根据 Tripla 预订数据,11 月 21–27 日中国游客在日本的酒店预订量相比 11 月 6–12 日暴跌 57%,而整体预订仅下降 9%,显示中国市场收缩幅度远大于其他客源。背景是日本首相高市早苗本月初谈及台湾有事可能触发日本动员,引发北京劝阻公民赴日,随后大量自由行与团队游客取消行程。价格端尚未全面下跌,全国平均房价在 11 月 27 日当周仍上涨 1.1%,但京都下降 9.4%、大阪下降 0.1%,北海道上涨 1.4%,反映区域差异明显。

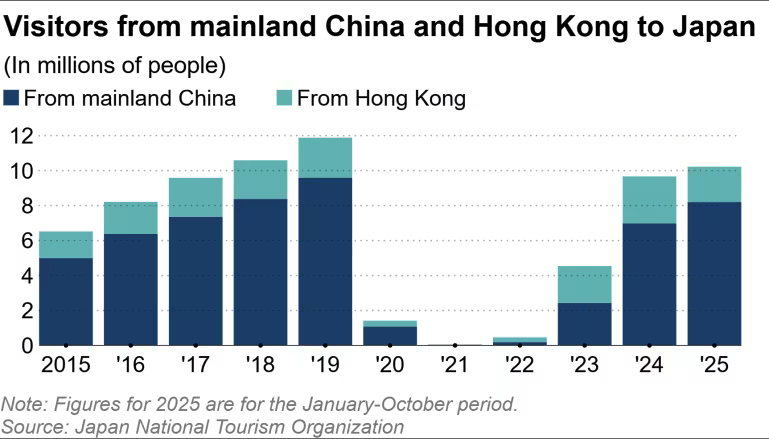

中国与香港游客 1–10 月合计 1022 万人次,远高于韩国的 766 万与台湾的 563 万,是日本最关键的客群。京都商户称中国客减少 20–30%,影响销售;若中国游客住宿夜数下降至南韩争端时期同等的“腰斩”幅度,则 11 月京都预计入住率将下降 4.7 个百分点,使同比降至 84.4%。大阪受冲击更重:20 家酒店报告截至 12 月 31 日中国客预订取消率达 50–70%,而中国旅客在 10 月占大阪访日客的 24%。部分酒店“几乎空置”。航班亦受重击:12 月第二周中—关西航班从原计划的 525 班缩减至 348 班,减幅 34%,自新年起平均将减少 28%。

海运与会展领域同样出现连锁反应:一艘载有约 1500 名乘客的中国邮轮取消 11 月冲绳靠港,更多邮轮亦调整航程;冲绳 OIST 国际会议上,323 名中国参会者中有 198 人临时取消,部分演讲者未获学校批准出境。北海道目前受影响较小,主要依赖韩国等其他客源,但鉴于春节临近且冬季一贯受中国游客青睐,未来冲击可能扩大。此外,中国赴日需求正从团体游转向散客模式,使预订波动更明显。

Hotel reservations by Chinese travelers to Japan collapsed 57% during Nov. 21–27 compared with Nov. 6–12, while total bookings fell only 9%, indicating the China market is contracting far more sharply than others. The drop followed Japanese Prime Minister Sanae Takaichi’s remarks that a Taiwan conflict could trigger Japanese military mobilization, prompting Beijing to urge citizens not to travel to Japan. Despite the demand shock, nationwide average daily rates rose 1.1%, though Kyoto prices fell 9.4%, Osaka dipped 0.1%, and Hokkaido rose 1.4%, highlighting regional divergence.

China and Hong Kong provided 10.22 million visitors from January to October—well above South Korea’s 7.66 million and Taiwan’s 5.63 million. Kyoto merchants report a 20–30% decline in Chinese customers, and if Chinese guest nights fall by half—as during a past Korea–Japan dispute—November occupancy would drop 4.7 points to 84.4% year over year. Osaka is hardest hit: 20 hotels reported 50–70% of Chinese bookings through Dec. 31 canceled, and Chinese visitors accounted for 24% of inbound travelers in October. Some hotels report being “almost empty.” Air traffic mirrors the collapse: China–Kansai flights for the second week of December have been cut from 525 to 348 (–34%), with average flight reductions of 28% expected from January onward.

Maritime and event sectors are also affected: a Chinese cruise ship with roughly 1,500 passengers canceled a November Okinawa stop, and additional Shanghai- and Hong Kong-linked cruises altered schedules. At an OIST academic conference, 198 of 323 Chinese participants canceled last minute, with some speakers denied travel permission. Hokkaido currently reports minimal impact thanks to strong demand from South Korea and other markets, but risks remain given its winter popularity among Chinese tourists ahead of February’s Lunar New Year. China’s shift from group tours to individual travel adds further volatility to booking patterns.