日本国债市场剧烈波动引发市场猜测,规模达1.8万亿美元的日本政府养老金投资基金可能被动员以稳定收益率并支撑日元。GPIF被视为日本机构投资者的风向标,当前持有约4000亿美元海外债券。市场人士认为,若其提高日本国债配置、相应降低海外债券比重,尤其是美国国债,将同时缓解日债收益率上行压力并减少日元抛售。该讨论在日本长期国债收益率飙升至历史高位、日元跌至18个月低点后迅速升温。

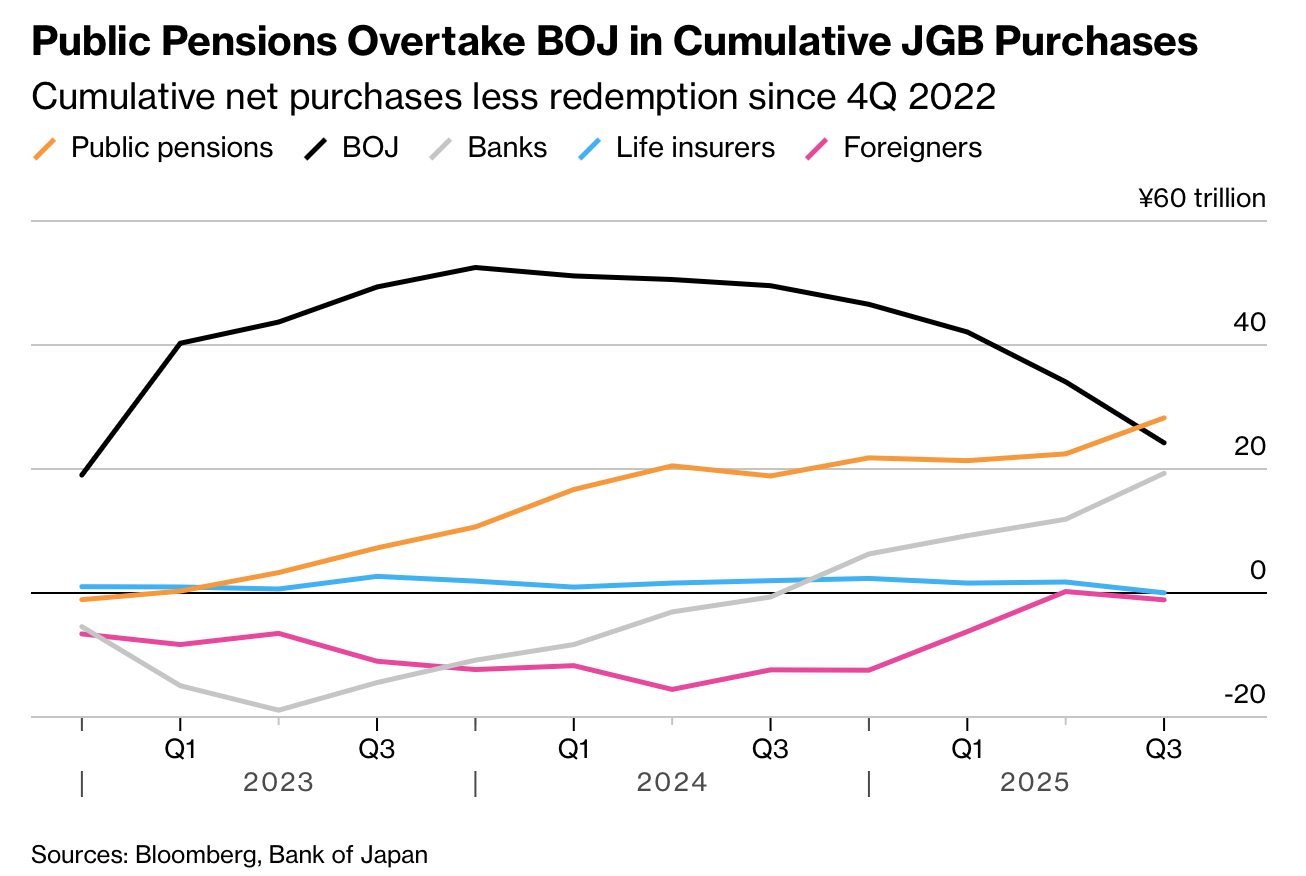

日本公共养老金近年来已成为国债的重要国内买家。自2022年第四季度以来,它们净买入日本国债约28.2万亿日元,而日本央行因缩减购债规模,未能完全对冲到期债券。GPIF按照五年周期评估资产配置,在2025年的最新评估中维持股票与债券各占50%,并在日本与海外资产间各配置25%,目标回报率为名义工资增速以上1.9个百分点。尽管如此,历史上GPIF曾在周期外调整配置,例如2014年配合量化宽松扩张。

