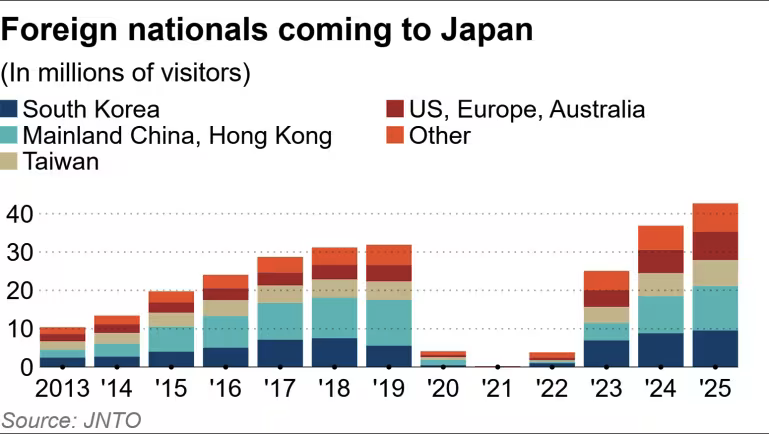

尽管日本去年迎来创纪录的入境游客,住宿业的盈利能力仍未同步改善。2024年共有4268万名外国游客入境,其中韩国946万人、中国大陆910万人、台湾676万人。游客总消费额达到9.46万亿日元(约598亿美元),同样创下新高。然而,住宿业2024财年的整体营业利润率仅为6.6%,低于服务业整体的8.1%,且仍未恢复至疫情前2017年的7.2%。

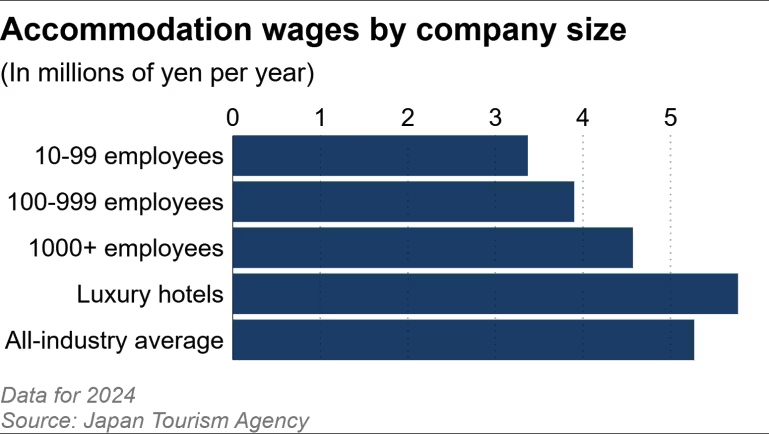

劳动力与成本结构进一步制约行业表现。2024年住宿业(员工10人以上企业)的平均年薪为390万日元,比全行业平均的527万日元低逾20%。按企业规模看,10至99人企业为337万日元,100至999人为390万日元,1000人以上企业为457万日元。疫情后游客激增加剧了用工紧张,2024年6月底住宿与餐饮业岗位空缺率升至4.4%,显著高于全行业的2.9%。部分企业已加薪应对,如藤田观光为约1300名员工平均加薪6.3%(17036日元),但也有酒店通过自动化与外包来压低人力成本。

政策目标与现实之间仍存差距。政府计划2030年接待6000万名国际游客、实现15万亿日元消费,并将人均消费提高至25万日元。去年第四季度人均消费为23.4万日元,低于2024年同期的23.6万日元;平均停留天数也从8.7天下降至8.3天。尽管人均消费较疫情前提高,但近期增长停滞。要实现目标,行业需通过提高房价覆盖更高工资与投资,并引导游客延长停留、分散至全国各地。

Despite Japan welcoming a record number of inbound visitors last year, profitability in the accommodation sector has lagged. In 2024, 42.68 million foreign travelers entered the country, led by South Korea with 9.46 million, mainland China with 9.1 million, and Taiwan with 6.76 million. Total tourist spending reached a record 9.46 trillion yen ($59.8 billion). Even so, the accommodation industry’s operating profit margin was only 6.6% in fiscal 2024, below the overall service-sector average of 8.1% and still under the pre-pandemic level of 7.2% recorded in 2017.

Labor conditions and costs are a major constraint. Average annual pay in accommodations at firms with 10 or more employees was 3.9 million yen in 2024, more than 20% below the all-industry average of 5.27 million yen. By firm size, pay averaged 3.37 million yen at companies with 10–99 workers, 3.9 million yen at those with 100–999, and 4.57 million yen at firms with 1,000 or more. The post-pandemic surge in visitors has worsened labor shortages, pushing the vacancy rate in accommodations and food service to 4.4% by end-June 2024, compared with 2.9% across all industries. While some operators raised wages—Fujita Kanko lifted pay by an average 6.3% for about 1,300 workers—others cut labor costs through automation and outsourcing.

A gap remains between policy goals and current trends. The government aims to attract 60 million visitors and generate 15 trillion yen in spending by 2030, while lifting per-capita spending to 250,000 yen. In the fourth quarter last year, per-capita spending was 234,000 yen, down from 236,000 yen a year earlier, and average length of stay slipped from 8.7 days to 8.3 days. Although spending per visitor is higher than before the pandemic, recent growth has stalled. Achieving targets will require higher room rates to fund wages and investment, and strategies to extend stays and disperse travel nationwide.