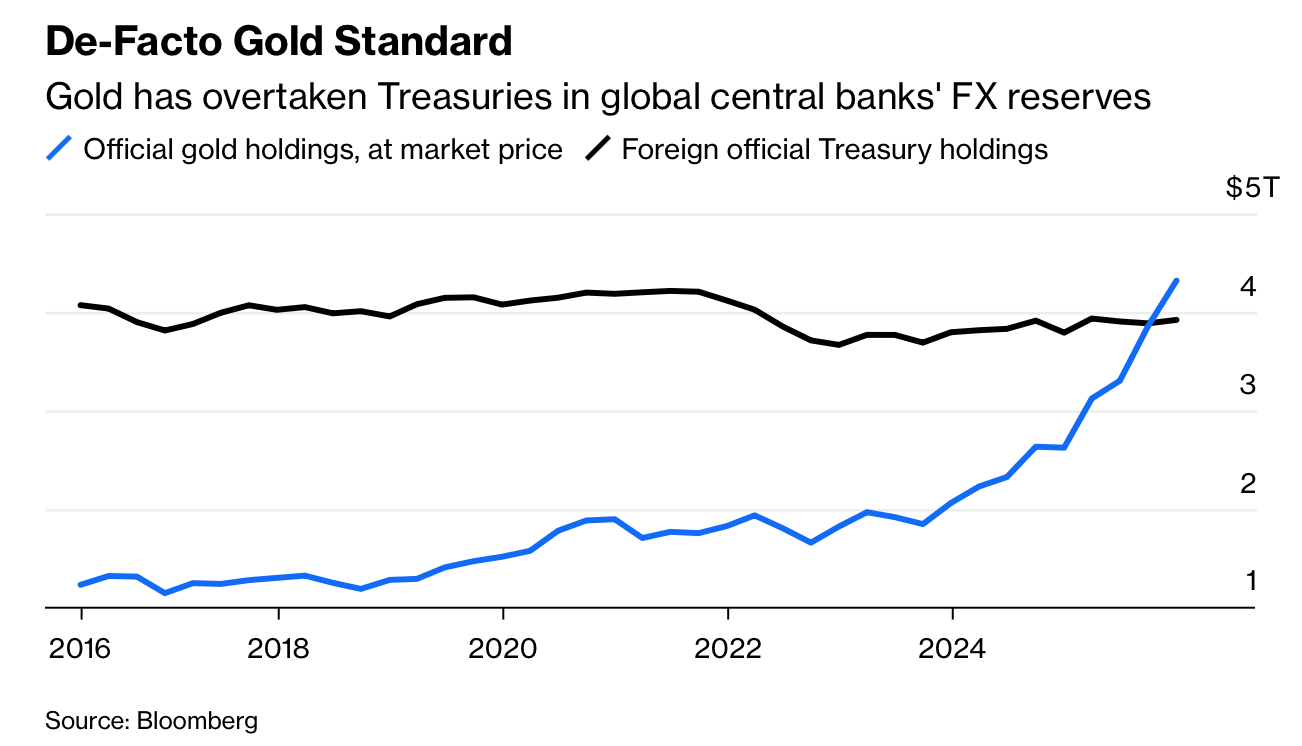

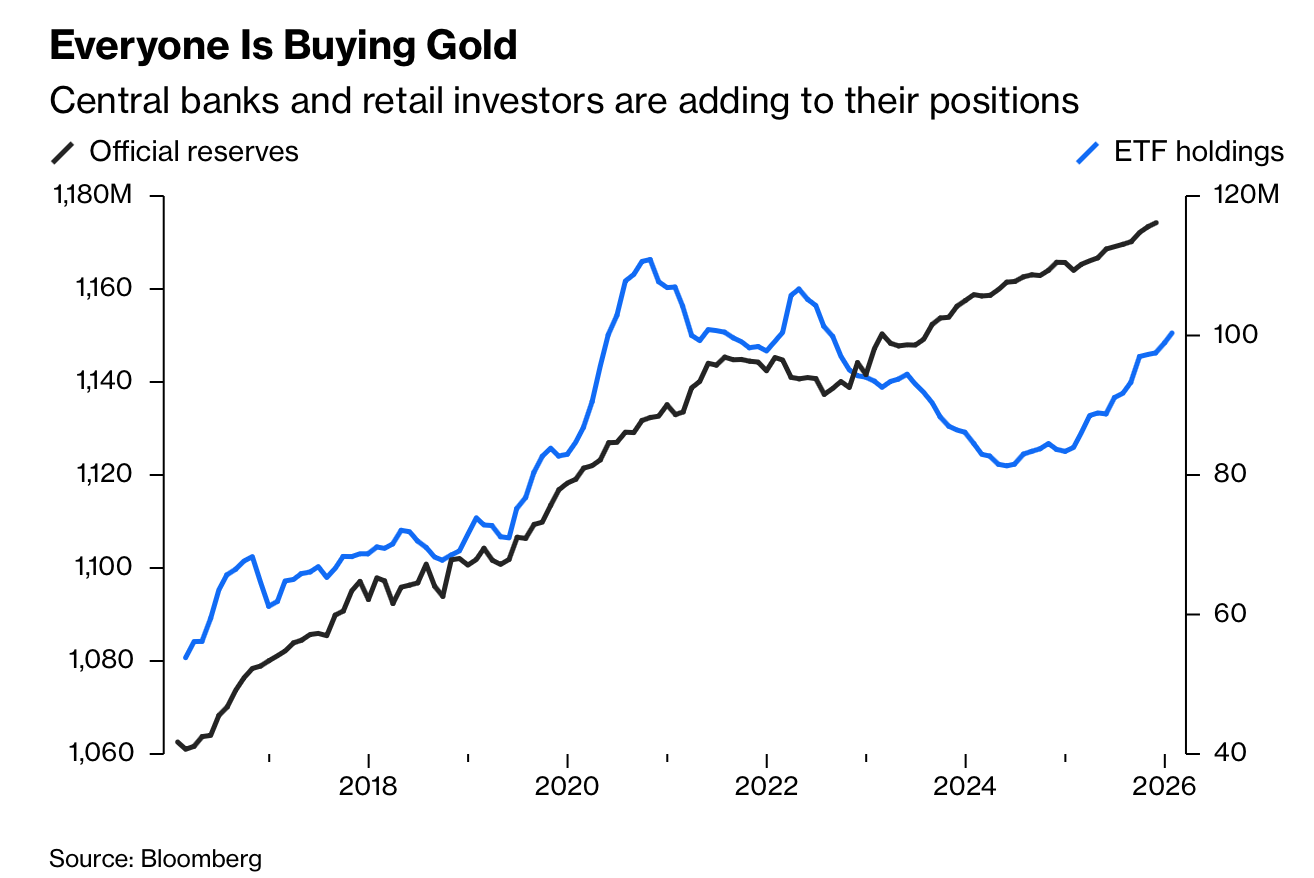

黄金正在取代美国国债成为全球央行外汇储备中的核心资产。在价格持续上涨的背景下,按当前市值计算,全球央行持有的黄金规模已超过其持有的美国国债。自2022年俄乌战争爆发以来,中国、印度、波兰等国持续增持黄金,并积累了可观的账面收益。与此同时,2025年底日本国债市场的波动外溢至美国国债,引发了对协调汇率干预的猜测,这类行动自20世纪90年代末以来极为罕见。金属价格普遍走强,白银、铜与黄金同步上涨,显示对主权债务和法币贬值的担忧正在加深。

资产配置层面,2022年疫情后下跌中,传统60/40组合失效,债券未能对冲股票回撤。进入2026年,全球股市处于历史高位,避险需求上升。近期的债市抛售再次证明缺乏“避险反弹”,美国国债未能上涨。作为替代方案,策略师提出60/20/20模型,即将固定收益配置减半,并将20%配置于贵金属。这一转向被认为部分解释了黄金本周仍维持在每盎司5000美元以上的水平。

