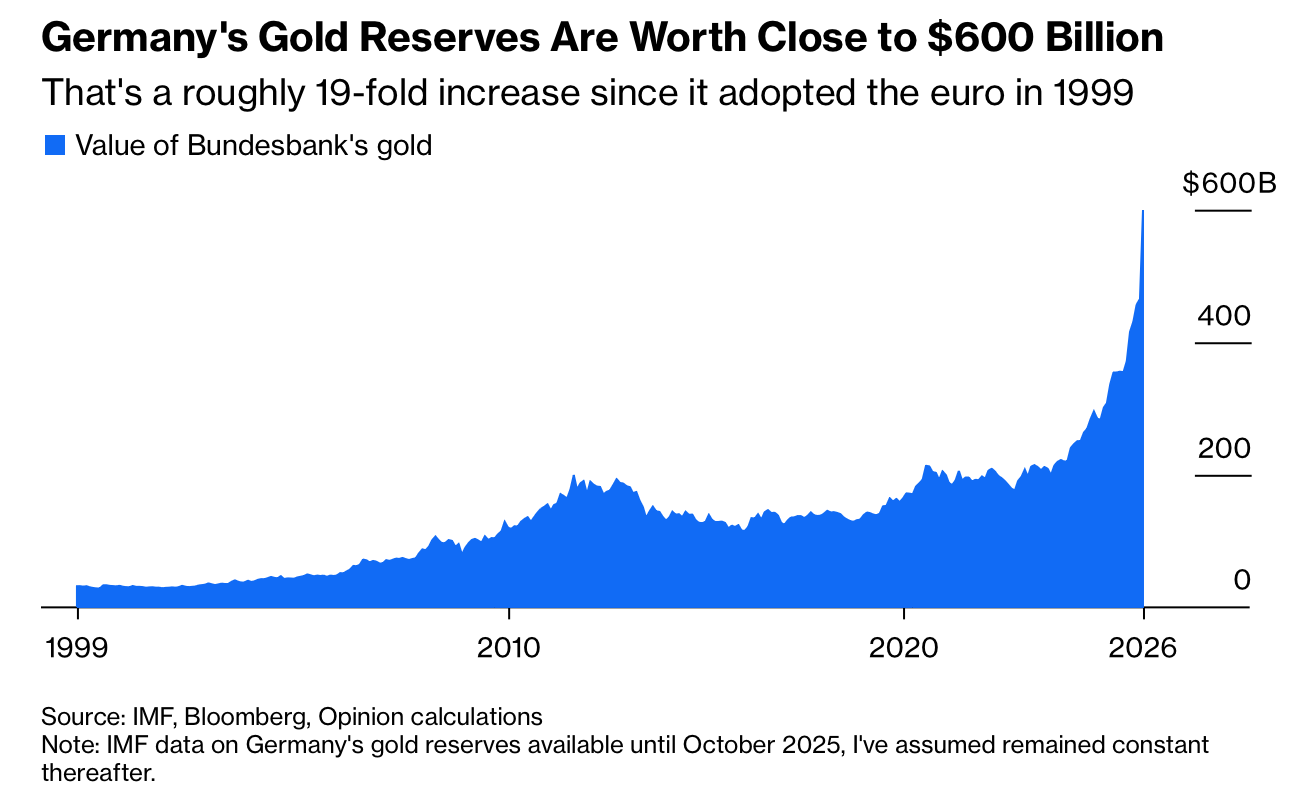

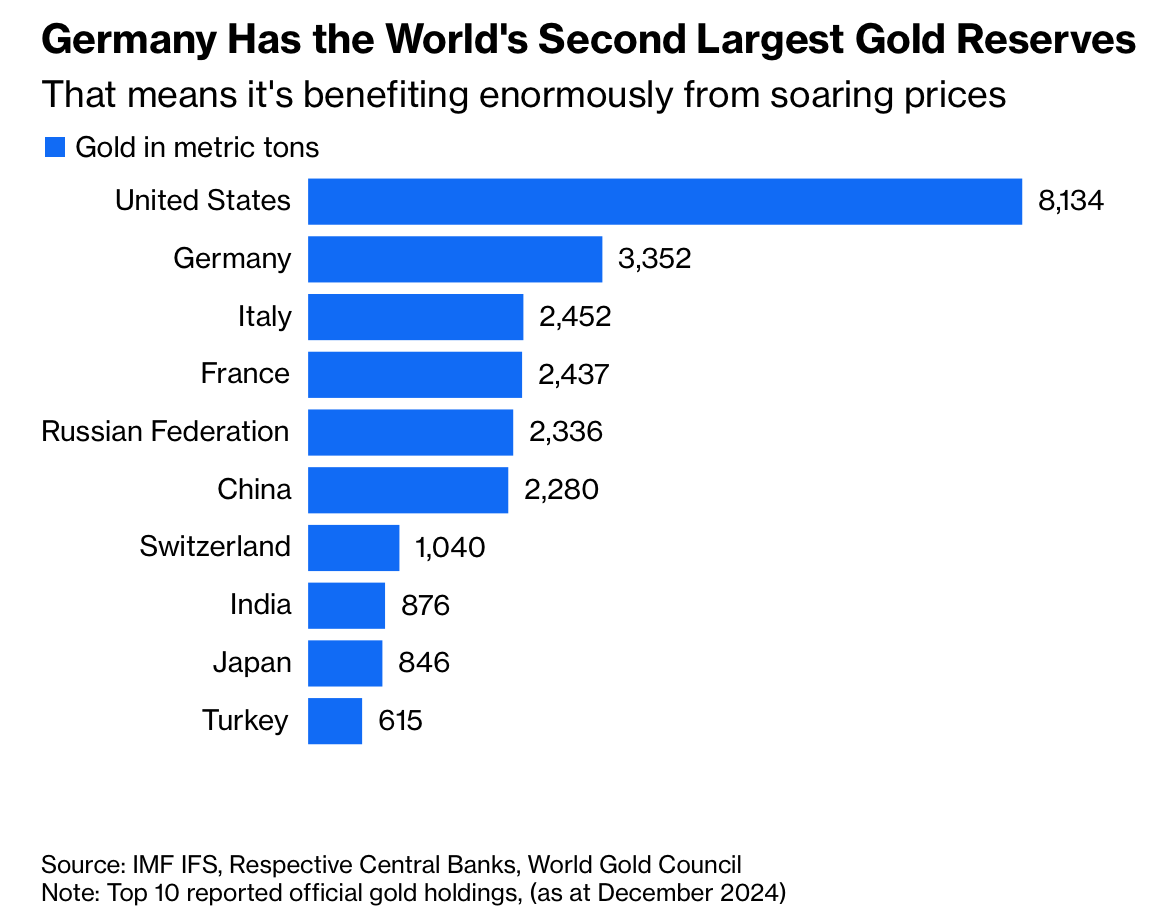

