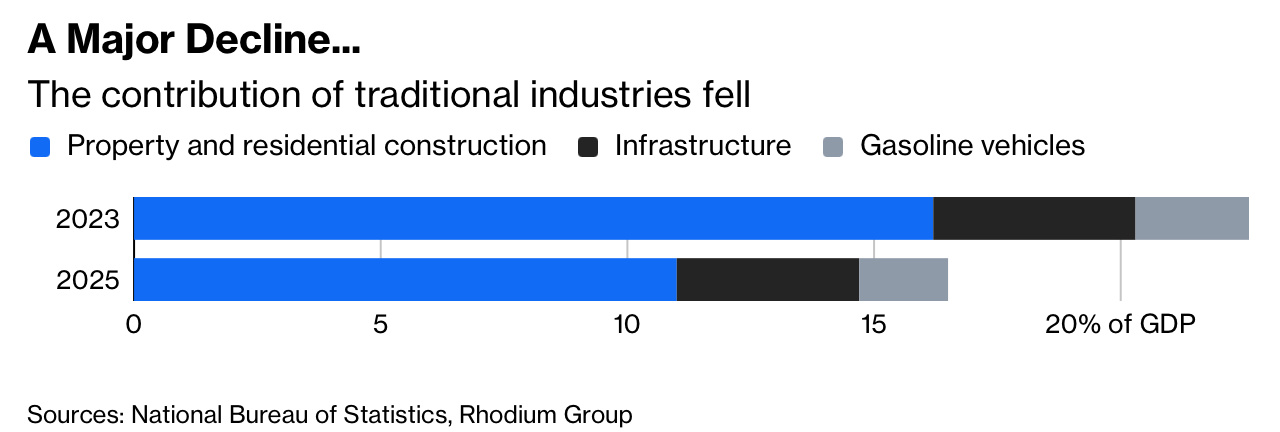

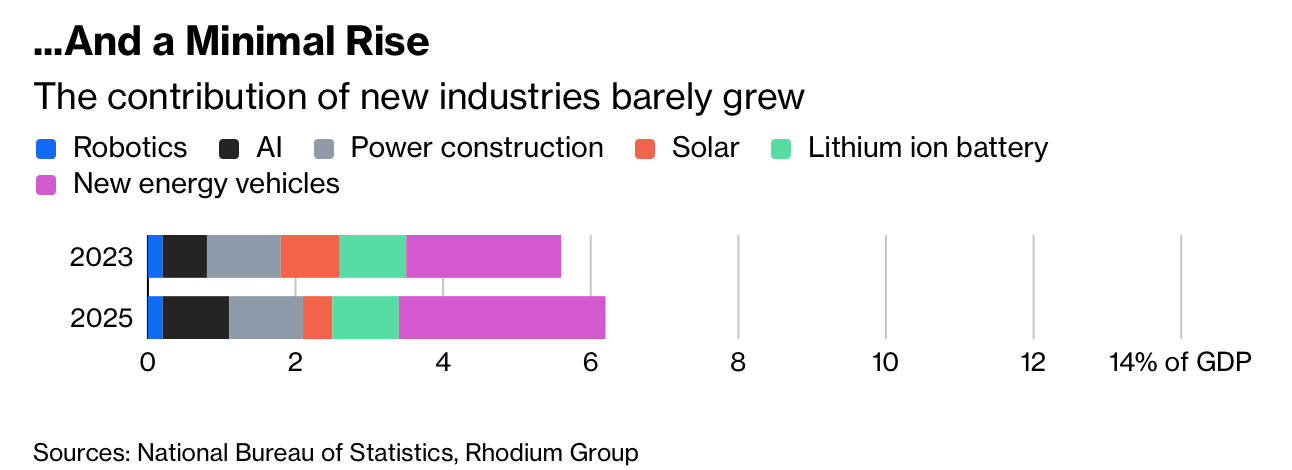

从 2023–2025 年,Rhodium Group 基于 National Bureau of Statistics 11 月发布的产业关联数据测算显示,“新质生产力”(如 EV、AI、机器人)的新增拉动远不足以对冲传统引擎下滑:旧产业活动下滑幅度是新动能增量的 6 倍。具体而言,三大传统部门(房地产、基建、内燃机汽车)合计对 GDP 的贡献占比在两年内下降 6 个百分点;同期六个新增长驱动带来的经济活动增量不足 1 个百分点,显示技术导向的增长再定位在经济层面尚未兑现。

这一缺口发生在政策即将制度化之际:中国计划在 3 月通过下一份五年规划,正式巩固以创新与安全为核心的增长路线。叙事上该路线被视为在与美国竞争、以及应对 President Donald Trump 的贸易施压时保持产业能力与稀土优势的必要条件,但现实代价体现为就业不确定与消费低迷,且 Big Tech 仍未能取代曾经占主导的房地产链条对总需求与就业的支撑作用。

