数据表明,休闲化着装趋势正在回落,取而代之的是更精致、更正式的穿搭。美国市场上,2025年1月至11月期间“时尚鞋类”整体销量同比下降约3%,但细分品类出现明显分化:女式乐福鞋需求强劲,秋冬季中位价格上涨40%,在美英零售网站上几乎全尺码售罄的比例同比上升66%;正式马靴表现更佳。男装方面,2025年秋冬季在美英新上架商品中,运动鞋占比同比下降4个百分点,而正装鞋上升7个百分点。与此同时,英国零售商Marks & Spencer的西装销量在截至12月27日的三个月内同比增长15%,正装裤销量增长24%。

运动与休闲品类并未全面下滑,但增长结构发生变化。美国运动鞋销量在2025年1月至11月仍同比增长4%,主要由跑步等性能型产品拉动,而日常时尚型运动鞋表现相对疲弱。即便是“时尚运动鞋”,也在向更正式外观演变,如运动芭蕾鞋和运动乐福鞋等混合款式。整体来看,小幅参与度变化即可反映消费偏好的结构性转移:运动休闲仍在,但更多被限制在功能性场景。

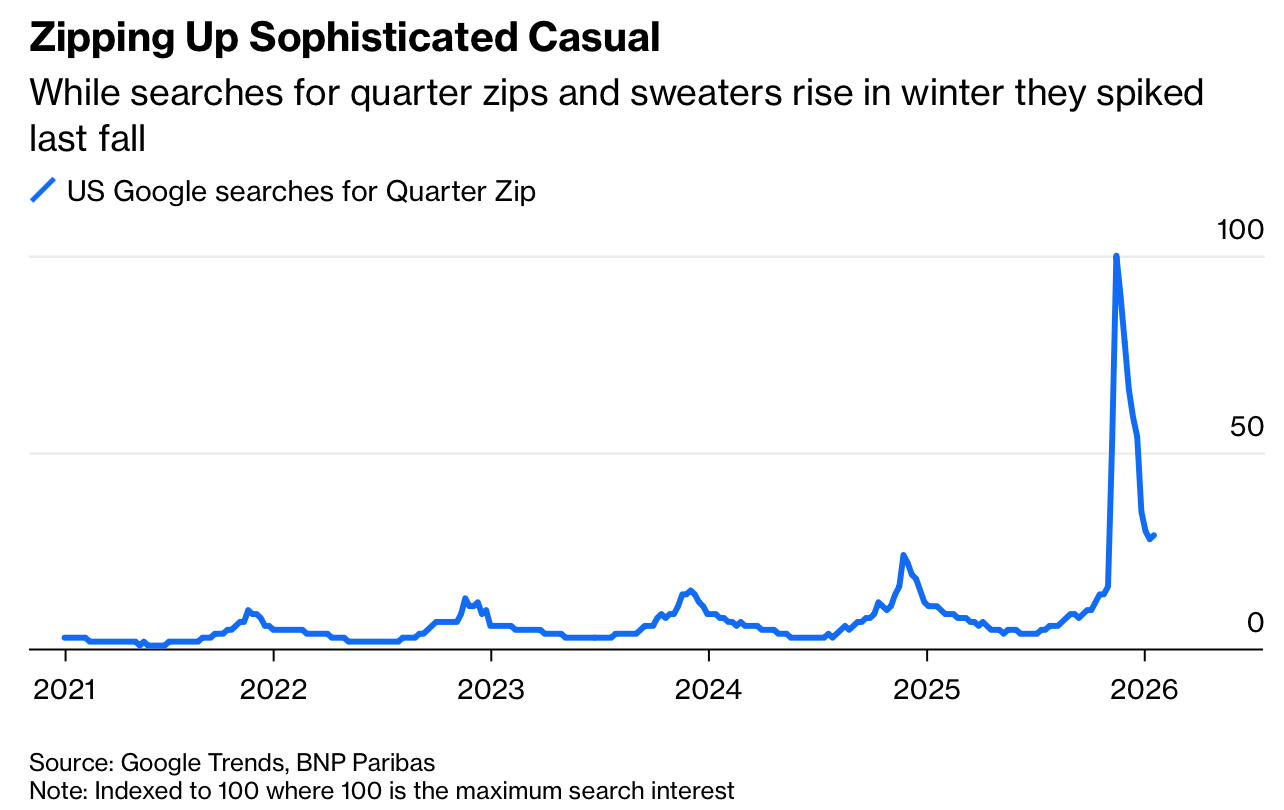

宏观与行为因素强化了这一趋势。随着更多人重返办公室、劳动力市场走弱、职场权力向雇主回归,消费者在“出现”的同时也更注重“体面”。社交媒体数据显示,对西装外套的提及量显著上升,预计船鞋和系带布洛克鞋将保持长期需求。尽管季节性因素可能影响短期数据,但从鞋类占比、价格涨幅和服装销量变化来看,市场已明显越过“极度随意”的峰值,正向更成熟的着装均值回归。

Data indicate a retreat from extreme casual dressing toward more refined styles. In the US, “fashion footwear” sales fell about 3% year on year from January to November 2025, but subcategories diverged sharply: women’s loafers saw a 40% rise in median prices in the fall/winter season, with the share selling out in most sizes across US and UK sites up 66% year on year, while riding boots performed even better. For men, fall/winter assortments showed sneakers’ share of new listings down 4 percentage points from 2024, while formal shoes rose 7 percentage points. In the UK, Marks & Spencer reported suit sales up 15% in the three months to Dec. 27, with formal trousers up 24%.

Athletic categories have not collapsed, but growth has become more selective. US sneaker sales still rose 4% year on year from January to November 2025, driven mainly by performance items such as running shoes, while everyday athleisure lagged. Even fashion sneakers are shifting toward smarter aesthetics, with hybrid designs borrowing from formal footwear. Small changes in category mix thus reflect a broader structural reallocation of demand away from casual dominance toward situational dressing.

Behavioral and macro factors reinforce the shift. As office attendance rises and labor markets weaken, workers face stronger incentives to appear more polished. Social-media data show a spike in blazer mentions, and analysts expect sustained demand for boat shoes and lace-up brogues. While seasonality may influence near-term figures, consistent signals from share shifts, price increases and apparel sales suggest the market has passed peak casual and is reverting toward a more dressed-up equilibrium.