住房疲弱与劳动市场恶化形成新的收缩阶段。抵押贷款利率约6.25%,较2022年区间偏低,但需求仍不足,导致建商削减建造、购地与人手。过去一年约1.5个百分点的利率下降仍无法修复利润率。就业端自年中急剧放缓,Waller 认为5月至8月实际就业可能下降。10月大规模裁员预告飙升至20年高位之一,尽管失业率仅4.4%。在此背景下,53%房屋自去年以来贬值,为2012年以来最高,使买家更不愿入市。

供需均向下拉动并互相强化。劳动市场低迷抑制购屋意愿,而需求不足迫使建商裁员,加剧就业疲弱。建筑业在6、7、8月均减少职位,9月增幅可能被下修。Beazer Homes 透过重新招标一年节省每户约10,000美元,但其供应商与承包商被迫自行吸收成本,公司也缩减员工。建设占美国就业仅5%,但2011至2019年间贡献10%新增职位,显示其循环性与前瞻性。房市与劳动情绪同步:收入预期转弱时,家庭不愿承担抵押贷款。

通膨与政策路径受此恶性循环牵动。房价与租金的疲软正推低住房类通膨,历史证据显示关税通常经由提高失业率压低通膨。核心通膨降速不及预期,使联准会对12月降息愈发迟疑,但延迟行动将使2026年压力扩散。住房与就业的双重疲态正在加深,若政策不及时调整,冲击将扩大。

