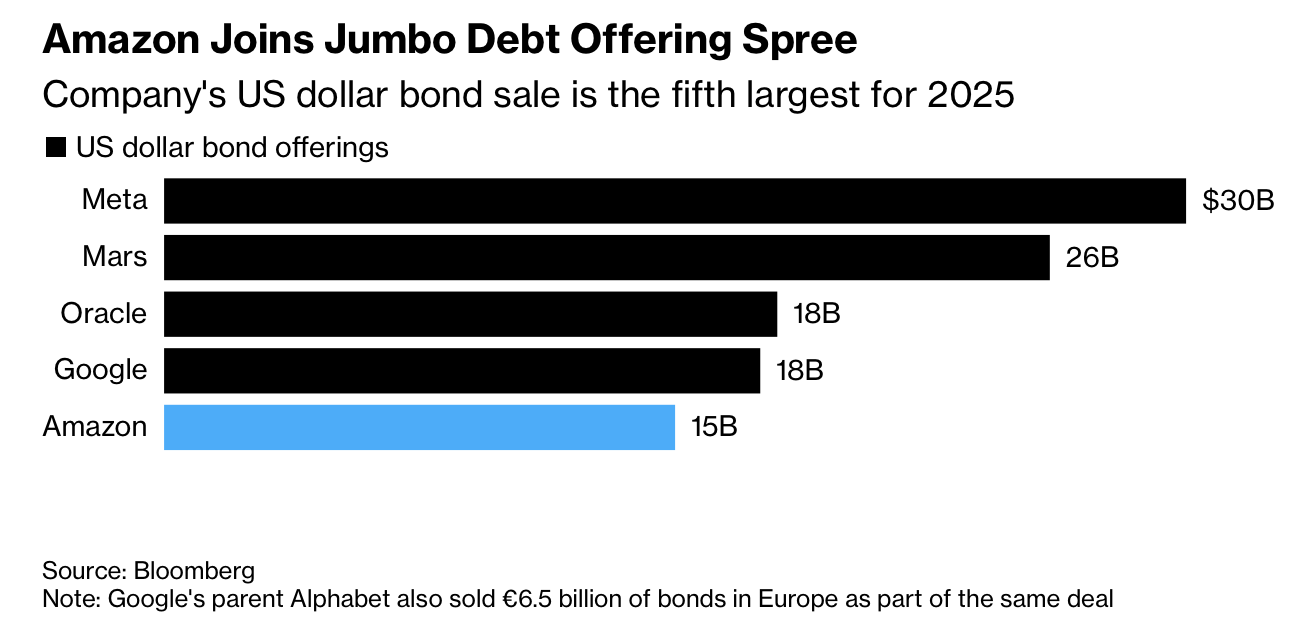

Amazon 三年来首次在美元债市场发行 150 亿美元债券,规模较最初预估多出 30 亿美元,并在峰值吸引约 800 亿美元认购,随后因定价收紧而砍半。该交易由六部分组成,40 年期债券利差自初始的比美债高 1.15 个百分点收窄至 0.85 个百分点。其发行位于科技公司“大额发债潮”之中:Alphabet 本月发行 250 亿美元,Meta 上月发行 300 亿美元,Oracle 九月发行 180 亿美元,推动今年全球发行量突破 6 万亿美元,且 JPMorgan 预测美国投资级市场将在明年创下 1.81 万亿美元纪录。

