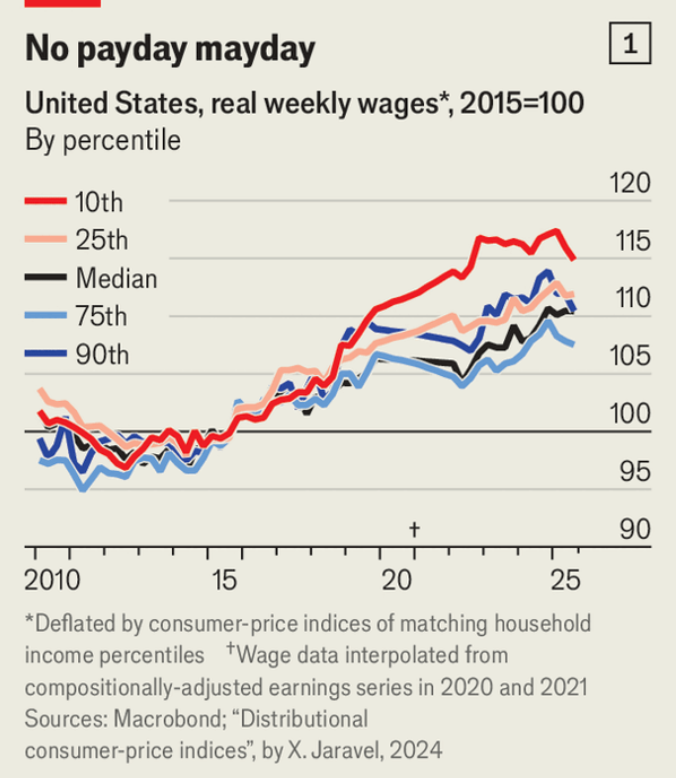

特朗普在2024年获胜时把通胀归咎于民主党并承诺价格会很快下降,但关税抬高了进口成本,而宏观图景更为平稳:实际工资已连续十年上升,且接近历史高位,低收入者尤为明显。美联储偏好的PCE通胀同比为2.8%,目标为2%(超出0.8个百分点),并在两年内大致处于2–3%区间,但价格水平仍比疫情前高约25%,即使名义工资也已上升约30%。