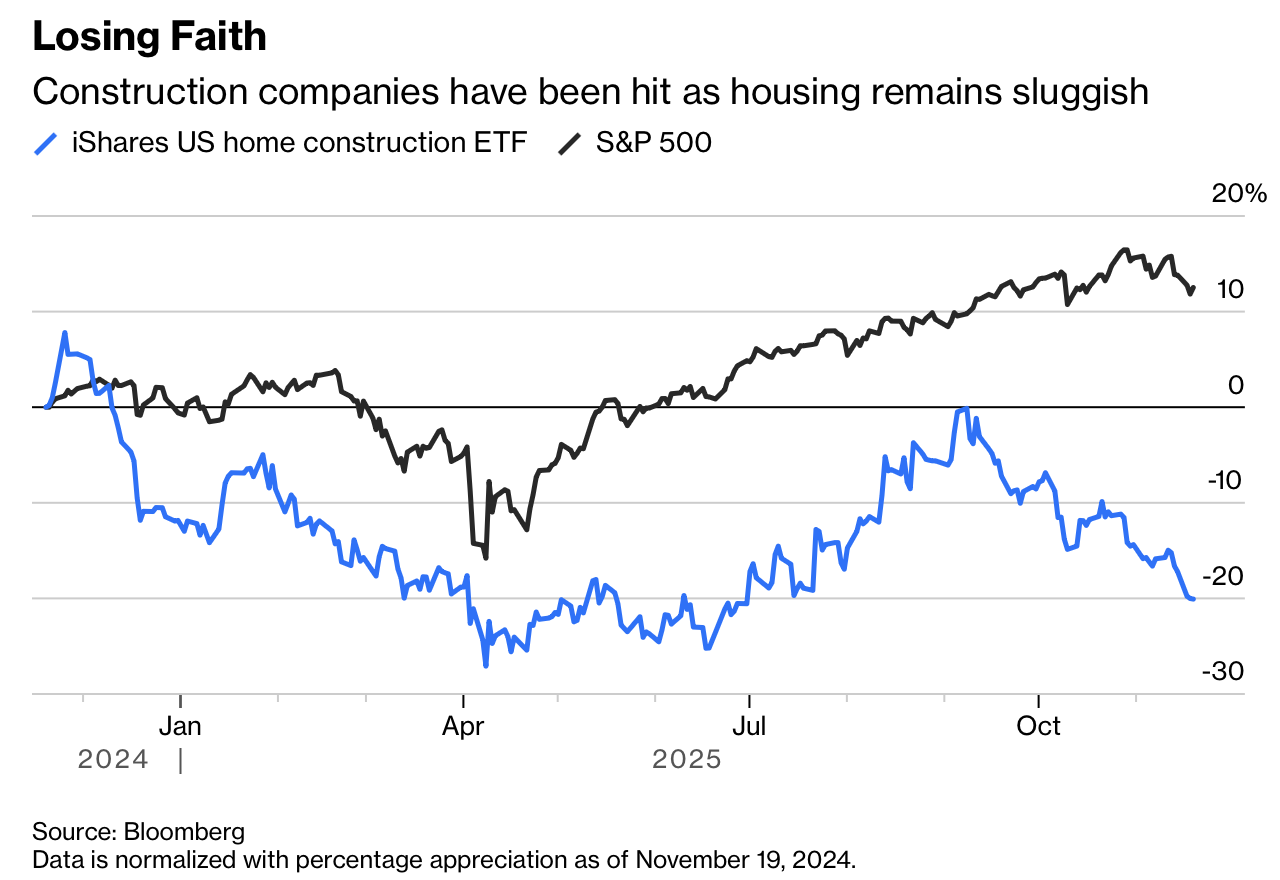

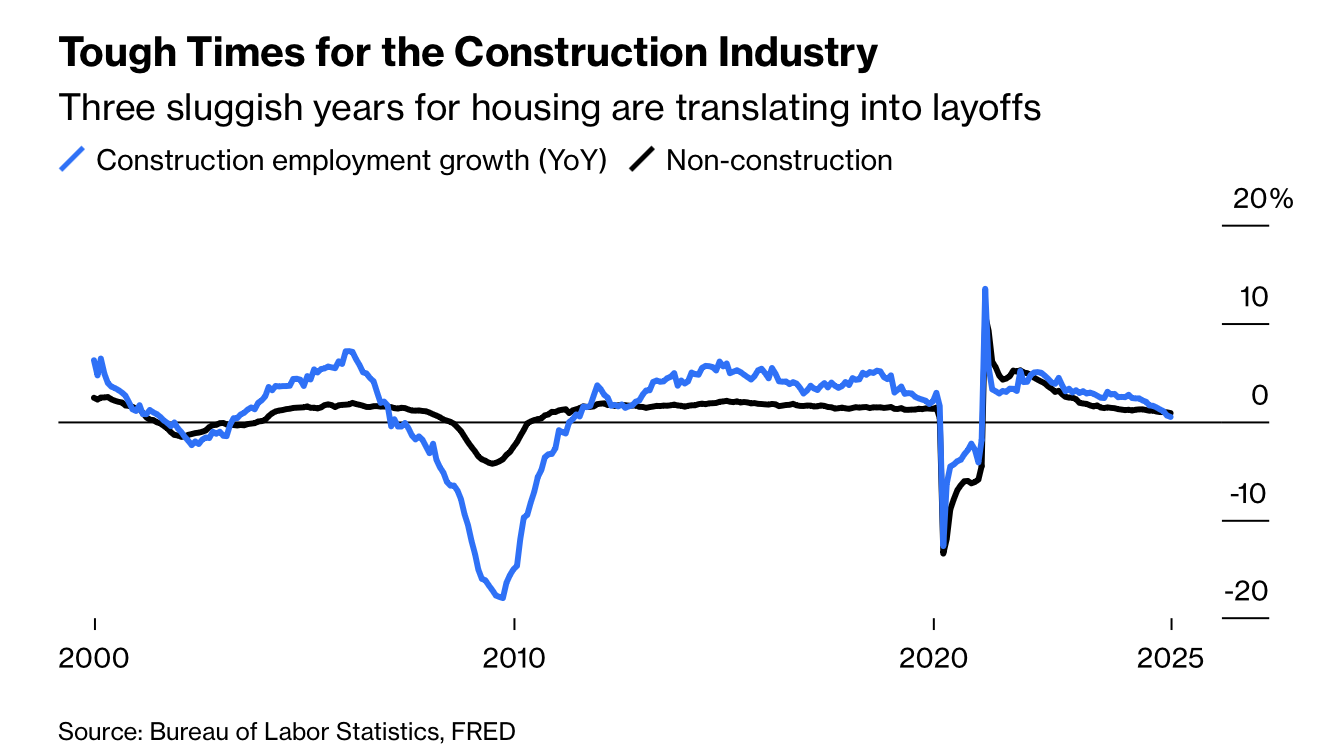

Housing weakness and labor-market deterioration have entered a new contraction phase. Mortgage rates near 6.25%, toward the low end since 2022, have not revived demand, leaving builders cutting construction, land purchases, and headcount. About 1.5 percentage points of easing over the past year has not restored margins. Job growth slowed sharply midyear, and Waller believes employment likely declined from May to August. October mass-layoff notices surged to one of the highest levels in 20 years despite a 4.4% unemployment rate. Meanwhile, 53% of homes have lost value since last year, the highest share since 2012, further discouraging buyers.

Demand and supply are dragging each other down. A weak labor market suppresses homebuying, while depressed demand forces builders to lay off workers, weakening employment further. Construction shed jobs in June, July, and August, and September gains may be revised lower. Beazer Homes saved about $10,000 per home through rebidding but shifted costs to suppliers and cut staff. Construction is only 5% of US employment but contributed 10% of job growth from 2011 to 2019, showing its cyclical and leading nature. Housing demand aligns with worker sentiment: weaker income prospects reduce willingness to take on mortgages.

Inflation and policy direction are being shaped by this loop. Declines in home prices and rents are pulling shelter inflation lower, and historical research shows tariffs reduce inflation by raising unemployment. With core inflation moderating slower than expected, the Fed is increasingly hesitant about cutting rates in December, but delays risk amplifying 2026 stress. The combined weakening of housing and jobs is intensifying and will broaden without timely policy adjustment.