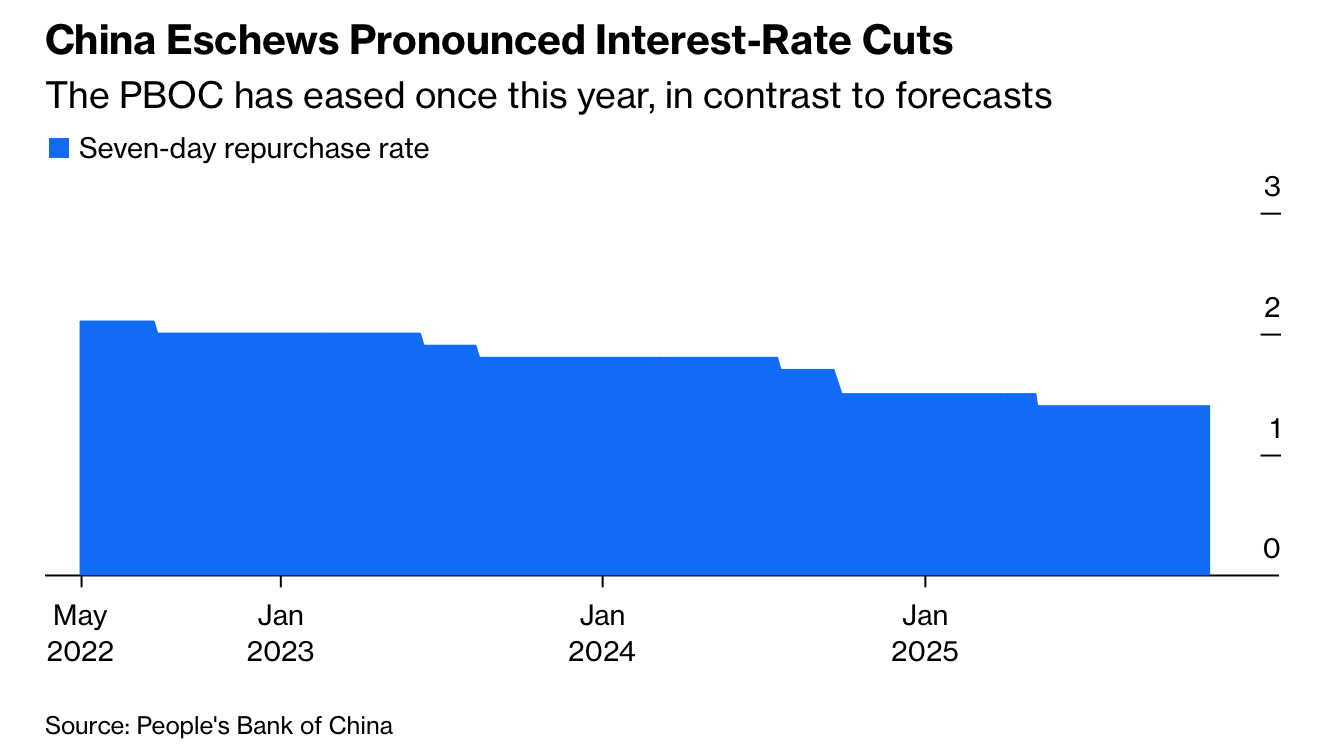

中国央行近期强调“长周期”与短期波动不必过度解读,市场由此下调宽松预期:Goldman Sachs 将降息预测推迟至 2026 年一季度,Citigroup 等机构已放弃近期宽松展望。过去一年政策落差显著——政治局承诺 2025 年实施“适度宽松”,华尔街预期强力降息与降准,但 PBOC 仅在 5 月小幅下调 10 个基点,主要政策利率(七天逆回购)维持在 1.4%。同时增长动能走弱:10 月出口意外下滑、工业生产放缓、投资下降、信用增速为一年多最低,通缩压力未散,中国 10 年期国债收益率徘徊近两月低点。

得益于强劲的一季度,中国仍有望完成 5% 年增速目标,这削弱了激进宽松的紧迫性,同时为中美贸易战进一步升级保留“弹药”。但与此形成对照的是美联储自 1990 年代后期以来一贯采用的“风险管理”模式,即在通胀低迷与增长前景偏弱时提前降息,Greenspan 以来四任主席皆如此。2025 年 9 月美联储降息虽与增长预测小幅上修相悖,但 Powell 指出风险结构已转变,应在政策上预先应对。

文章指出央行并非不会犯错:美联储在 2015–2016 年错判加息路径,ECB 在雷曼倒闭前错误加息,PBOC 在 2015 年的人民币改革出现混乱。若过度依赖“长周期判断”而忽视疲弱数据,可能使政策显得犹疑。PBOC 倾向避免步入非常规政策(如 QE),但若降息至 1% 以下,后续空间与退出难度将大幅增加。作者认为,在外需走弱与内需乏力并存之际,审慎虽可理解,但缺乏“保险式宽松”也可能让中国与全球经济付出代价。

China’s central bank has recently stressed long-term stability and downplayed short-term weakness, prompting markets to curb expectations for easing: Goldman Sachs now forecasts the next rate cut in Q1 2026, and Citigroup has abandoned near-term easing calls. The policy gap over the past year is notable—after the Politburo signaled “moderately loose” policy for 2025, Wall Street projected aggressive rate cuts and RRR reductions, yet the PBOC has delivered only a single 10bp trim in May, leaving the key seven-day repo rate at 1.4%. Meanwhile, momentum has cooled: exports unexpectedly contracted in October, industrial output slowed, investment declined, credit growth hit a 12-month low, deflation persists, and the 10-year yield hovers near a two-month low.

Thanks to a strong Q1, GDP is still likely to meet the 5% target, reducing urgency to ease and preserving policy space should the US–China trade war intensify. This contrasts with the Federal Reserve’s long-standing “risk management” approach—cutting pre-emptively under weak inflation or softening data, a strategy used since the late 1990s and reaffirmed in Powell’s September cut despite upward growth revisions. Central banks, however, often miscalculate: the Fed mis-projected its 2015–2016 hikes, the ECB raised rates on the eve of Lehman’s collapse, and the PBOC mishandled the 2015 yuan adjustment.

The commentary warns that leaning too heavily on long-term optimism while dismissing deteriorating indicators risks appearing indecisive. The PBOC prefers to avoid unconventional tools like QE, but if rates fall below 1%, exit challenges grow. With external demand softening and domestic deflation entrenched, eschewing “insurance” cuts carries its own hazards. The long game may prove right—but excessive caution could impose costs on both China and the global economy.