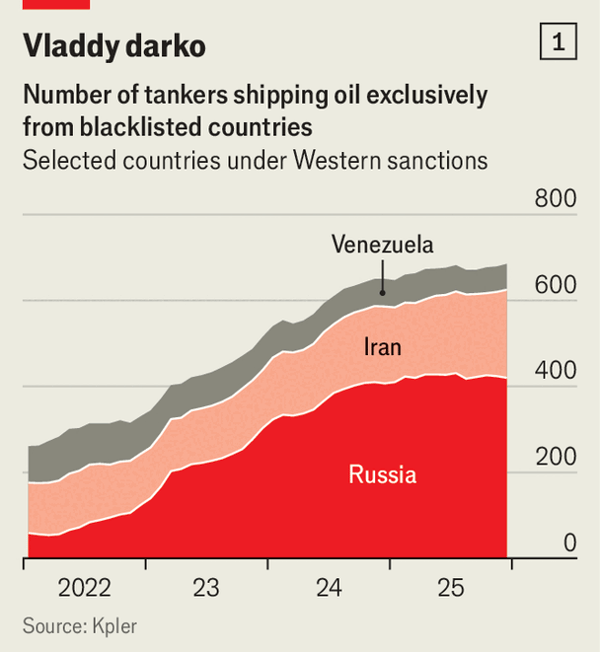

1月22日,“Grinch”号在西班牙外国际水域被法国海军直升机截停并改道至马赛附近港口受警戒停泊;该船在制裁之下悬挂伪造的科摩罗旗,载有73万桶俄罗斯石油,并且至少是本月落入西方之网的五艘此类船只之一。自2022年年中以来,这支在西方禁运下专门运输石油的“影子船队”规模已翻倍以上,现接近700艘(若计入偶尔参与的可达约1500艘),2025年12月运送约500万桶/日的受禁运原油(占全球海运流量的11%),且估算每5艘从事国际航运的油轮就有1艘是“暗船”。

