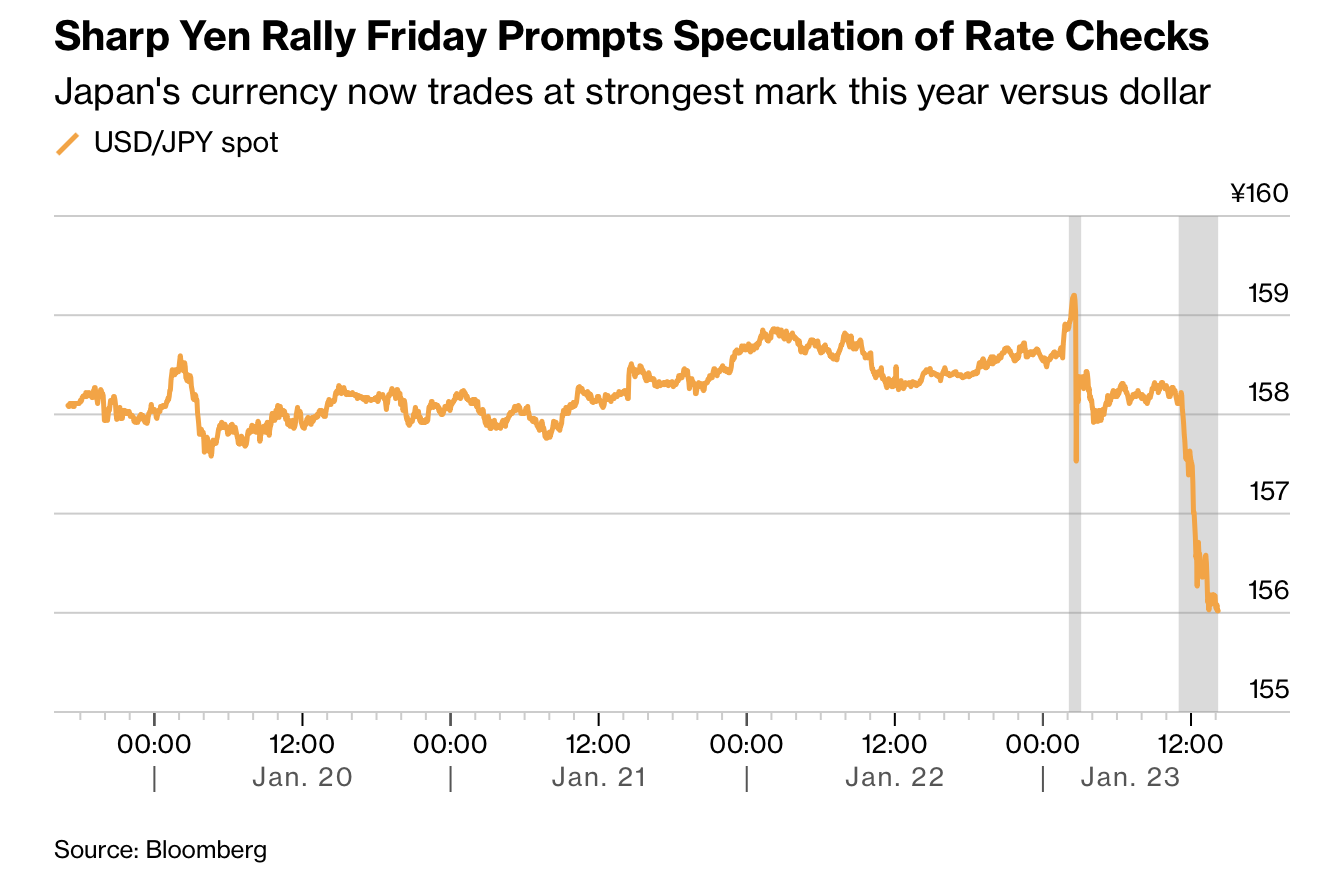

市场猜测日本可能即将入市干预汇率以阻止日元下跌,甚至不排除获得美国罕见协助。周五日元一度上涨1.75%至1美元兑155.63日元,创年内最强水平,为自8月以来最大单日涨幅,并扭转了此前逼近2024年干预前水平的跌势。交易员称,纽约联储向金融机构询问日元汇率,被解读为为潜在干预铺路的信号。

此次汇率波动与日本国债市场动荡密切相关。日本央行1月会议维持政策利率不变之际,40年期国债收益率升至发行以来新高,反映对财政扩张与通胀的担忧。2024年,当日元跌破1美元兑160日元时,日本曾进行干预,事前亦有“汇率检查”。美国财长本周与日本财务大臣就日债抛售沟通,显示外溢效应已影响美债市场。

分析人士强调,单次检查或干预通常难以产生持久效果,除非伴随实质性政策变化。美日此前在9月重申由市场决定汇率,但允许在“过度波动或无序”时干预。自1996年以来,美国仅三次入市干预汇率,最近一次是2011年地震后与七国集团联手卖出日元。即便未实际行动,仅美国可能参与的预期,也可能迅速引发日元空头回补,加速汇率反弹。

Speculation grew that Japan may be preparing to intervene in currency markets to halt the yen’s slide, possibly with rare US assistance. On Friday the yen rose as much as 1.75% to 155.63 per dollar, its strongest level of the year and the biggest one-day gain since August, reversing a move toward levels seen before Japan’s 2024 intervention. Traders cited reports that the New York Fed queried banks about the yen, seen as groundwork for potential action.

The currency move coincided with turmoil in Japan’s bond market. As the Bank of Japan held rates steady in January, the 40-year government bond yield climbed to a record since its debut, reflecting fears over fiscal expansion and inflation. In 2024, Japan intervened after the yen weakened past 160 per dollar, preceded by rate checks. US Treasury Secretary Scott Bessent said he discussed the Japanese debt selloff with Japan’s finance minister, noting spillovers into the US Treasury market.

Analysts caution that checks or interventions rarely have lasting impact without real policy shifts. In September, the US and Japan reaffirmed market-determined exchange rates while allowing intervention to counter excess volatility or disorderly moves. The US has intervened only three times since 1996, most recently in 2011 alongside G7 peers after Japan’s earthquake. Even without action, expectations of possible US involvement could trigger a rapid unwinding of yen shorts and accelerate gains.