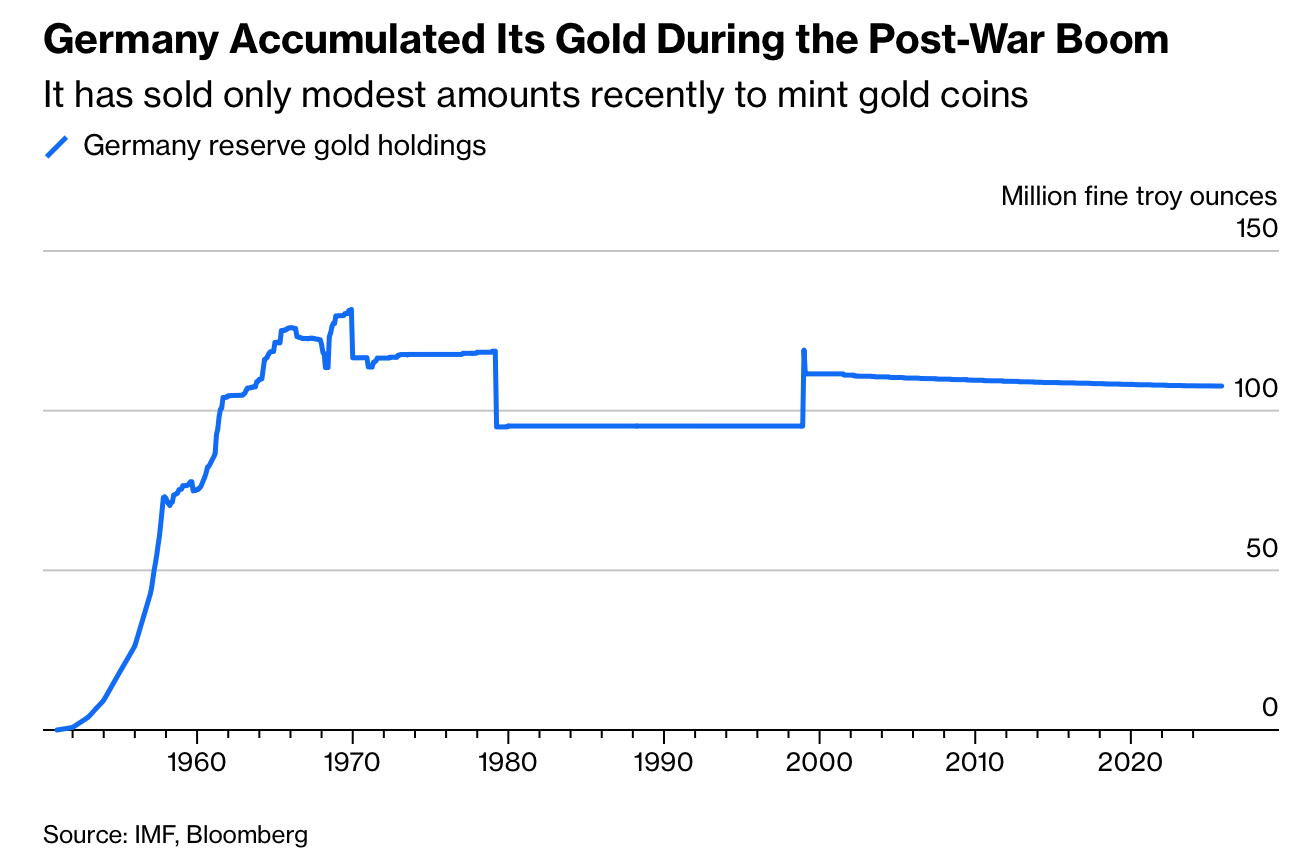

德国央行持有约5000亿欧元(5990亿美元)的黄金储备,是全球仅次于美国的第二大官方持有者,相当于德国国家债务的约18%,也是1999年采用欧元以来价值增长近19倍的资产。其中约1236吨、接近10万根金条存放在纽约联储,价值约2200亿美元。黄金价格飙升显著推高了资产规模,但这些储备不产生利息,且高度集中于单一、波动性资产。

