2025年12月,日本百货店免税销售同比下降17.1%,降至519亿日元,连续第二个月下滑,核心原因是中国游客锐减。日本国家旅游局数据显示,12月中国访日人数同比下降45.3%至33.04万人。中国游客长期被视为奢侈品消费主力,其下滑使其他地区游客增长难以完全抵消,直接削弱了零售端对2026年的预期。

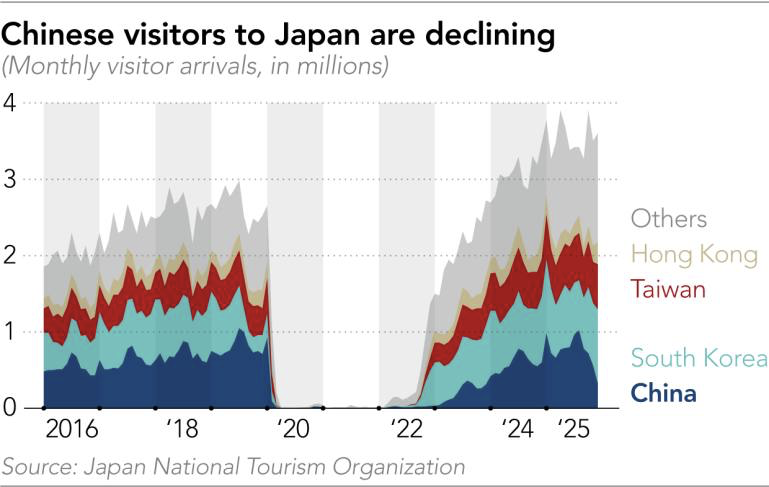

宏观层面上,2025年全年入境游客总量仍同比增长15.8%,达约4270万人次,消费额创纪录达9.5万亿日元。然而结构性变化明显:中国游客虽在2025年上半年恢复至2019年水平,但全年亚洲客源整体持平,而欧美游客增长,部分受大阪关西世博会带动。中国游客在2025年贡献约2万亿日元,占入境消费约20%,但其占比在第四季度降至14%,低于上一年同期的18.7%。

对2026年的预测分歧较大。私营部门预计入境人数可能降至4140万人;在不考虑中日紧张关系的情况下,潜在规模或达4500万人,但若中国游客人数减半,总量可能回落至约4000万人。研究机构警告,中国经济前景未来两到三年偏弱,叠加旅行限制,或导致未来一年入境消费减少1.2万亿日元,三年累计损失达2.3万亿日元。与此同时,中国游客人均消费在2025年已同比下降11%,价格上涨与日元走强削弱了其购买力,这一趋势预计延续至2026年。

In December 2025, Japan’s department store duty-free sales fell 17.1% year on year to 51.9 billion yen, marking a second consecutive monthly decline, driven primarily by a sharp drop in Chinese tourists. Official data show Chinese arrivals fell 45.3% in December to 330,400 visitors. As Chinese travelers have historically dominated luxury spending, growth from other regions was insufficient to offset the contraction, darkening retailers’ outlook for 2026.

At the aggregate level, inbound tourism in 2025 still grew 15.8% to about 42.7 million visitors, with spending hitting a record 9.5 trillion yen. Structural shifts were evident: Chinese arrivals recovered to 2019 levels by the first half of 2025, but overall Asian arrivals were flat for the year, while visitors from Europe and the U.S. increased, partly due to the Osaka Kansai Expo. Chinese tourists accounted for roughly 2 trillion yen, or about 20% of total inbound spending in 2025, yet their share fell to 14% in the October–December period from 18.7% a year earlier.

Outlooks for 2026 diverge. Private forecasts see inbound travelers slipping to around 41.4 million; without Japan–China tensions, arrivals could reach 45 million, but a halving of Chinese visitors could pull totals down to roughly 40 million. Analysts warn China’s weak economic outlook over the next two to three years and prolonged travel advisories could cut inbound spending by 1.2 trillion yen in the next year and 2.3 trillion yen cumulatively over three years. Chinese per-capita travel spending already fell 11% in 2025, and ongoing price hikes suggest continued pressure into 2026.