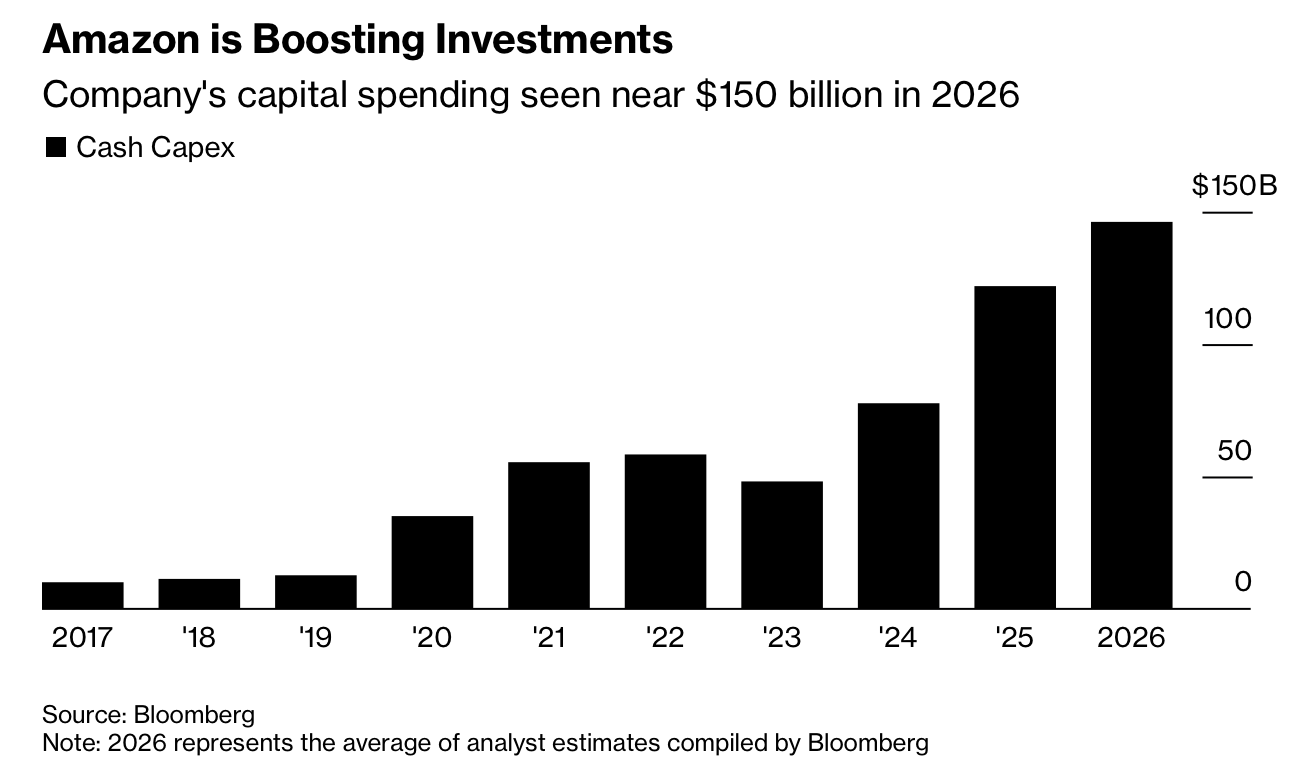

债券资金将用于并购、资本开支、回购及再融资,适逢 Amazon 大幅提高 AI 基础设施投入。公司 2026 年资本开支预计将达到 1470 亿美元,约为 2023 年水平的三倍,并开始通过举债增强资金结构灵活性。Amazon 数据中心电力容量自 2022 年起已翻倍,预计到 2027 年再度翻倍,同时其云业务在本月签署 380 亿美元、为期七年的算力合同,向 OpenAI 提供数十万片 Nvidia GPU。

Amazon 此前于 2022 年发行 82.5 亿美元,这次发行与科技业融资浪潮相呼应。JPMorgan 认为公司可进一步借助私募信贷与售后回租或合资结构为其迅速扩张的数据中心资产融资,反映 AI 驱动资本密集型投资的持续升级。

Amazon issued $15 billion of US dollar bonds, exceeding initial expectations by $3 billion and drawing peak demand of roughly $80 billion before order books were cut as pricing tightened. The six-tranche deal included a 40-year note whose spread narrowed from 115 basis points over Treasuries to 85. The sale adds to a series of jumbo tech offerings: Alphabet issued $25 billion this month, Meta $30 billion last month, and Oracle $18 billion in September, pushing global issuance above $6 trillion for the year, with JPMorgan projecting a US high-grade record of $1.81 trillion next year.

Proceeds will fund acquisitions, capital expenditures, buybacks, and refinancing, aligning with Amazon’s surge in AI-related investment. Capital expenditures are expected to reach $147 billion next year—triple 2023 levels—and the firm is shifting from relying on internal cash flow toward debt to enhance flexibility. Amazon’s data-center power capacity has doubled since 2022 and is projected to double again by 2027, while its cloud unit recently agreed to a $38 billion seven-year deal to provide OpenAI with hundreds of thousands of Nvidia GPUs.

Amazon last tapped the US high-grade market in 2022 with an $8.25 billion offering. JPMorgan notes the company could further use private credit via sale-leaseback or joint-venture structures to finance its expanding data-center footprint, highlighting the accelerating capital intensity of AI infrastructure.