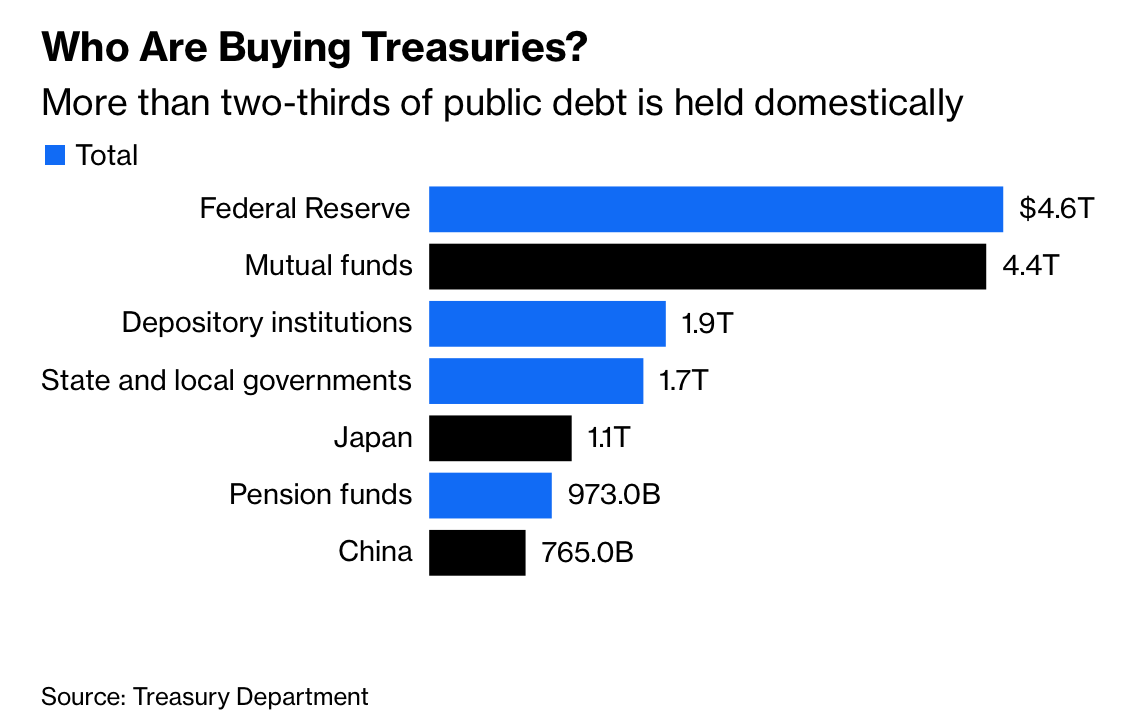

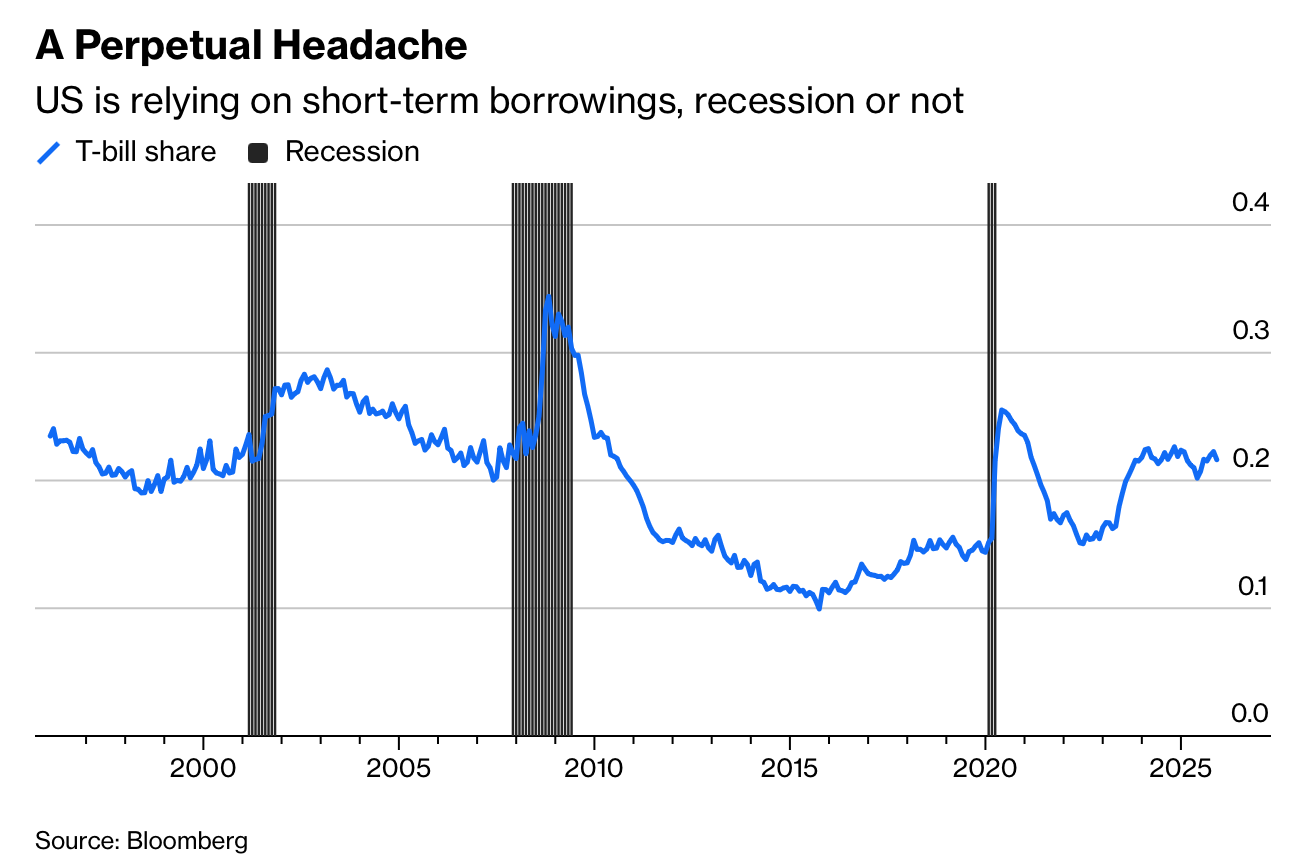

对美国财政部而言,风险集中在国内投资者行为上。截至2025年3月,美国国内共同基金持有4.4万亿美元国债,远高于日本的1.1万亿美元和中国的7650亿美元。若美国家庭转向贵金属,其影响远大于外国官方抛售。结果是更多融资需依赖一年期以内的国库券。到2025年底,国库券占可流通国债的约22%,显著高于2010年代水平。短期债务比例上升使融资成本更具波动性,这一长期问题正持续压迫财政政策。

Gold is displacing US Treasuries as the core asset in global central-bank reserves. After a sustained rally, the market value of official gold holdings now exceeds that of Treasuries. Since Russia’s invasion of Ukraine in 2022, countries including China, India, and Poland have steadily accumulated gold, generating substantial capital gains. In late 2025, tremors in Japan’s bond market spilled into Treasuries, reviving speculation about coordinated currency intervention, an event rare since the late 1990s. Broad strength across metals, with silver and copper rising alongside gold, signals intensifying concern over sovereign debt and currency debasement.

In portfolio construction, the traditional 60/40 model failed during the 2022 post-Covid downturn, as bonds did not cushion equity losses. Heading into 2026, global equities sit at record highs, amplifying demand for hedges. A recent bond market rout again showed no flight to safety, with Treasuries failing to rally. As an alternative, strategists promote a 60/20/20 allocation, cutting fixed income in half and assigning 20% to precious metals. This shift is cited as a factor behind gold holding above $5,000 per ounce this week.

For the US Treasury, the critical risk lies with domestic investors. As of March 2025, US mutual funds held $4.4 trillion of Treasuries, far exceeding Japan’s $1.1 trillion and China’s $765 billion. A move by American households into precious metals would outweigh foreign selling. Financing would then rely more on bills maturing within one year. By end-2025, bills accounted for about 22% of marketable Treasury debt, well above 2010s levels. The higher short-term share increases borrowing cost volatility, turning the debasement trade into a persistent fiscal constraint.