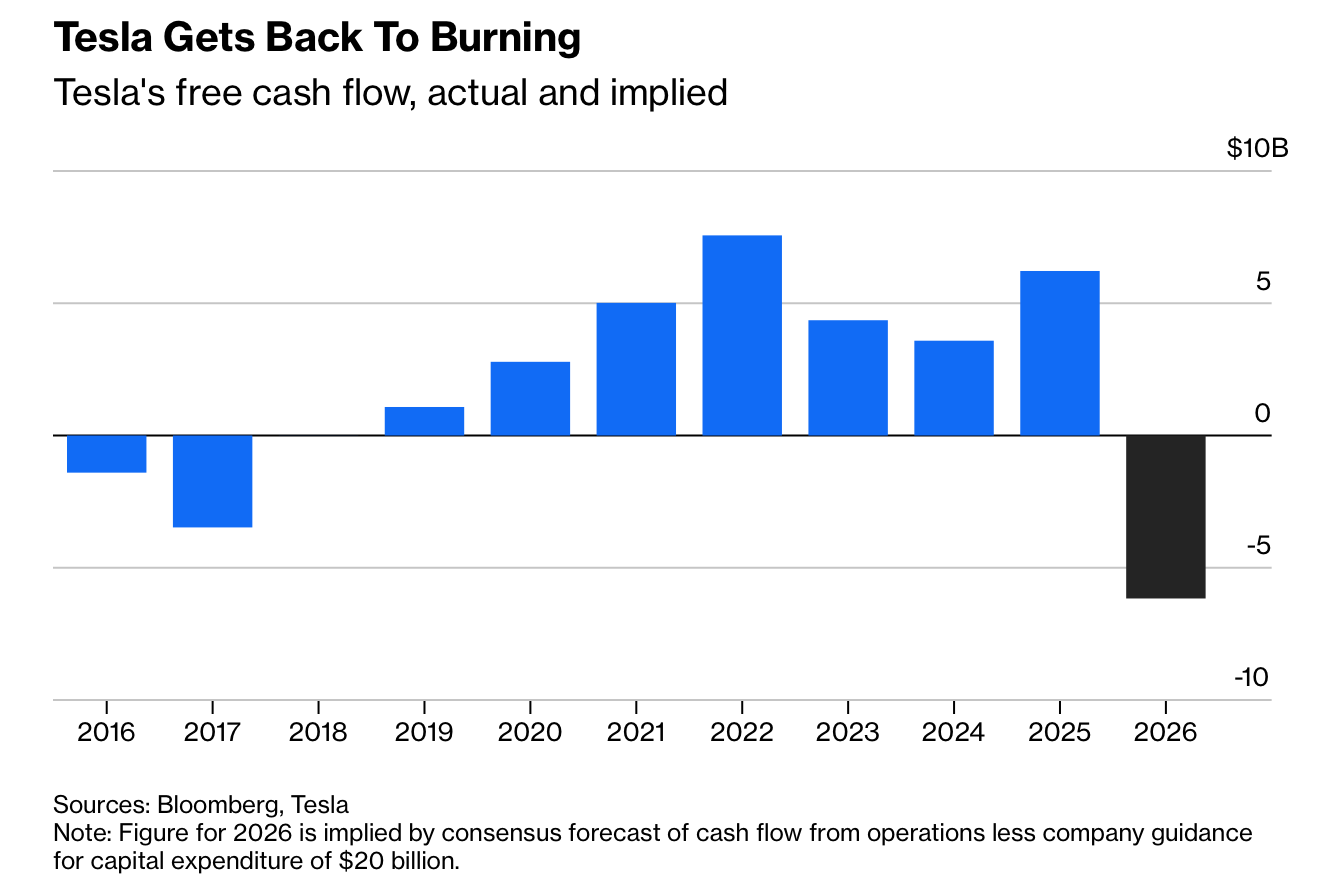

特斯拉宣布将投资预算在2026年大幅上调至200亿美元以上,较此前水平翻倍以上,标志着公司在自动驾驶、机器人和人工智能上的全面押注。这一资本支出规模不仅超过过去两年的总和,也显著高于特斯拉历史上最高的年度经营现金流——2024年的149亿美元。公司账面现金与投资约440亿美元,足以支撑扩张,但共识预测显示,这一计划将导致特斯拉在2026年烧掉约60亿美元现金,成为自2018年以来首次出现自由现金流为负。

财务表现本身并不亮眼。第四季度,剔除监管积分后的汽车毛利率为17.9%,整体营业利润率仅5.7%;GAAP口径下,季度盈利同比下滑60%。尽管能源业务表现稳健、毛利环比持平,但未能抵消“其他成本”激增的拖累。在主营电动车业务利润承压、销量下滑的背景下,特斯拉仍宣布向马斯克个人创办的xAI投资约20亿美元,进一步加大资金消耗。

资本支出规模之大本身具有结构性意义。超过200亿美元的年度投资约等于特斯拉资产负债表上全部物业、厂房和设备账面价值的一半,意味着在极短时间内进行激进扩张。与之相伴的是战略重心转移:两款高端车型S和X将于下季度退役,资源转向计划于6月底前启动生产的无人驾驶Cybercab,以及预计年内量产的人形机器人Optimus。结果是,特斯拉越来越像一家“空白支票公司”,在核心盈利业务放缓之际,依然选择以数十亿美元现金燃烧来换取对未来技术叙事的持续押注。

Tesla plans to lift its 2026 investment budget to more than $20 billion, more than doubling prior levels as it bets heavily on autonomous vehicles, robots and artificial intelligence. The capex figure exceeds the combined spending of the previous two years and is well above Tesla’s highest-ever annual operating cash flow of $14.9 billion in 2024. With about $44 billion of cash and investments on its balance sheet, the company can fund the push, but consensus forecasts imply roughly $6 billion of cash burn in 2026, marking Tesla’s first year of negative free cash flow since 2018.

The underlying financial results were weak. In the fourth quarter, auto gross margin excluding regulatory credits was 17.9%, while overall operating margin fell to just 5.7%. GAAP earnings dropped 60% year on year. Strength in the energy segment and stable gross profit did little to offset surging “other” costs. Against this backdrop of slowing vehicle sales and pressured profitability, Tesla also disclosed a roughly $2 billion investment in Elon Musk’s xAI venture, further intensifying cash outflows.

The scale of spending is structurally significant. Annual capex of more than $20 billion is equivalent to about half the value of Tesla’s entire property, plant and equipment base, signaling rapid expansion in a short period. Strategically, the company is retiring its Model S and X next quarter, shifting resources toward Cybercab production planned by late June and Optimus humanoid robots targeted for mass production by year-end. As its core EV business faces competitive pressure, Tesla increasingly resembles a blank-check vehicle, prepared to burn billions of dollars to sustain expansive future-oriented ambitions.