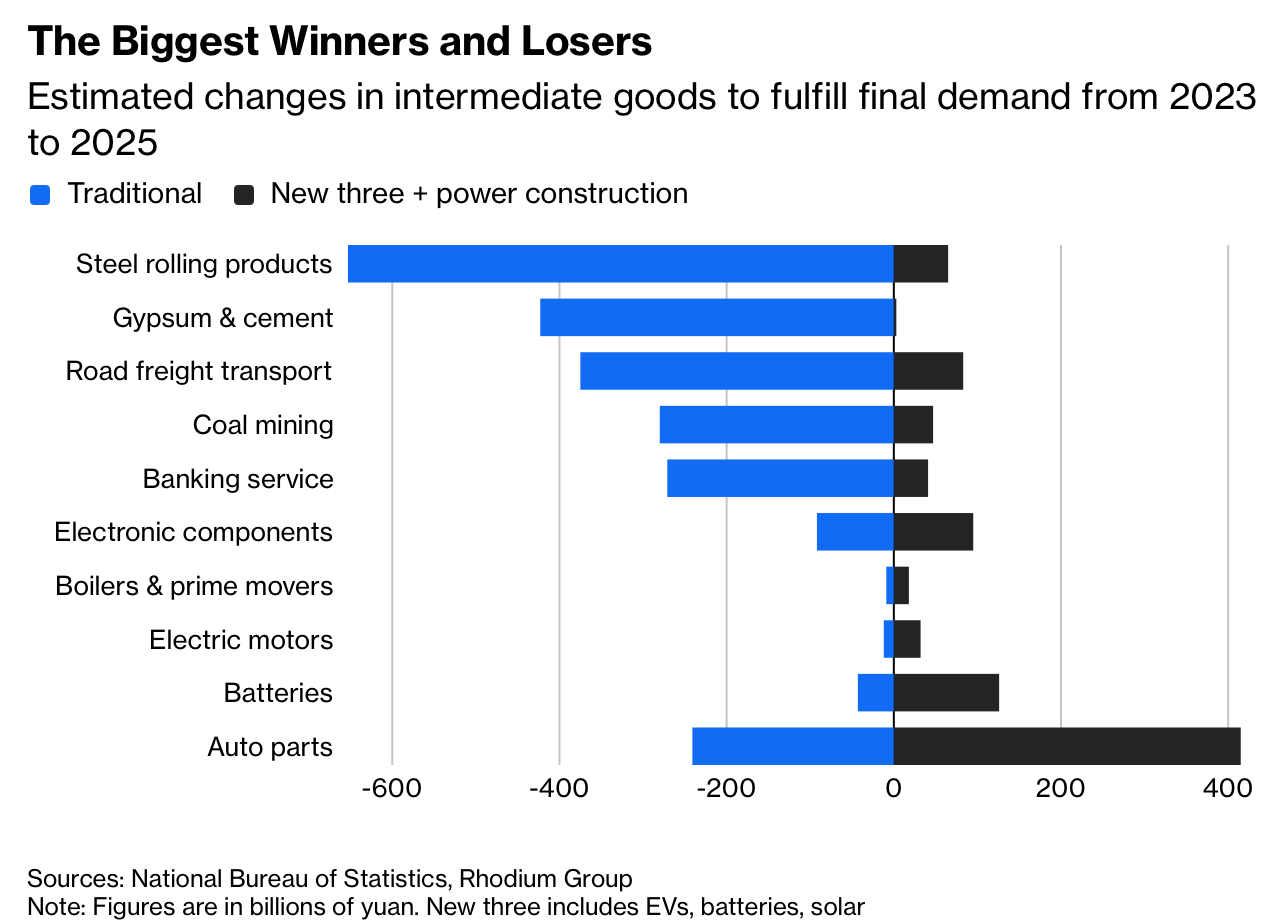

EV 行业展示了“量增不等于产出增”的机制:去年中国售出 2,400 万辆乘用车,其中 EV 超过一半;长期价格战使多数 EV 价格低于燃油车,而在他国 EV 通常更贵。Rhodium 估算显示,尽管 EV 产业过去两年扩张显著,燃油车因单价更高,其总经济产出仍比 EV 高 2,320 亿元人民币(330 亿美元)。汽车业过度竞争与饱和使政府连续第 3 年恢复“以旧换新”(cash-for-clunkers)补贴;海外提价与利润成为关键,因此欧盟本周同意建立企业自愿限制对欧出货的机制,被视为可能以最低定价承诺替代高关税的利好。

Across 2023–2025, Rhodium Group’s analysis of November National Bureau of Statistics input-output style data finds “new quality productive forces” (e.g., EVs, AI, robotics) have not offset legacy-engine contraction: the drop in activity from older industries was six times larger than the gains from the new forces. Concretely, three legacy sectors—property, infrastructure, and internal-combustion cars—saw their combined GDP contribution share fall by 6 percentage points over the period, while the increase in activity from six new growth drivers was less than 1 percentage point, implying an innovation pivot that has not yet delivered in aggregate economic terms.

This gap matters as China plans to formalize the tech- and security-centered model in its next five-year plan in March. The blueprint is widely accepted as necessary for resilience in rivalry with the US and against President Donald Trump’s trade pressure, anchored in industrial capacity and rare-earth dominance, yet the economic symptoms remain job insecurity and weak consumption, with Big Tech still failing to replace the demand and employment role once played by the property complex.

The EV sector illustrates how volume leadership can coexist with low value-add: of 24 million passenger vehicles sold last year, more than half were EVs, and a prolonged price war has made most EVs cheaper than gasoline cars (the reverse of typical foreign pricing). Rhodium estimates that despite rapid EV expansion over the past two years, gasoline vehicles still generated 232 billion yuan ($33 billion) more total output because they cost more per unit. Saturation and hyper-competition have pushed the government to reinstate a “cash-for-clunkers” trade-in program for a third straight year; higher prices and margins are increasingly sought overseas, making the EU’s new mechanism for voluntary shipment limits potentially supportive if it swaps steep tariffs for minimum-price commitments.