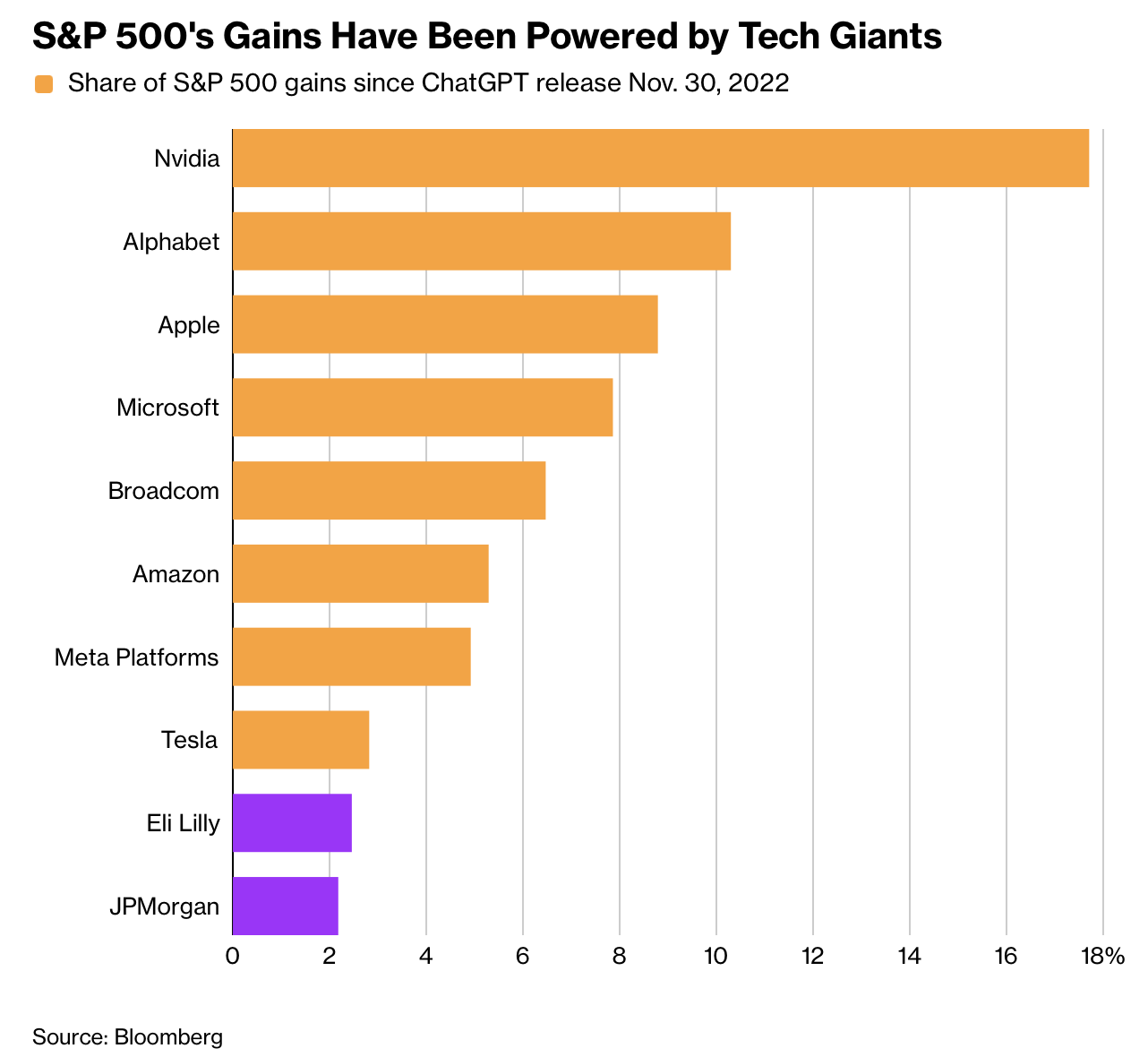

三年间,美国股市的结构被生成式人工智能推动的资本集中重塑。自 ChatGPT 于 2022 年 11 月推出以来,AI 投资驱动的牛市令 S&P 500 上涨约 64%,并将市值最集中的七家科技公司权重从约 20% 推升至约 35%。这些公司(Nvidia、Microsoft、Apple、Alphabet、Amazon、Meta、Broadcom)贡献了近半数指数涨幅。与此同时,与 AI 冲击相关的风险集中压制了软件、人员配置与广告等行业,一篮子受威胁企业的股价自同一时间点起下跌逾三分之一,部分个股如 LivePerson 与 Chegg 下跌约 97%,而 ManpowerGroup 与 Robert Half 下跌逾 65%。