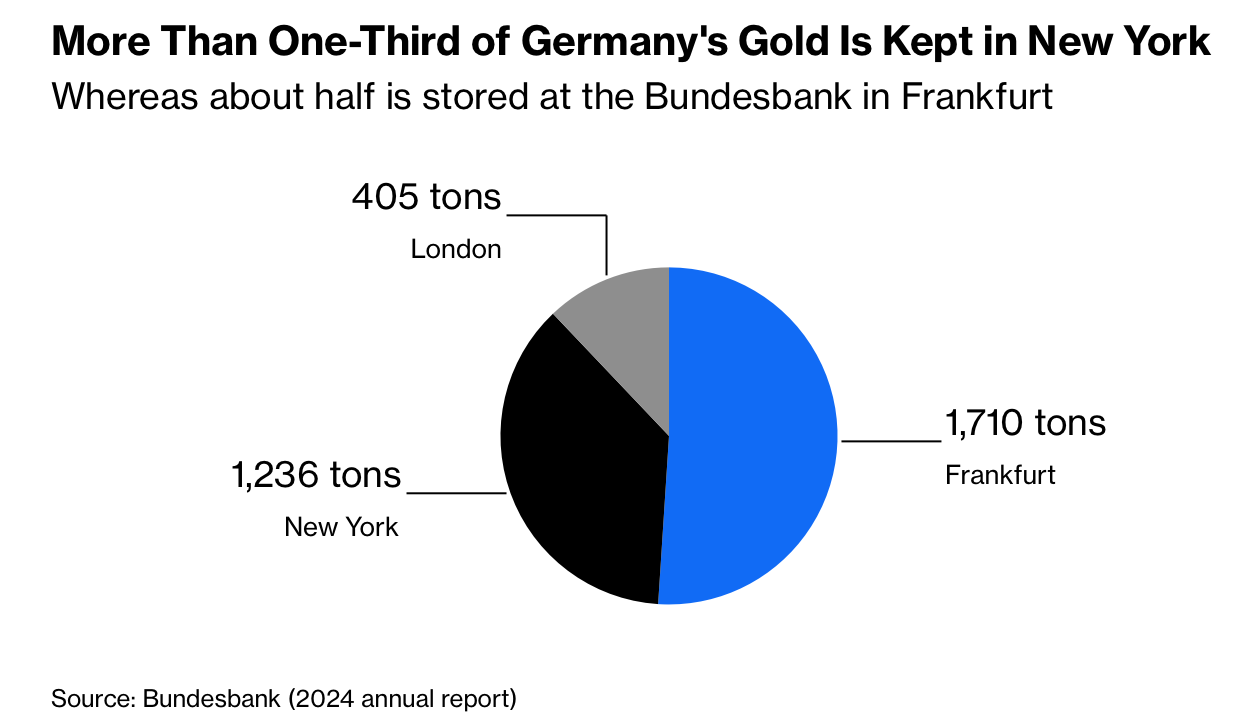

在政治与制度层面,德国已于2017年从纽约运回300吨黄金,目前约一半存放在法兰克福,12%在伦敦,其余仍在纽约。尽管特朗普削弱美联储独立性并引发美元外流,德国政府和央行仍反对进一步回流或出售。法律上,欧盟条约保障央行独立性;操作上,大规模抛售可能压低金价,并被市场解读为财政货币化或经济疲弱信号,需高度谨慎的节奏管理。

