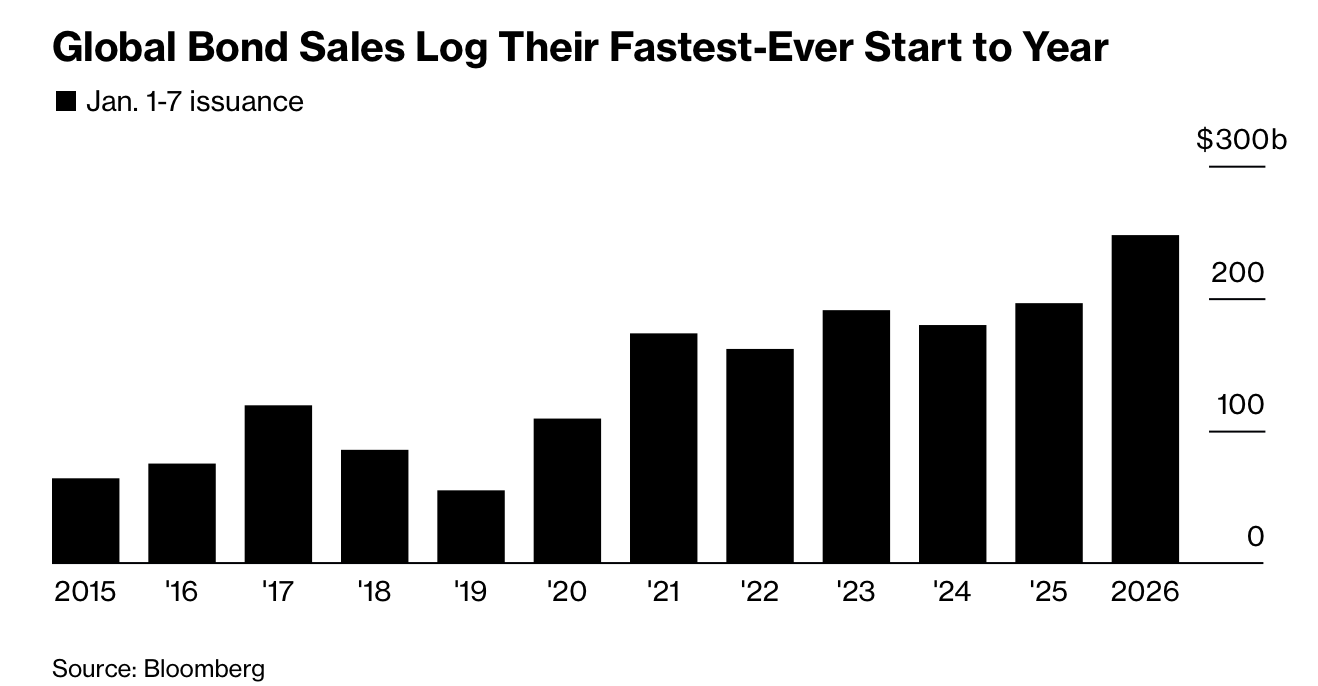

2026 年伊始,全球债券发行规模创下纪录,跨货币融资总额约 2,600 亿美元,为历史同期最高水平。美国、欧洲和亚洲的企业与政府同步入市,亚洲新一轮发行仍在推进,预计将进一步推高总量。此前在 12 月推迟融资的发行人集中回归市场,以赶在下周财报静默期前锁定资金,同时对地缘政治紧张局势反应有限。

美国投资级债市单日共有 11 家发行人定价,使当周发行量突破 880 亿美元,成为非疫情时期规模最大的单周。博通通过多期限结构发行 45 亿美元债券,法国电信公司 Orange 发行 60 亿美元、五个期限的美元高评级债,显示长期债需求延续。美国高收益市场本周发行规模超过 60 亿美元,为一个月来最繁忙一周。

欧洲市场同样强劲,周三单日新债发行额超过 570 亿欧元(约 665 亿美元),创纪录水平,涵盖企业、金融机构与主权发行人。信用利差在大规模供给下仍保持低位,反映风险偏好充足。亚太地区本周融资额超过 220 亿美元,处于历年年初高位。整体来看,紧俏的信用利差、仍具吸引力的收益率与年初资金配置需求,共同支撑了这一历史性发行浪潮。

Global bond issuance began 2026 at a record pace, with roughly $260 billion raised across currencies, the highest total ever for the comparable period. Corporations and governments in the U.S., Europe, and Asia all tapped markets simultaneously, with additional Asian deals expected to push volumes higher. Borrowers that delayed issuance in December are rushing to secure funding ahead of an earnings blackout next week, largely unfazed by rising geopolitical tensions.

In the U.S. investment-grade market, 11 issuers priced debt in a single day, driving weekly supply past $88 billion, the largest non-Covid week on record. Broadcom raised $4.5 billion through a multi-tranche deal, while France’s Orange sold $6 billion across five tranches, reinforcing strong demand for longer maturities. The U.S. high-yield market also saw more than $6 billion issued since Monday, its busiest week in a month.

Europe recorded a similarly strong start, with over €57 billion ($66.5 billion) of bonds sold in one day, a record covering corporate, financial, and sovereign issuers. Despite the surge in supply, corporate bond spreads remain tight, signaling sustained risk appetite. In Asia-Pacific, issuance has exceeded $22 billion this week alone. Tight spreads, still-attractive yields, and early-year reinvestment flows are driving one of the fastest starts to global bond issuance on record.