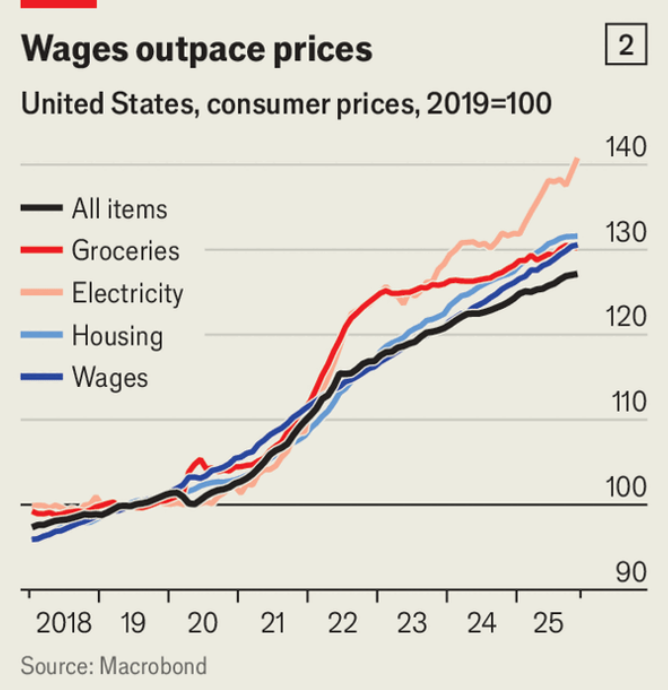

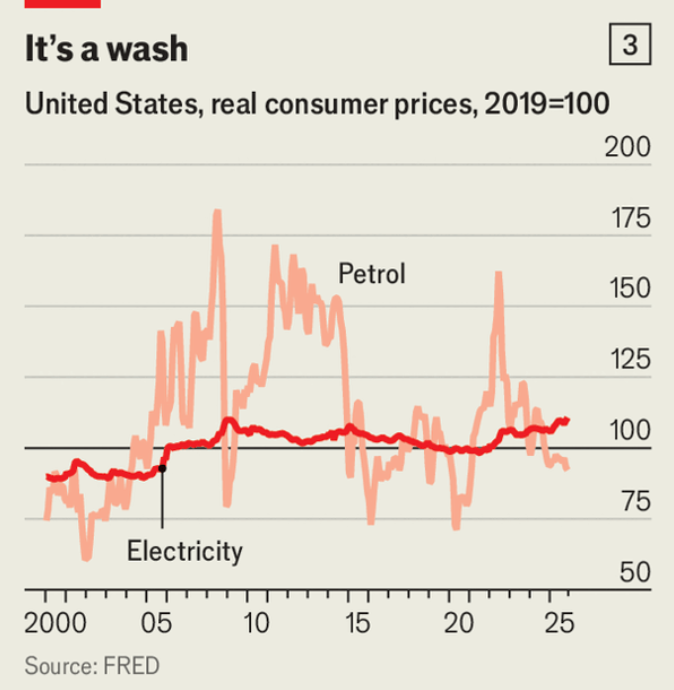

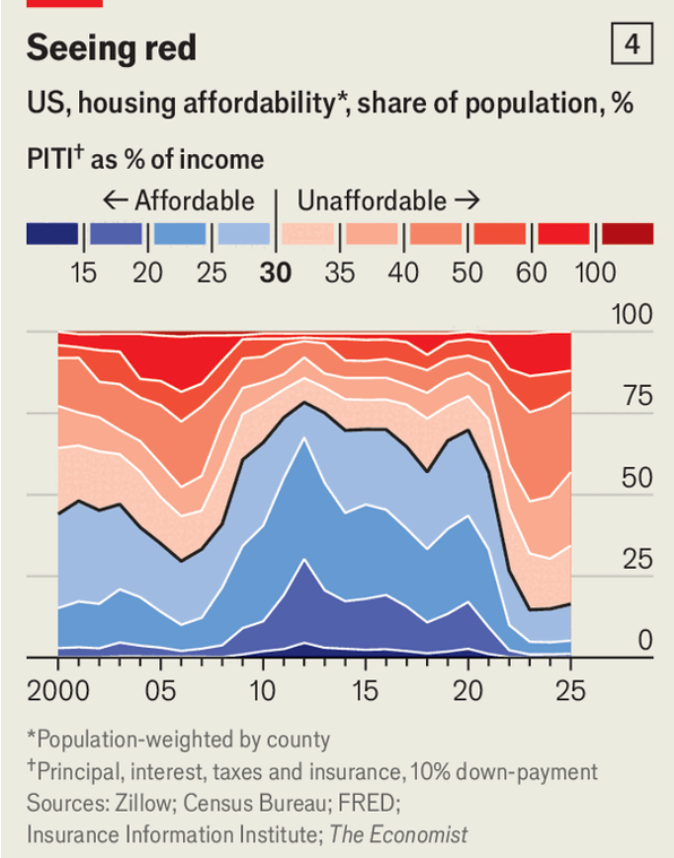

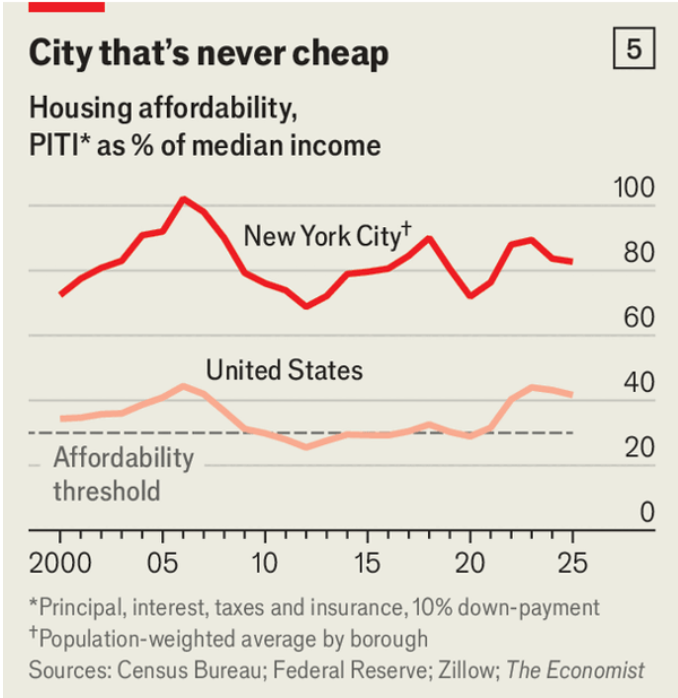

尽管鸡蛋价格曾上涨到四倍,食品杂货总体仍大体跟随总体通胀;自2019年以来电价相对通胀高出超过10个百分点;而汽油价格自2019年以来已下降,尽管家庭在汽油上的支出约比电力高40%。住房是最明显的挤压:在曼哈顿和布鲁克林,按揭、保险和房产税超过当地平均税前收入的90%,而可负担性的经验规则是30%;在超级城市之外,自2022年以来按揭利率上升使多数县超过这条30%线(即便首付10%),不过存量按揭平均利率约为4.3%,比新按揭低近2个百分点。

在2022–23年的峰值期,大约五分之一的商品与服务年涨幅超过10%,反复的个别暴涨加上更高的借贷成本让“可负担性”成为焦点,尽管薪资购买力总体健康。情绪重置缓慢:历史研究估计通胀愤怒的“一年半衰期”(意味着大约三年才会淡化),但民调显示对食品杂货、租金和信用卡费用涨幅设上限的支持极高,而盖洛普发现三分之二的美国人对大企业持负面看法,高于疫情前约一半。

The PCE inflation rate stands at 2.8% year-on-year, which is above the 2% target by 0.8 points. This has hovered around 2-3% for two years, but the price level remains about 25% higher than pre-pandemic levels, even as nominal wages have increased by roughly 30%.

Looking into groceries, they generally follow overall inflation trends, despite egg prices soaring. Also, electricity bills have outpaced inflation by over 10 percentage points since 2019. Petrol prices have decreased, yet people are spending around 40% more on petrol compared to electricity. Housing is a major challenge, particularly in Manhattan and Brooklyn, where costs consume over 90% of average pre-tax income, contrasting sharply with the 30% affordability rule.

Trump won in 2024 by blaming Democrats for inflation and promising prices would fall fast, yet tariffs raise import costs while the macro picture is steadier: real wages have risen for a decade and are near record highs, especially for low earners. PCE inflation is 2.8% year on year versus a 2% target (a 0.8-point overshoot) and has sat around 2–3% for two years, but the price level is still about 25% above pre-pandemic even as nominal wages are up roughly 30%.

Source: America’s affordability crisis is (mostly) a mirage

Subtitle: That doesn’t diminish its political power

Dateline: 12月 30, 2025 08:45 上午 | Washington, DC