美国的人工智慧热潮正与电力短缺正面冲突。亚马逊、Google、Meta 和微软等超大规模业者计划投入逾 4,000 亿美元资本支出扩建资料中心,而 OpenAI 单独就签下总值 1.4 兆美元、未来八年约 28GW 容量的基础设施合约。经过数十年停滞后,公用事业预估至 2030 年电力需求将以每年 5.7% 成长,其中逾半增量来自 AI 资料中心。

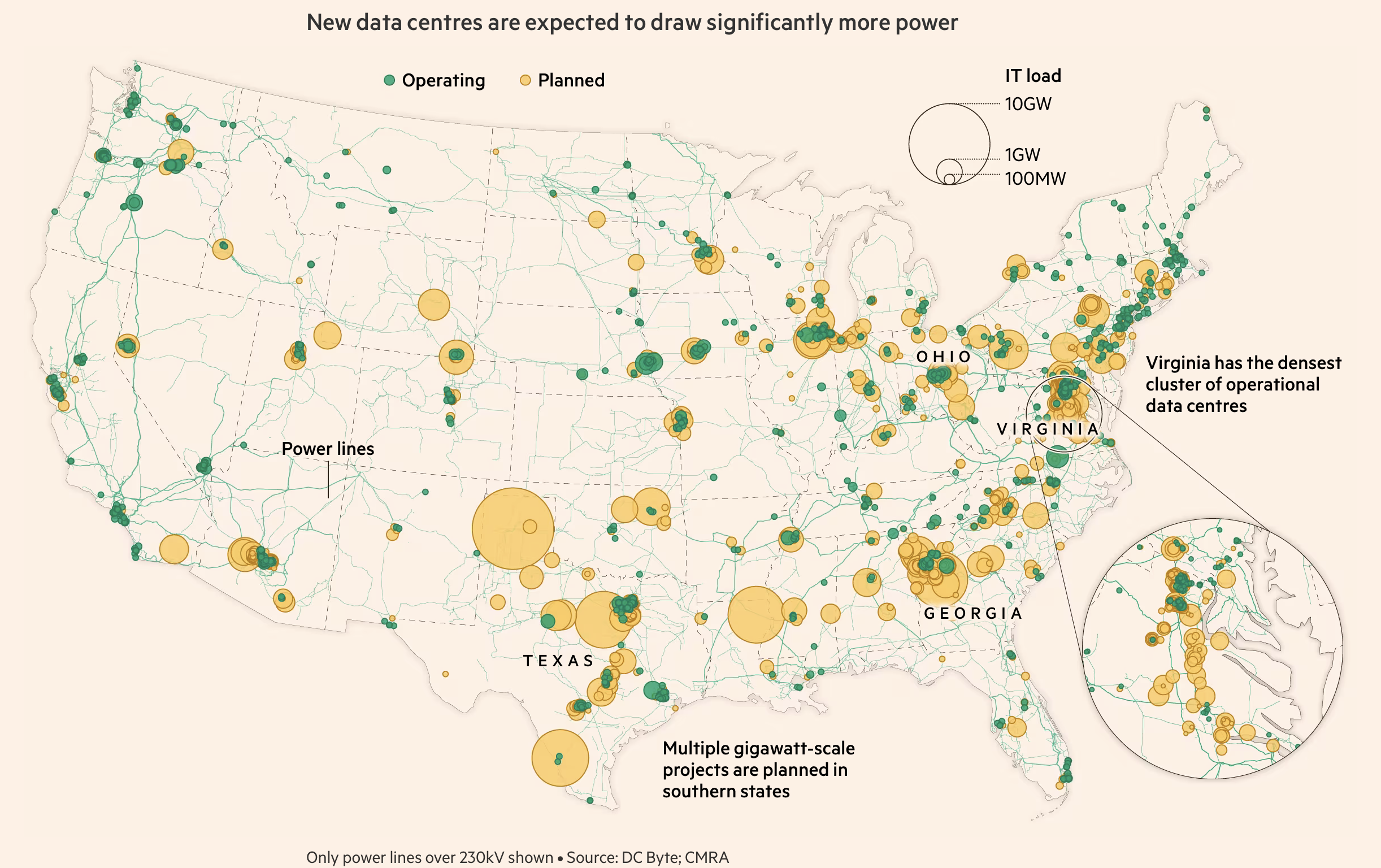

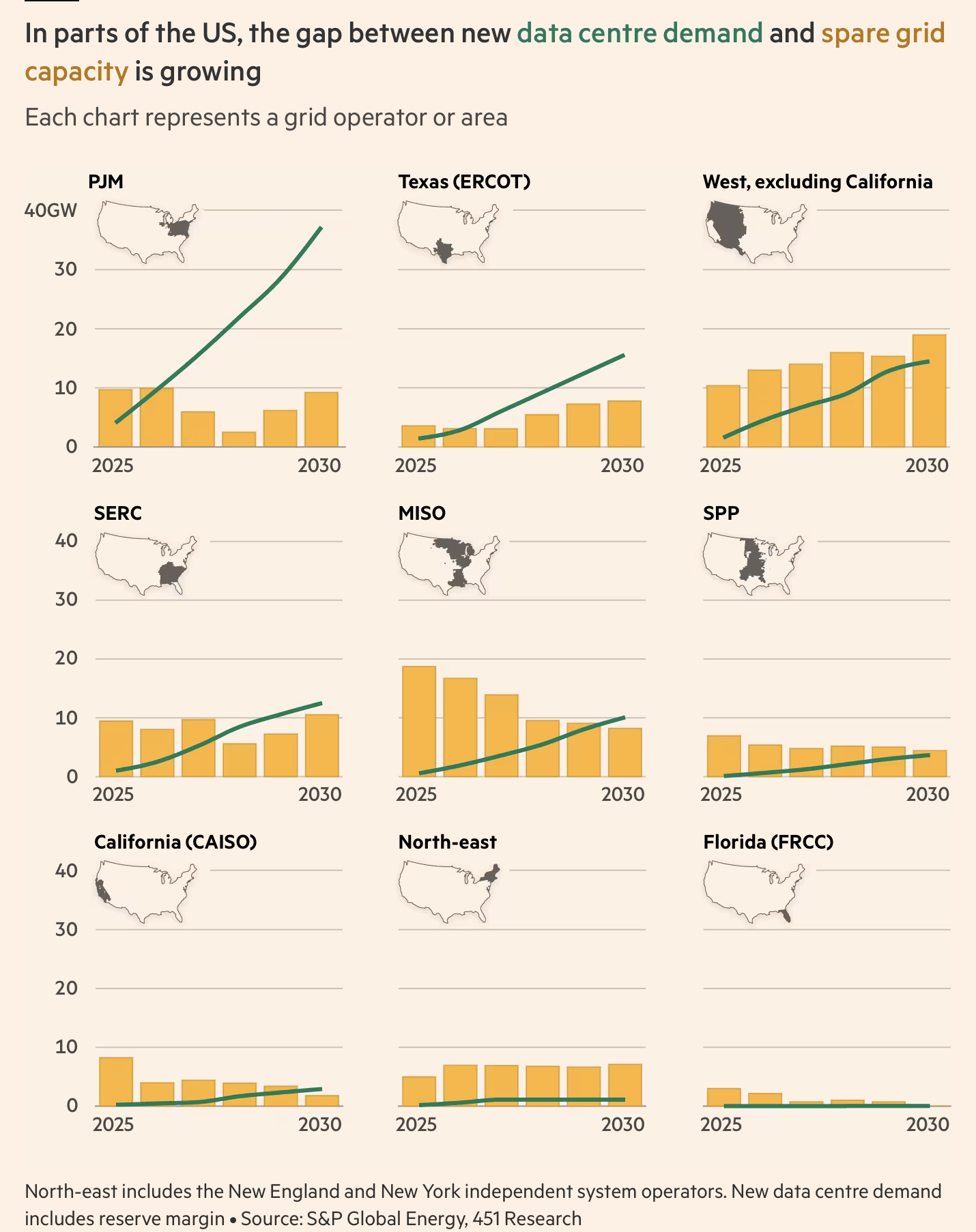

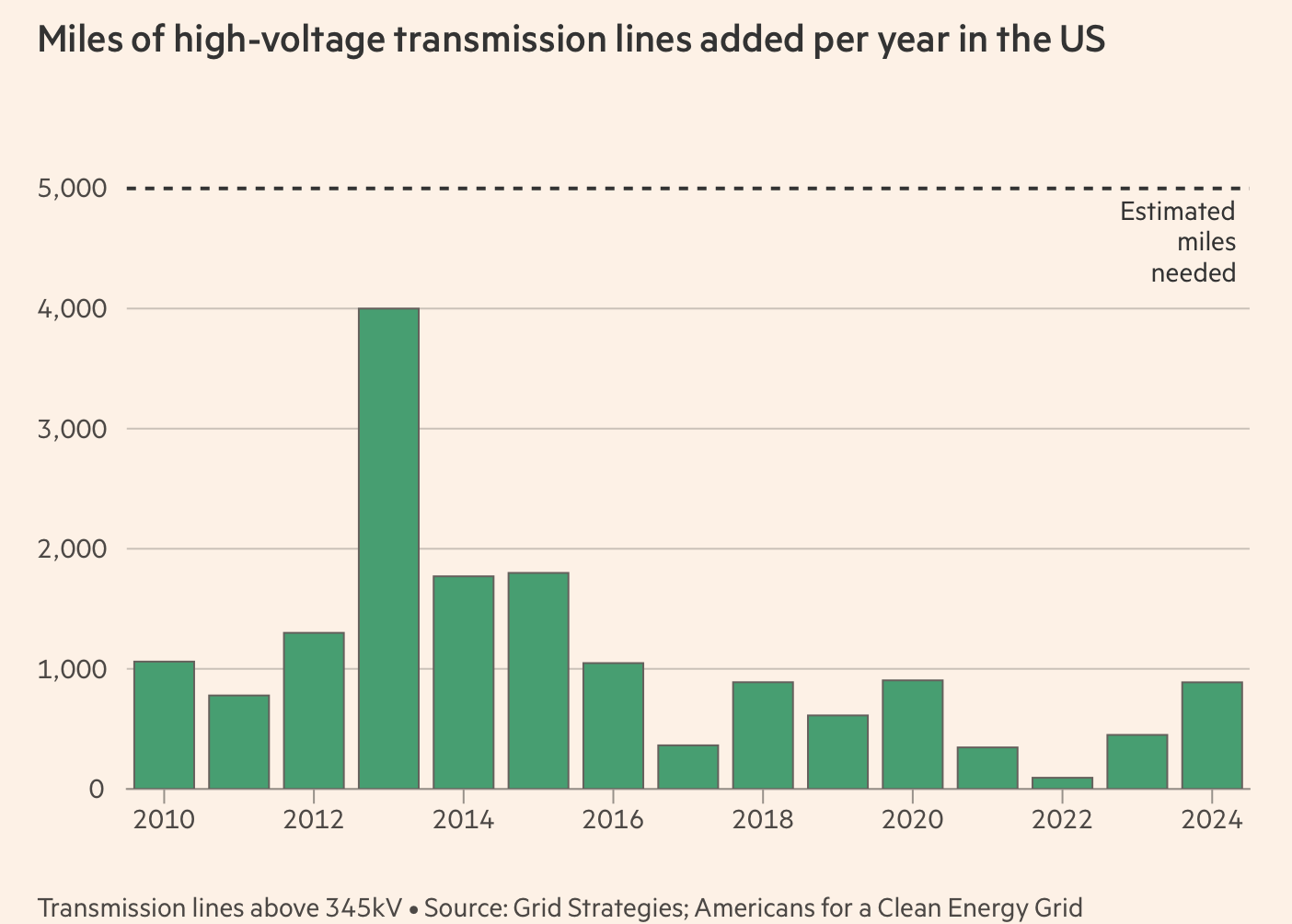

电网瓶颈十分严重:在拥有维吉尼亚「资料中心走廊」的 PJM 区域,从并网申请到商转平均已超过八年;全美去年仅新增约 900 英里高压输电线,远低于为确保稳定与成长每年约 5,000 英里的需求。大型变压器交货期较 2020 年拉长三到四倍,新燃气机组造价约每千瓦 2,400 美元,四年内上涨 71%。

