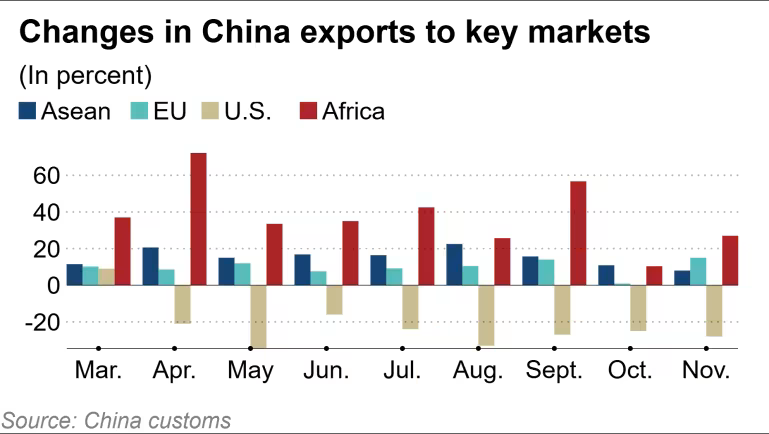

11月对美出口年减28.6%,连续第八个月下滑,且跌幅大于10月的25%,尽管川普与习近平达成休兵与部分关税下调。这一下滑被其他市场的强劲需求所抵消:对非洲出口大增27%,对欧盟成长15%,对东南亚成长8%,受惠于贸易改道以及中国在电机设备与低阶半导体领域的优势。

经济学者指出,在内需疲弱与房地产低迷压抑消费之际,出口仍是支撑中国成长的关键动能;野村预估明年整体出口可成长约4%,仍高于全球贸易平均水准。然而,中国今年前11个月对欧盟顺差已达2,667亿美元,加上外界对补贴过剩产能的质疑,正推升欧洲采取更严厉措施的压力并加剧通往2026年的贸易紧张。

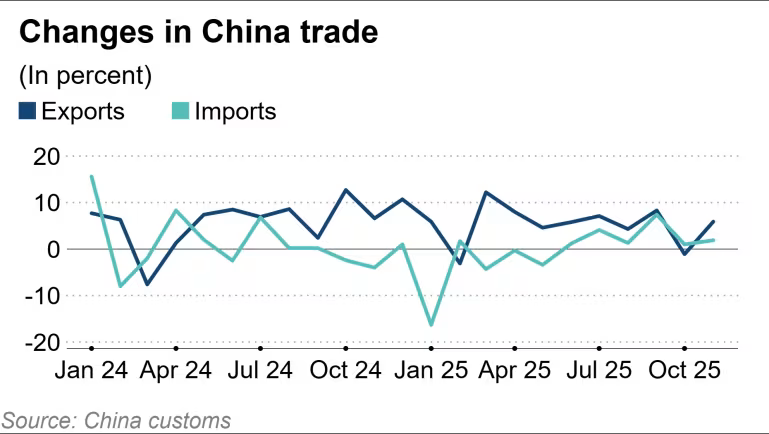

China's trade surplus topped a record $1.07 trillion in the first 11 months of the year, already exceeding 2024's full-year $992 billion, as exports rose 5.4% year on year while imports slipped 0.6%. In November, exports rebounded 5.9% in dollar terms after October's 1.1% drop, beating forecasts of 2.5% growth, while imports grew 1.9%, weaker than the 4% expansion expected.

Exports to the United States plunged 28.6% year on year in November, the eighth straight monthly decline and worse than October's 25% fall, despite the Trump-Xi trade truce and tariff reductions. This slump was offset by strong demand elsewhere: shipments to Africa jumped 27%, to the European Union 15%, and to Southeast Asia 8%, helped by trade rerouting and China's strength in electrical machinery and low-end semiconductors.

Economists say exports remain a key growth driver as weak consumption and a prolonged property downturn weigh on domestic demand, with Nomura projecting overall export growth of about 4% next year, still above the global trade average. However, China's $266.7 billion surplus with the EU in the first 11 months and accusations of subsidized overcapacity are fueling threats of tougher European measures and rising trade tensions into 2026.