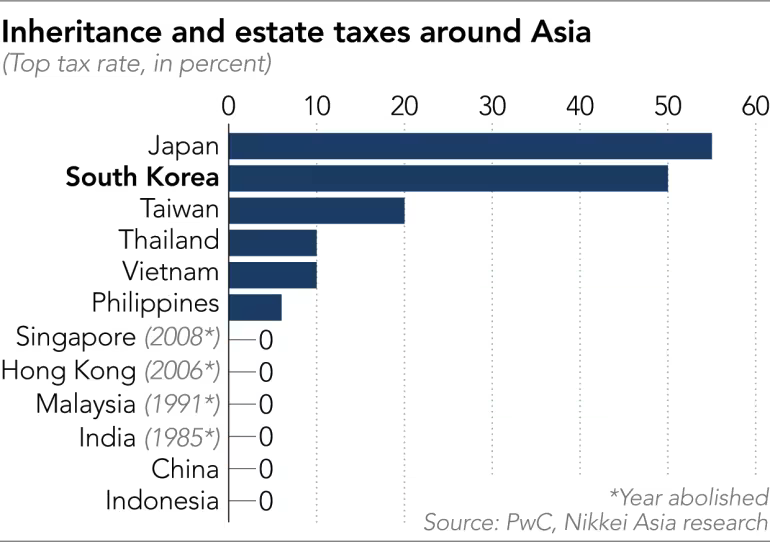

韩国的最高遗产税率为 50%,在经合组织中仅次于日本的 55%,且在遗产净值超过 30 亿韩元时适用。2024 年,全国 20,167 个需缴税的遗产中,70% 的估值不超过 20 亿韩元,显示征税对象已明显向中产阶级扩散。房产占应税遗产总价值的 46%,在小额遗产中更是绝对主体。典型案例中,1.74 亿韩元的住宅遗产可能触发约 3.2 亿韩元税单,迫使继承人出售房产以筹资。

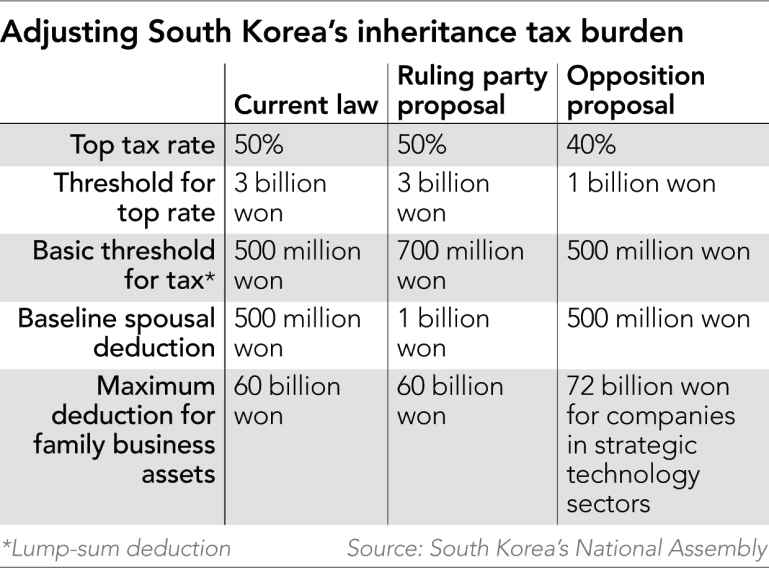

政治层面改革陷入僵局。反对党提议将最高税率从 50% 降至 40%,并取消对大股东股票的 20%附加税,该方案获得 69% 民调支持。执政党则主张提高免税额,如将配偶免税门槛提高至 17 亿韩元、子女扣除额增至 5 亿韩元。尽管社会普遍认为改革必要,但对“为富人减税”的疑虑与财政收入压力并存。政府 2024 年遗产税收入为 9.64 万亿韩元,任何折中方案都面临填补财政缺口的现实约束。

South Korea’s real estate boom over the past decade has sharply increased household paper wealth, but an inheritance tax system left largely unchanged for nearly 30 years has squeezed the middle class. The median Seoul home sold last year for 1.43 billion won, while estates exceeding 1 billion won are generally taxed at 40%. As the population ages rapidly, the share of estates subject to tax rose from 0.7% in 2007 to 6.8% in 2023, pulling many ordinary families into the tax net.

The country’s top inheritance tax rate is 50%, second only to Japan’s 55% among OECD members, and applies when taxable estates exceed 3 billion won. In 2024, 70% of the 20,167 taxable estates were valued at 2 billion won or less, showing how the burden has shifted toward the middle class. Real estate accounted for 46% of total taxable estate value and dominated smaller estates. In typical cases, a 1.74 billion won home can generate a tax bill of about 320 million won, often forcing heirs to sell property to raise cash.

Reform efforts remain politically deadlocked. Opposition proposals would cut the top rate to 40% and scrap a 20% surcharge on major shareholders’ stock, an idea supported by 69% of respondents in a recent poll. The ruling party instead favors raising baseline deductions, such as increasing the spousal exemption to 1.7 billion won and the child deduction to 500 million won. Despite broad agreement that reform is needed, fears of benefiting the wealthy and concerns over fiscal gaps persist. The government collected 9.64 trillion won in inheritance taxes in 2024, making any compromise contingent on offsetting lost revenue.