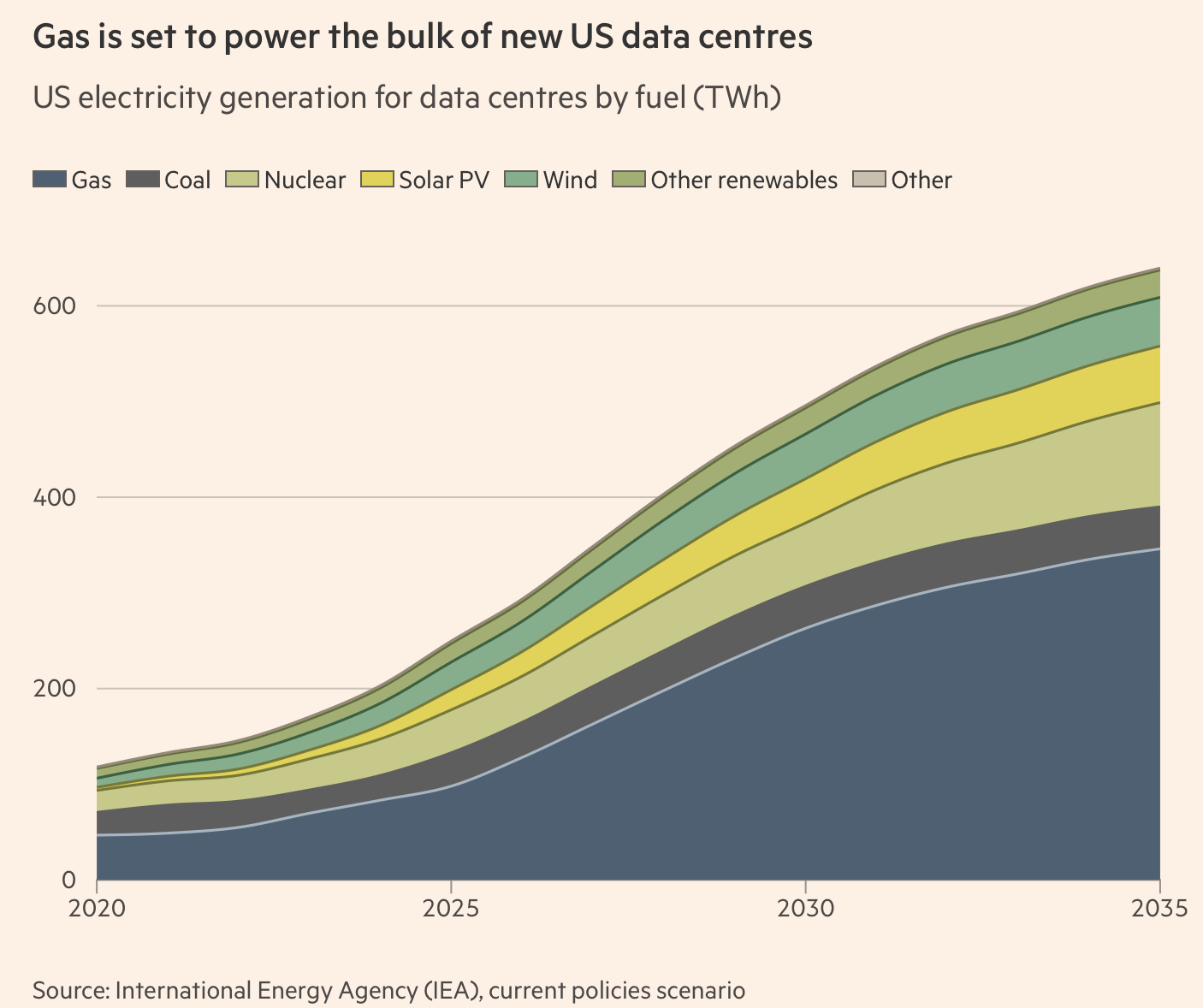

在此压力下,业者转向成本高昂的替代方案,例如场内燃气自发电:OpenAI 的 Stargate 设施规画 361MW 天然气机组,Meta 也在俄亥俄州目标新增 200MW。公用事业机构警告停电风险升高,顾问预估未来五年住家电价恐上涨 15–40%。2024 年中国新增 429GW 发电容量,而美国仅 51GW,加深外界对美国可能错失 AI 领先目标的忧虑。

