数十年来,日本投资者在国内利率长期偏低的情况下转向海外寻求更高收益,累积了超过10万亿美元的对外投资,规模超过其年度GDP的两倍。如今利率上升并向市场传导,日元本月跌至接近1990年以来对美元最弱水平、并引发关于两国可能出手支撑的讨论,但汇市干预并不会降低源自日本的金融动荡风险。

对官方买入的预期使日元自1月23日以来反弹,并推动美元出现一轮普遍而急剧的下跌。1月27日,唐纳德·特朗普总统似乎欢迎美元走弱;自其上任以来,关税、对美联储的抨击与更高的举债倾向促使投资者更愿意对冲美国敞口,而美元在2025年按贸易加权口径下跌了7%。

尽管日美利差在同一时期收窄了近三分之一、利率趋同通常会拉近汇率,日元却在美元走弱的背景下仍显得异常疲软;日本通胀在2020年代年均约2%,高于2010年代的0.6%,而按“大麦克指数”估算日元被低估约50%。与此同时,市场对日本财政与货币可信度的担忧上升:净债务仍约为GDP的130%,30年期国债收益率本月创历史新高,而首相高市早苗将于2月8日举行选举并承诺财政放松(包括将食品消费税暂停两年)却缺乏明确的筹资方案。

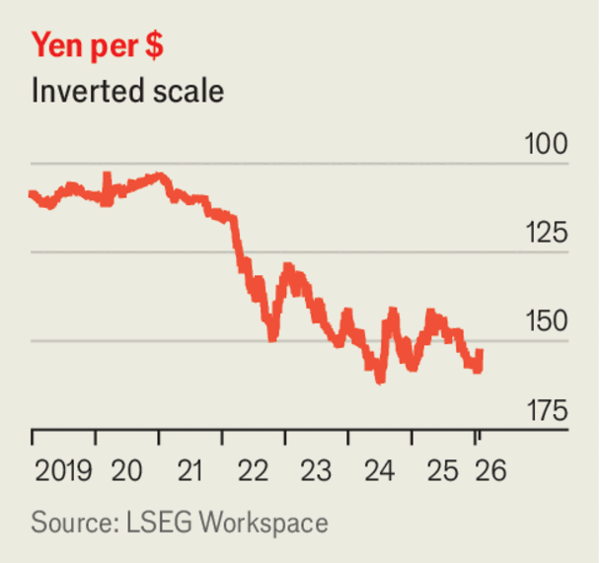

For decades, Japanese investors sought higher-yielding assets abroad while interest rates at home stayed low, building foreign investments worth over $10trn—more than twice annual GDP. With rates now rising and rippling through markets, the yen fell this month to near its weakest against the dollar since 1990 and sparked talk of support, but currency intervention will not cut the risk of financial turmoil emanating from Japan.

The prospect of official purchases has made the yen rally since January 23, contributing to a sharp, broad-based fall in the dollar. On January 27 President Donald Trump appeared to welcome the slide; since he came to office, tariffs, attacks on the Federal Reserve and an appetite for debt have pushed investors to hedge U.S. exposure, and in 2025 the dollar fell 7% on a trade-weighted basis.

The yen’s weakness is striking given a falling dollar even as the Japan–U.S. rate gap has shrunk by nearly a third; Japan’s inflation has averaged about 2% in the 2020s versus 0.6% in the 2010s, yet the Big Mac index implies the currency is roughly 50% undervalued. Fears center on credibility risks, with net debt still around 130% of GDP and 30-year yields hitting a record high this month, as Prime Minister Sanae Takaichi calls an election on February 8 and promises unfunded fiscal loosening including a two-year suspension of consumption taxes on food.

Source: The weak yen and the weakening dollar are signs of financial fragility

Subtitle: But neither Japan nor America should meddle with exchange rates

Dateline: 1月 29, 2026 04:19 上午