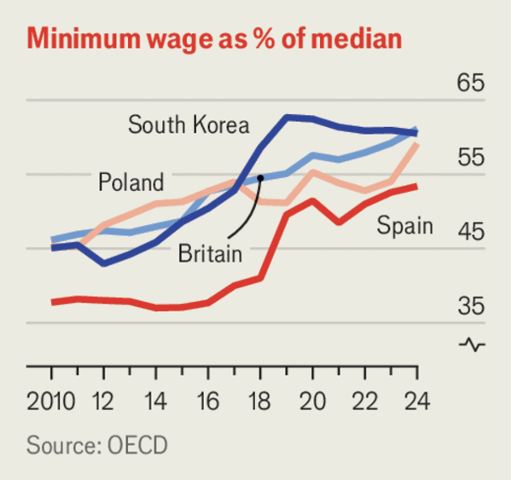

过去十年,英国最低工资从中位收入的48%上升至61%,德国自2015年引入最低工资后,到2023年已超过50%。美国联邦最低工资自2009年以来一直为每小时7.25美元,但许多民主党控制的州和城市设定了更高的标准,平均有效最低工资约为每小时12美元,最高超过21美元。这表明最低工资在全球范围内持续上涨,各国政府积极采用该政策以缩小收入差距。

然而,研究显示高最低工资带来负面影响,部分情况未反映在失业数字中。例如,西雅图2015-2016年大幅提高最低工资后,低端劳动力市场的招聘速度下降了10%。此外,雇主为应对更高工资,不裁员但可能削减其他福利,如缩短工时、减少弹性、增加工伤事故和降低健康保险覆盖。当前对美国适当最低工资的一个估算为每小时低于8美元,高于这一水平反而加剧市场扭曲并损害就业。

政策制定者应警惕最低工资过度上调带来的连锁反应。最低工资虽然民调支持度高,但若成本压力被转嫁给消费者,反而导致物价飙升,生活负担加重,反而伤及需要帮助的弱势群体。例如,纽约市计划到2030年将最低工资从16.5美元提高到30美元,势必推高生活成本。相比之下,通过带动经济增长的税收支持的在职税收补贴,更能精准、有效地改善低收入者生活,避免过度依赖最低工资上涨带来的负面效应。

Over the past decade, the UK’s minimum wage has risen from 48% to 61% of median income, while Germany’s rate surpassed 50% by 2023 after introducing a minimum wage in 2015. Although the US federal minimum wage has remained at $7.25 since 2009, Democratic-led states and cities have set higher rates, leading to an average effective minimum wage of around $12 per hour and peaks above $21. This trend highlights the global surge in minimum wage policies, as governments seek to reduce income inequality at minimal direct cost.

However, research indicates that high minimum wages have negative side effects not always reflected in employment figures. For instance, Seattle’s substantial wage hike in 2015 and 2016 led to a 10% slowdown in low-end hiring, despite existing workers keeping their jobs. Employers facing higher wage floors often trim other benefits instead, such as reducing or destabilizing hours, increasing workplace accidents, and cutting health insurance coverage. Notably, one estimate puts a market-power-adjusted American minimum wage at under $8 per hour, above which labor market distortions and job losses become more likely.

Policymakers should beware the cascading consequences of aggressive minimum wage hikes. Despite broad public support, passing higher costs onto consumers can cause price surges and erode affordability, undermining support for the very workers minimum wages intend to help. For example, New York City’s plan to raise its minimum wage from $16.50 to $30 by 2030 would sharply increase the cost of living. In contrast, in-work tax credits backed by growth-friendly funding more precisely aid low earners without the downsides of steep wage mandates, suggesting it is time to pause further minimum wage increases.