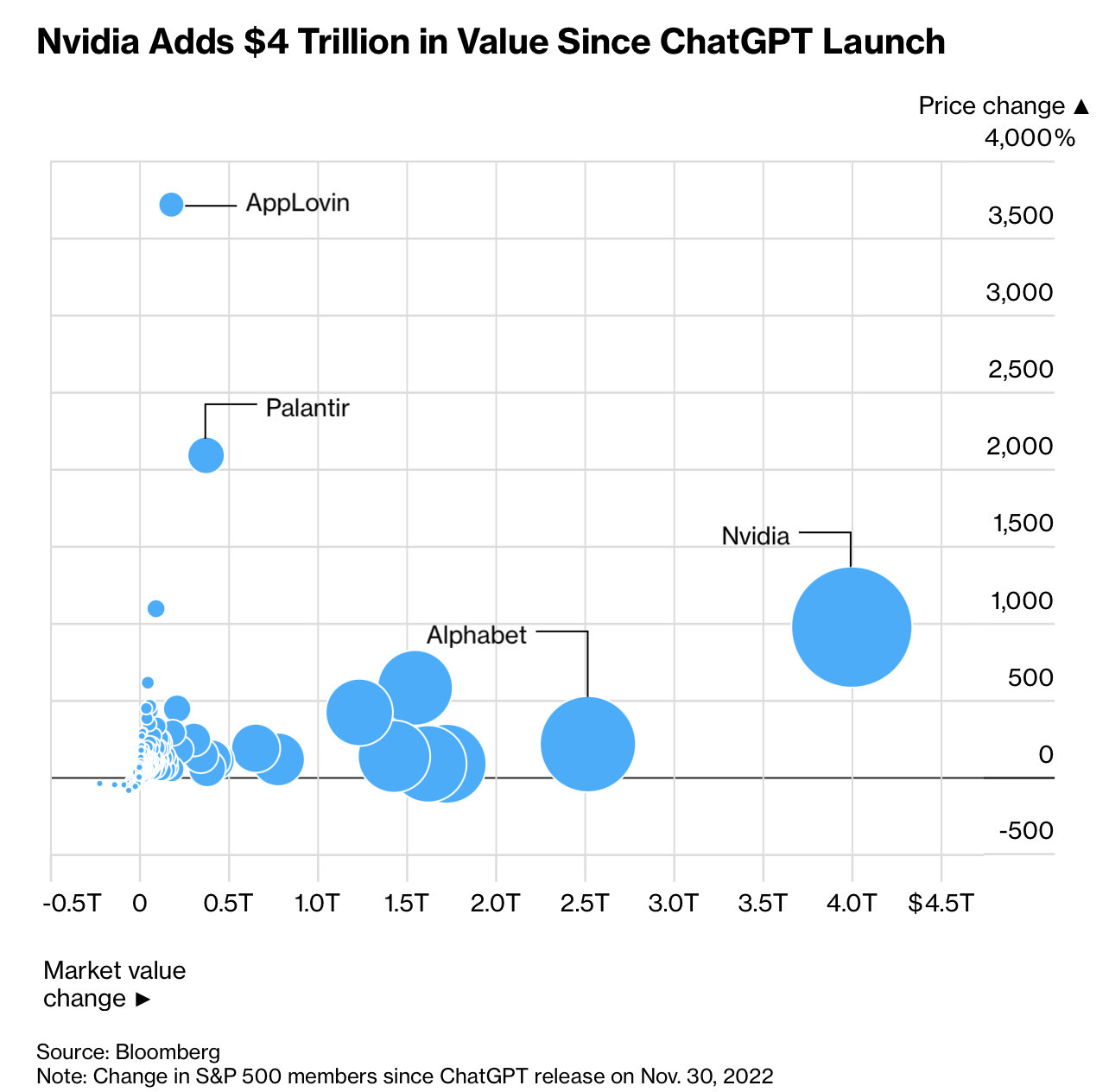

Nvidia 成为最显著受益者,其股价上涨约 979%,并在 AI GPU 市场形成主导地位。公司年收入从 2022 年的 270 亿美元跃升至预期的逾 2000 亿美元,未来 12 个月净利润预测超过 S&P 500 三分之一成分股的合计水平。芯片需求的高速增长吸引竞争者加入,包括 Meta 传出计划向 Google 采购价值数十亿美元的 AI 芯片,导致 Nvidia 股价短暂下跌,而 Alphabet 上涨。与之并行,电力供应商在电力需求激增中获益,Vistra 股价三年涨约 620%,NRG Energy 与 Constellation Energy 均上涨逾 250%,而核能项目重新获得资本投入。

在 AI 资本推动 winners 与 losers 分化的同时,市场集中度升至历史未见的水平,引发对系统性脆弱性的担忧。科技公司在计算设备、能源供应与基础设施投资中的主导强化了行业间表现差异。尽管市场内部仍存在对 AI 支出可持续性的疑问,科技与 AI 主题仍保持主导,结构性力量尚未出现显著逆转迹象。

Over three years, the structure of the US equity market has been reshaped by capital concentration driven by generative AI. Since the launch of ChatGPT in November 2022, AI-driven gains have lifted the S&P 500 by about 64% and expanded the weight of the top seven technology firms from roughly 20% to about 35%. These firms (Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, Broadcom) contributed nearly half of index performance. Conversely, sectors exposed to AI displacement—software, staffing, advertising—fell sharply, with a UBS basket down more than one-third, while individual stocks such as LivePerson and Chegg dropped about 97%, and ManpowerGroup and Robert Half declined more than 65%.

Nvidia became the prime beneficiary, with its share price rising about 979% and its GPUs dominating the AI market. Revenue rose from USD 27 billion in 2022 to an expected more than USD 200 billion, while projected 12-month net income exceeds the combined profits of one-third of S&P 500 constituents. Surging demand intensified competition, including reports that Meta may spend billions on Google’s AI chips, pushing Nvidia lower and Alphabet higher. Power producers also benefited from soaring electricity needs, with Vistra up roughly 620% and NRG Energy and Constellation Energy up more than 250%, while nuclear projects attracted renewed support.

As AI-driven capital reinforces the divide between winners and losers, market concentration has reached unprecedented levels, raising concerns over systemic fragility. Technology firms’ dominance in computing hardware, energy procurement, and infrastructure investment has widened performance dispersion. Despite questions over the sustainability of AI-related spending, the technology and AI theme remains entrenched, with no significant reversal evident.