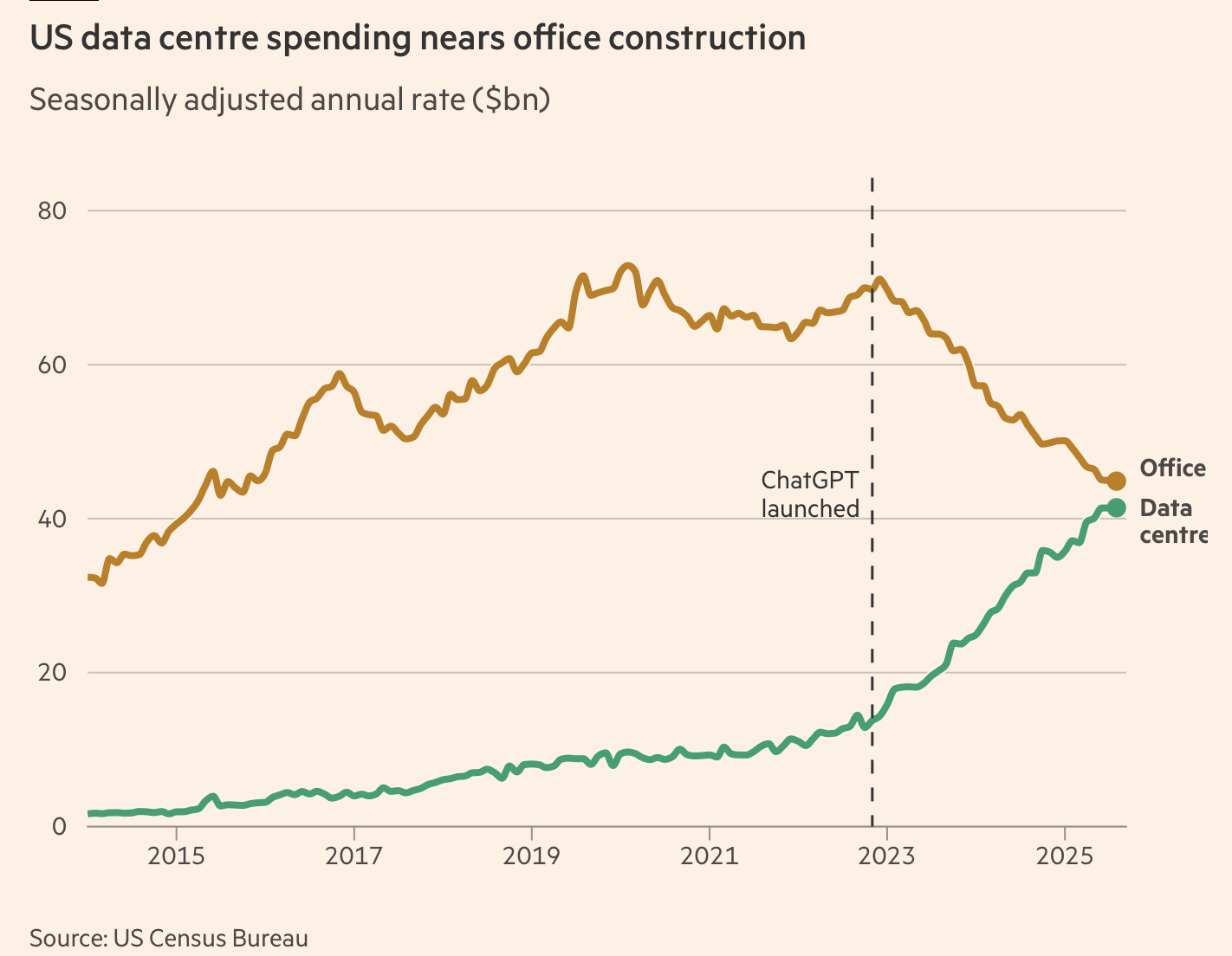

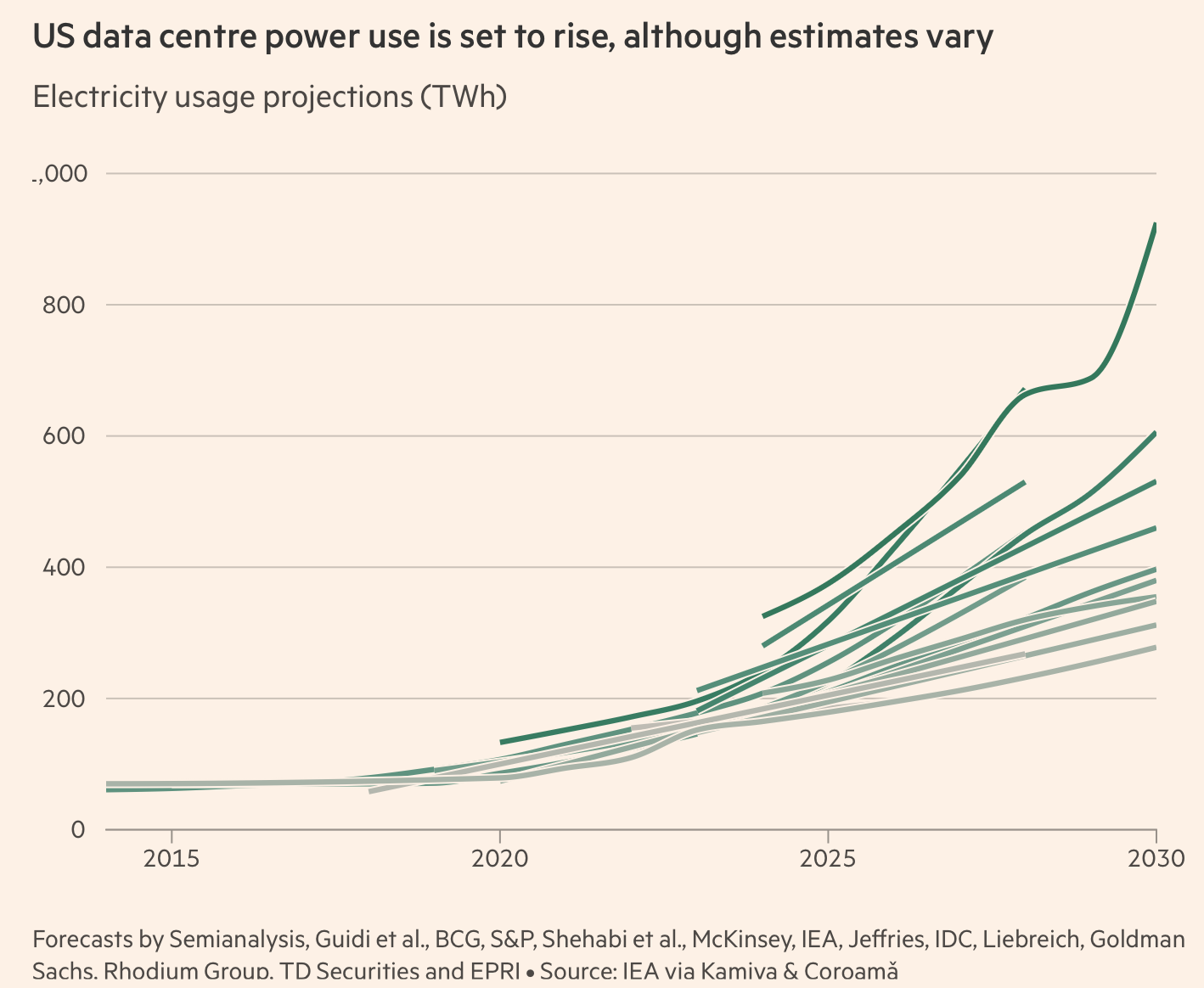

America's AI boom is colliding with a power crunch as hyperscalers plan more than $400bn of data-centre capex and OpenAI alone signs $1.4tn of infrastructure deals for about 28GW over eight years. US electricity demand, after decades of stagnation, is forecast by utilities to grow 5.7% annually to 2030, with over half of new load coming from AI data centres.

Grid constraints are severe: interconnection queues mean projects in PJM now take more than eight years from request to operation, while nationally only about 900 miles of high-voltage lines were built last year versus an estimated 5,000 miles a year needed. Transformer lead times are three to four times longer than in 2020, and new gas capacity costs about $2,400 per kW, up 71%.

These bottlenecks push developers toward costly workarounds such as behind-the-meter gas, exemplified by OpenAI's 361MW Stargate plant and Meta's planned 200MW in Ohio, while utilities warn of outages and residents face projected residential power price rises of 15–40% within five years. In 2024 China added 429GW of new capacity versus 51GW in the US, intensifying fears America could miss its AI ambitions.