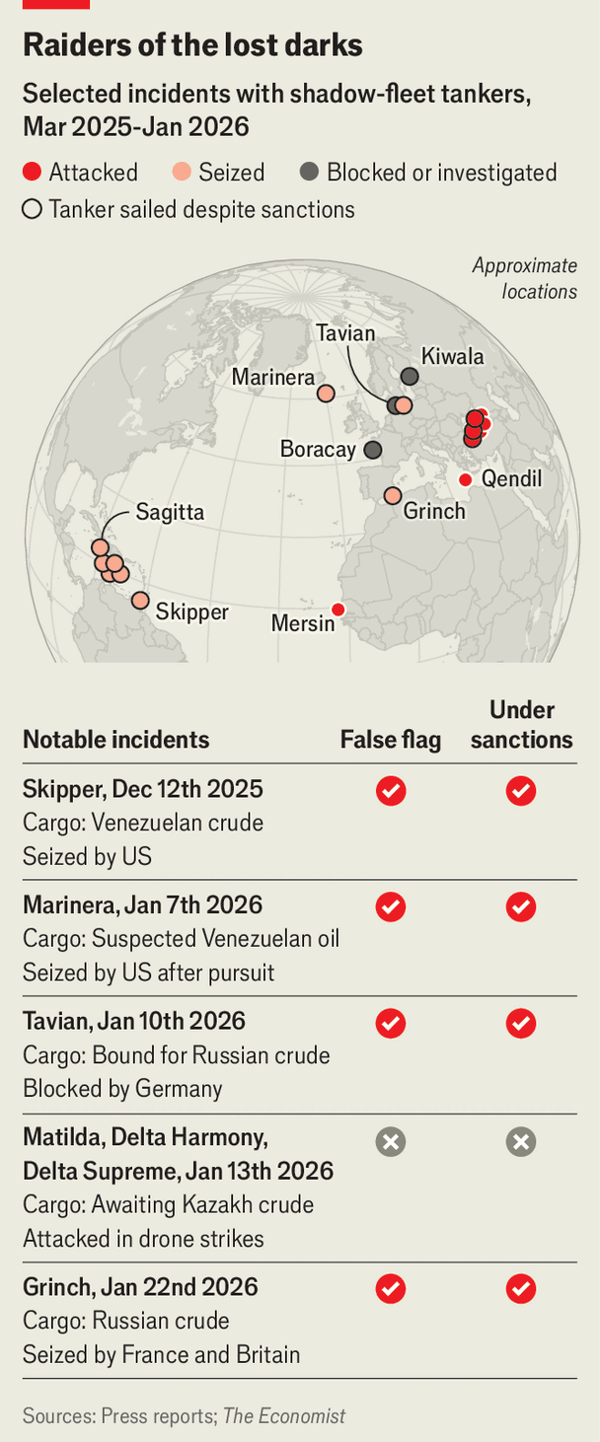

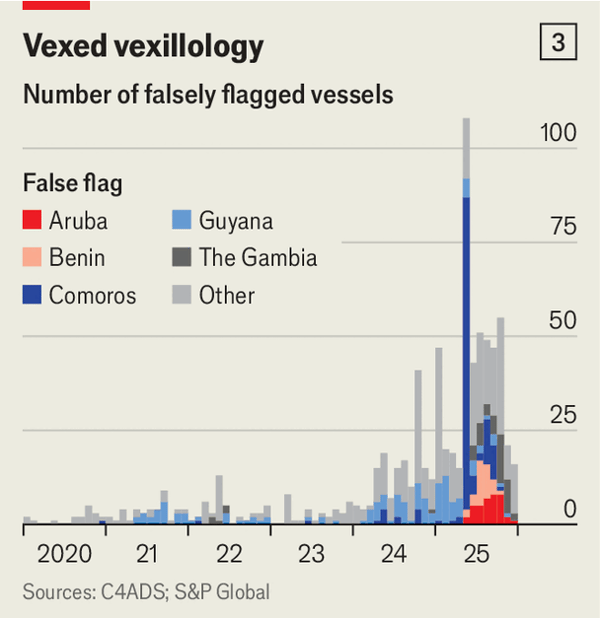

制裁正转向直接打击船舶:2025年首次被列入清单的船只达623艘,高于2024年的225艘;去年运送俄罗斯石油的船中约40%已被至少一个政府列黑,伊朗相关船只则约三分之二被列黑,并且在叠加措施后,承运俄罗斯产量80%桶量的油轮暴露于潜在制裁,导致其难以获得认证、保险与合规金融服务。Kpler估计油轮在被欧盟列黑后的6个月内按“吨英里”计的生产率下降30%,被美国列黑则下降70%,而在2025年约700艘船在两到六次之间更换旗帜;自12月以来,美国以“无国籍”为由至少扣押7艘,且每天有约12艘类似船只穿越多佛海峡,1月10日德国还首次在欧盟层面阻止一艘疑似伪造注册的油轮进入其波罗的海水域。