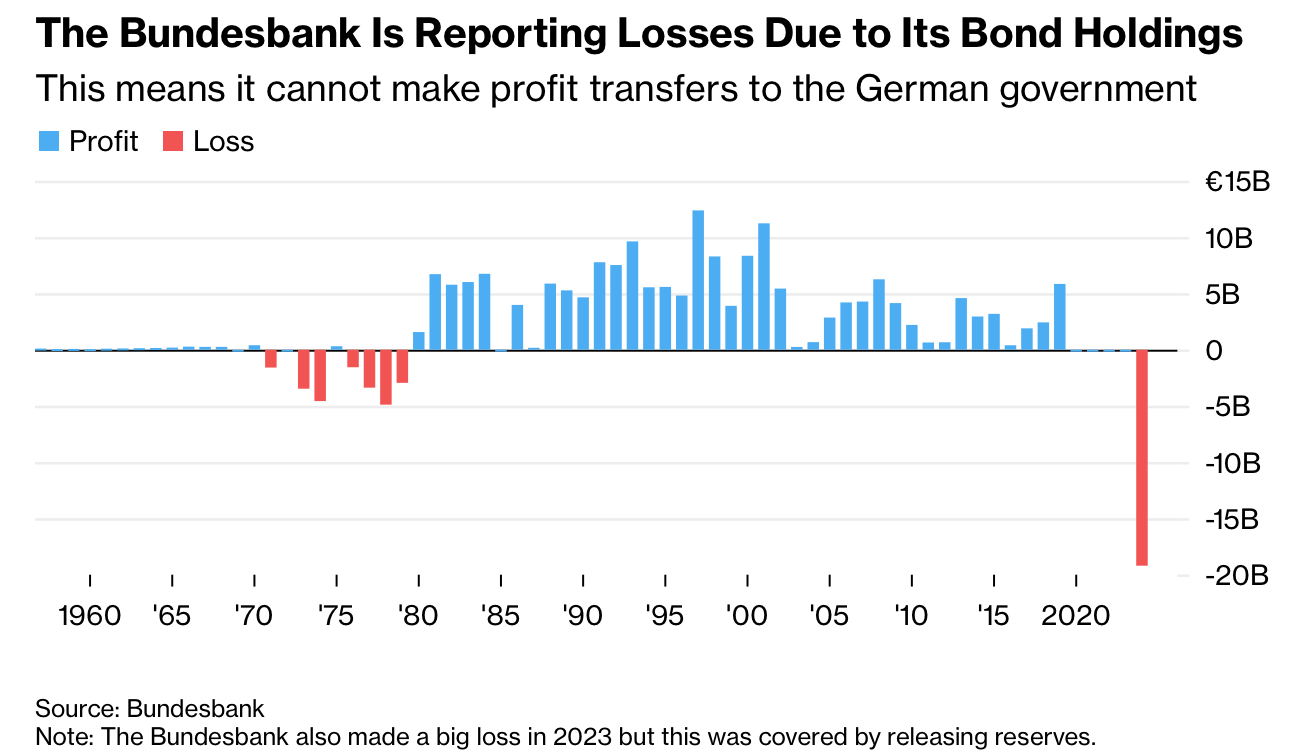

财务压力凸显了重新审视的动因。受量化宽松后资产负债错配影响,德国央行近两年每年亏损约200亿欧元,但黄金重估使其截至2025年2月的净资产超过2500亿欧元。由于自2020年起暂停向财政分红,纳税人未直接受益。在德国计划通过新增数千亿欧元举债用于基建与再武装之际,逐步、小规模出售黄金以换取生息资产或支持长期生产率投资,成为值得认真评估的政策选项。

Germany’s central bank holds about €500 billion ($599 billion) in gold, the world’s second-largest official stockpile after the US, equal to roughly 18% of national debt and nearly a 19-fold increase in value since adopting the euro in 1999. About 1,236 tons—nearly 100,000 bars—are stored at the New York Fed, worth around $220 billion. Soaring prices have inflated the balance sheet, but the hoard earns no interest and concentrates risk in a single volatile asset.

Politically and institutionally, Germany repatriated 300 tons from New York by 2017; roughly half now sits in Frankfurt, 12% in London, with the remainder in New York. Despite concerns about US governance and dollar outflows, Berlin and the Bundesbank oppose further repatriation or sales. EU treaties protect central bank independence, while execution risks loom: large sales could depress prices and be read as monetary financing or economic weakness, requiring careful pacing and messaging.

Fiscal realities sharpen the case for review. After quantitative easing, asset-liability mismatches produced losses of about €20 billion in each of the past two years, yet gold revaluation lifted net equity above €250 billion as of February 2025. Since profit transfers to the budget halted in 2020, taxpayers have not benefited. With Germany planning to borrow several hundred billion euros for infrastructure and rearmament, a gradual, limited sale to rebalance into interest-bearing assets or fund long-term productivity investments merits serious consideration.