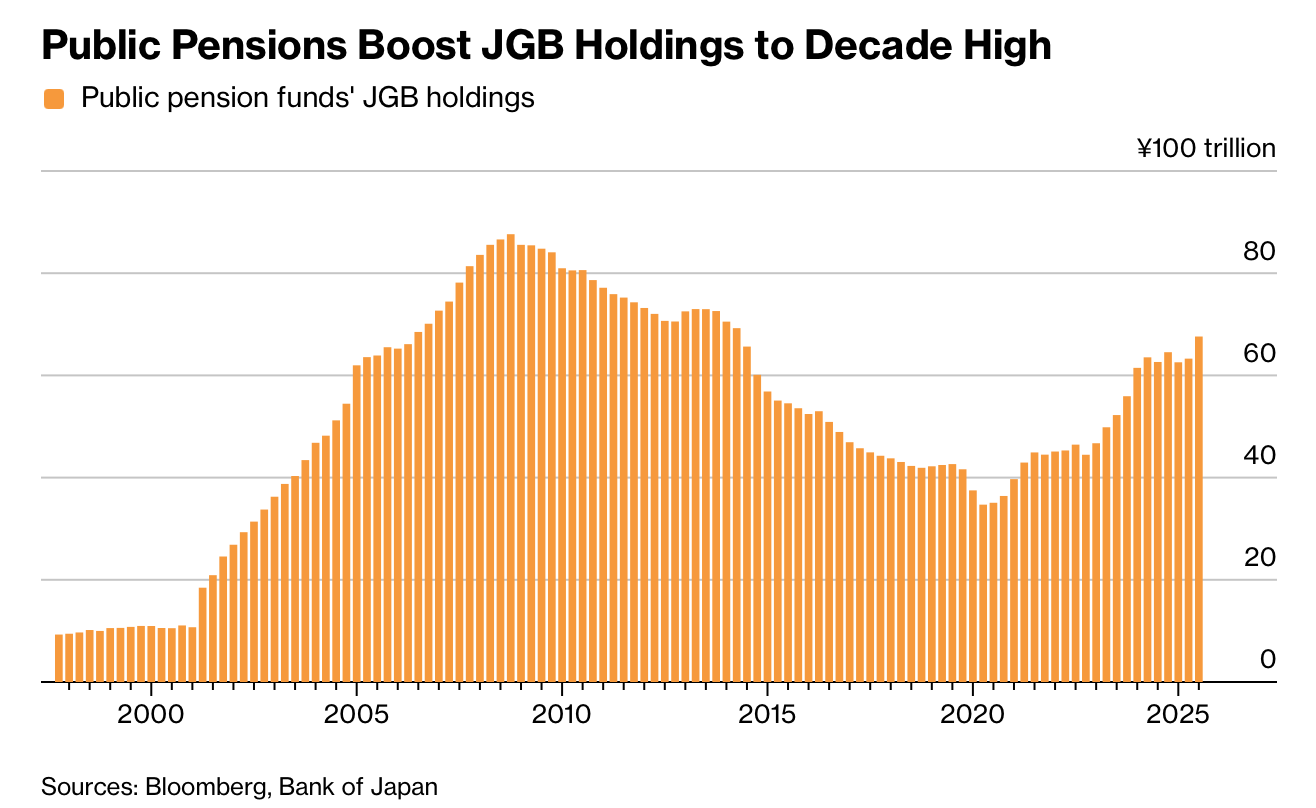

潜在调整对全球市场影响显著。到2025年3月,GPIF外债中51.8%配置于美国国债,为2015年以来最高比例。相比之下,日本公共养老金持有的国债规模为67.6万亿日元,仍远低于央行的522.2万亿日元。分析人士指出,即便只是小幅转向或释放明确信号,也可能稳定超长期国债情绪并提振日元,但国际协议限制养老金以汇率为目标操作,或制约其行动幅度。

Japan’s violent government bond selloff has prompted speculation that the $1.8 trillion Government Pension Investment Fund could be mobilized to stabilize yields and support the yen. As a bellwether for Japanese institutions, GPIF holds about $400 billion in foreign bonds. Investors argue that increasing allocations to Japanese government bonds while cutting overseas holdings, especially US Treasuries, could ease upward pressure on yields and reduce yen selling. The debate intensified after long-term JGB yields hit record highs and the yen slid to an 18-month low.

Public pension funds have increasingly become steady domestic buyers of JGBs. Since the fourth quarter of 2022, they have net purchased about ¥28.2 trillion of government debt, while the Bank of Japan’s slower buying failed to offset bonds rolling off its balance sheet. GPIF reviews its portfolio every five years and in 2025 kept a 50-50 split between stocks and bonds, allocating 25% each to Japanese and foreign assets, with a return target of 1.9 percentage points above nominal wage growth. Still, the fund has adjusted outside regular cycles before, notably in 2014.

Any shift would have global implications. As of March 2025, 51.8% of GPIF’s foreign bond holdings were in US Treasuries, the highest share since 2015. By comparison, public pensions’ JGB holdings totaled ¥67.6 trillion, far below the BOJ’s ¥522.2 trillion. Strategists say even a modest reallocation or a strong signal could steady sentiment at the super-long end, though international agreements constrain pension funds from targeting exchange rates directly.