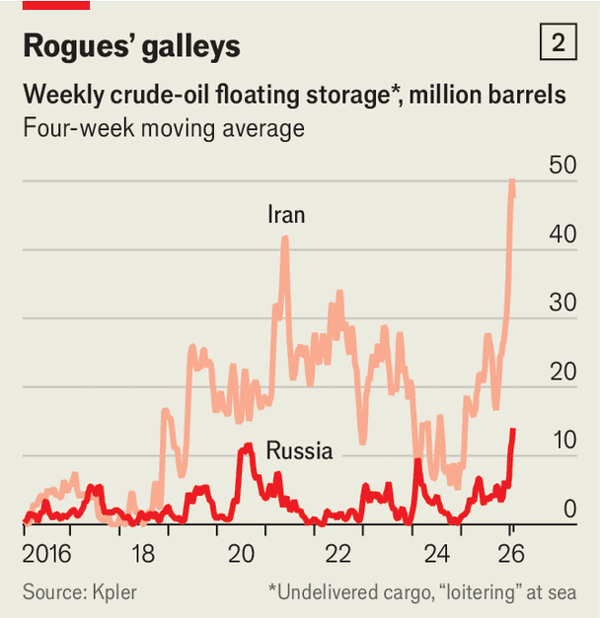

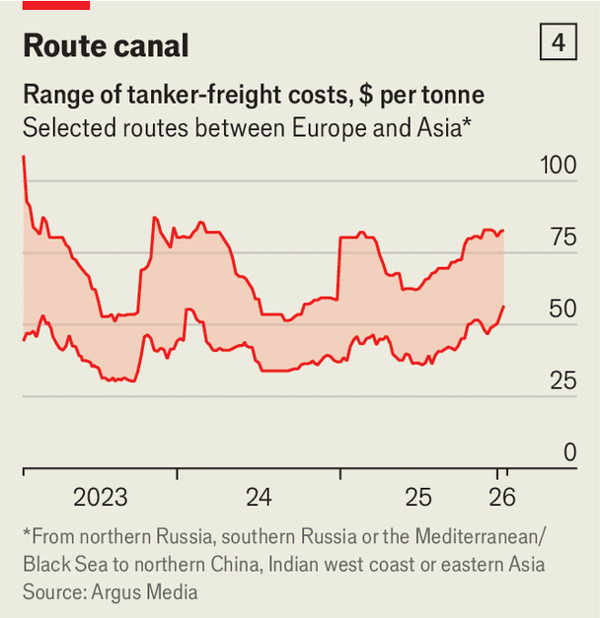

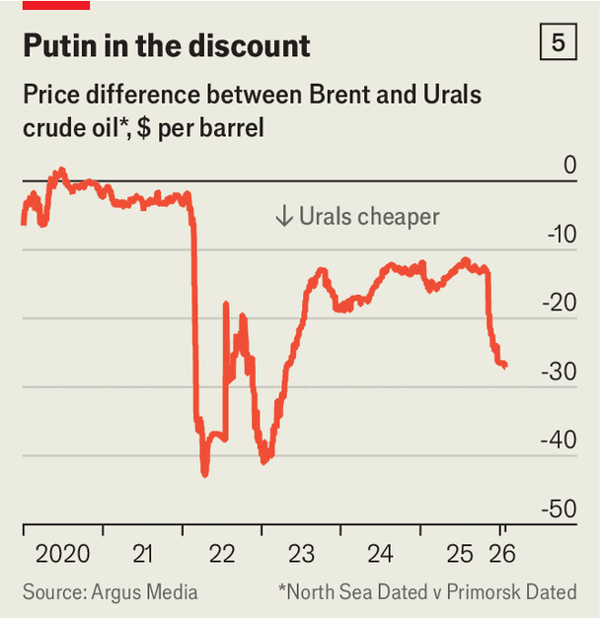

自11月下旬以来,乌克兰至少袭击9艘油轮(其中7艘为影子船队)并常造成致命性损伤,带动俄罗斯黑海的战争风险保险费率在过去一个月跃升至船体与机器价值的1%(一年前为0.4%,而无冲突的高风险水域通常不超过0.05%)。近期运费上升也将乌拉尔原油对布伦特的折价推至每桶低27美元(为自2023年4月以来最大),若未来数季度过剩供给继续压低布伦特,乌拉尔可能跌破30美元/桶、低于其2024年平均水平的一半,俄罗斯油气月收入可能降至100亿美元以下;同时俄罗斯自12月中旬起已将32艘受制裁油轮纳入其海事登记,显示其正提高直接控制比例。

On January 22nd, the Grinch was intercepted in international waters off Spain and rerouted under guard to a port near Marseille; it was under sanctions, flew a false Comorian flag, carried 730,000 barrels of Russian oil, and was one of at least five such vessels caught this month. Since mid-2022, the embargo-shipping “shadow fleet” has more than doubled to nearly 700 ships (up to about 1,500 if occasional participants are counted), moved nearly 5m embargoed barrels per day in December 2025 (11% of global seaborne flows), and is estimated to include one “dark” tanker for every five internationally trading tankers.

Sanctions are shifting onto ships: 623 vessels were first listed in 2025 versus 225 in 2024; about 40% of ships that carried Russian oil last year and about two-thirds tied to Iran are now blacklisted by at least one government, and older measures plus new “secondary” penalties leave tankers carrying 80% of Russia’s pumped barrels exposed to potential sanctions that block certification, insurance, and compliant banking. Kpler estimates productivity (tonne-miles) falls 30% in the six months after an EU blacklist and 70% after a US one, while nearly 700 ships changed flags between two and six times in 2025; since December America has seized at least seven on statelessness grounds, around a dozen sail through the Dover Strait daily, and on January 10th Germany made an EU first by blocking a tanker suspected of forged registration from entering its Baltic waters.

Since late November, Ukraine has attacked at least nine tankers (seven shadow-fleet) with mines and drones, often causing critical damage, and war-risk insurance in the Russian Black Sea has jumped in the past month to 1% of hull-and-machinery value (from 0.4% a year ago, versus under 0.05% in high-risk but conflict-free waters). Higher costs coincide with Urals trading at a $27-per-barrel discount to Brent (the biggest since April 2023), and if oversupply pushes Brent lower, Urals could fall below $30 a barrel—less than half its 2024 average—cutting Russia’s oil-and-gas revenues below $10bn a month; meanwhile 32 sanctioned tankers have entered Russia’s registry since mid-December, signaling rising direct control of the fleet.

Source: The West and Ukraine are capsizing Russia’s shadow fleet

Subtitle: And sinking its oil revenues in the process

Dateline: 1月 29, 2026 07:20 上午