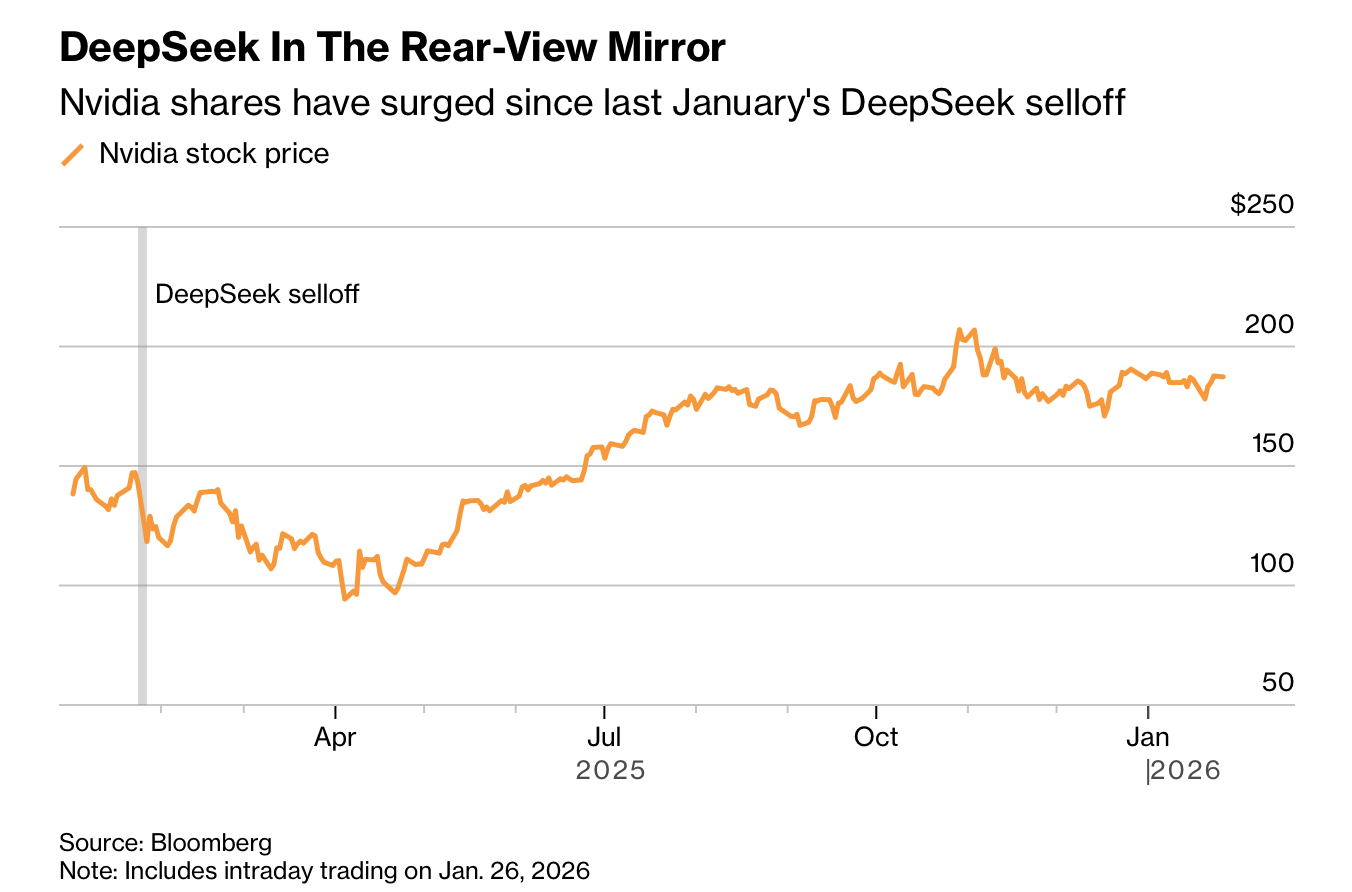

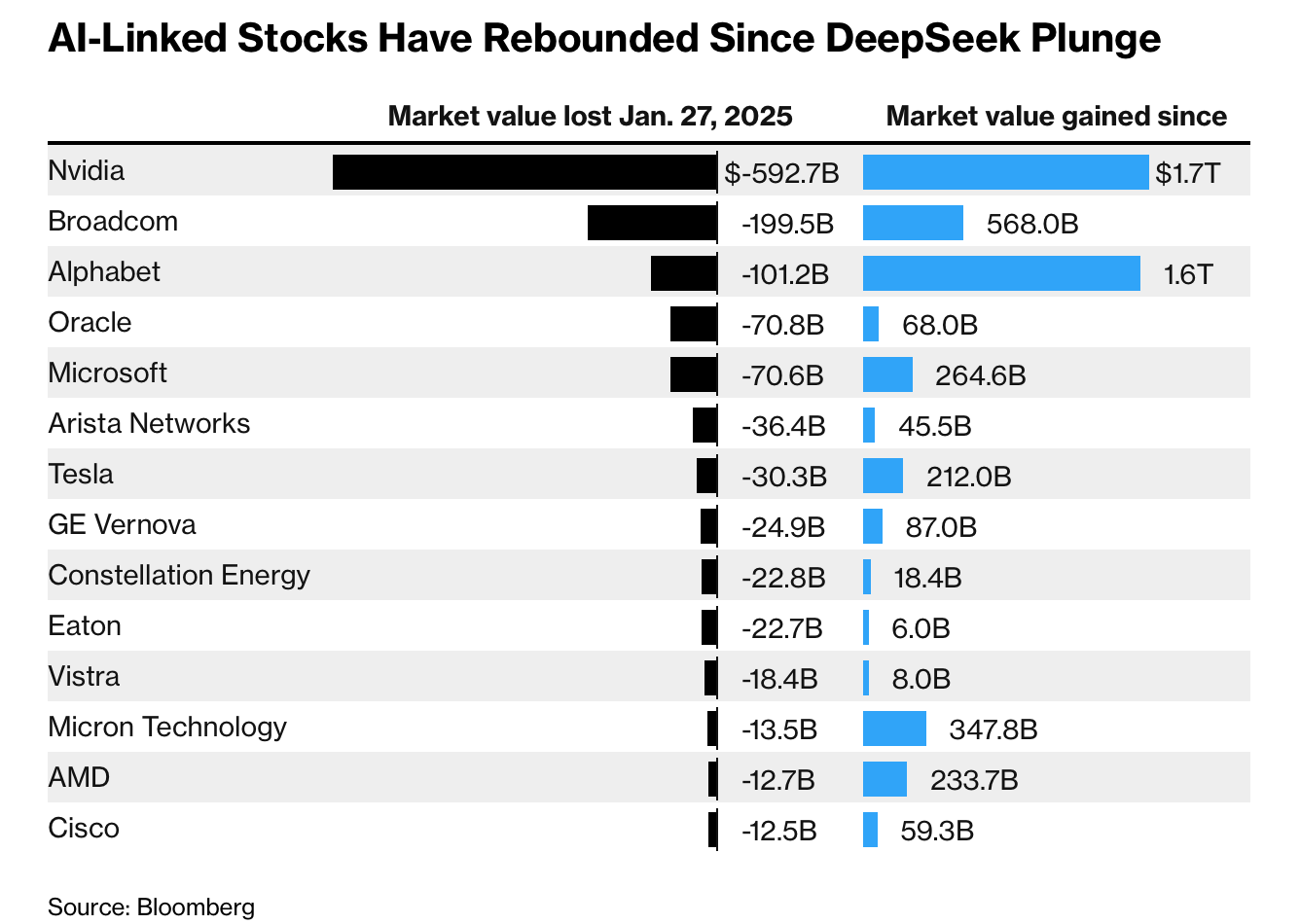

一年前,DeepSeek 的低成本 AI 模型引发市场恐慌,单日抹去英伟达 5890 亿美元市值,拖累标普 500 指数下跌 1.5%,纳斯达克 100 指数下跌 3%。当时市场担心 AI 开发成本骤降将削弱对高端芯片的需求。但一年后事实证明这一冲击被严重高估,英伟达股价自当次抛售以来已累计上涨 58%,成为 2025 年推动标普 500 上行的主要力量之一。

核心担忧之一是超大规模云厂商会削减资本开支,但数据走向相反。根据彭博汇编的预期,Meta、微软、亚马逊和 Alphabet 在 2026 年的资本支出合计将达约 4750 亿美元。巨额投入推动 AI 交易从芯片制造商扩展至更广泛领域。2025 年,存储芯片股成为标普 500 表现最佳板块,能源、公用事业、材料和工业板块也因数据中心建设需求受益,相关趋势在 2026 年初仍在延续。

结构性变化显示 AI 投资进入“扩散期”。尽管英伟达 GPU 仍占据主导地位,但定制芯片与通用处理器并存,为 Alphabet、博通、AMD 乃至英特尔带来上行空间。与此同时,“七巨头”股票今年整体下跌约 0.3%,表明收益增长正从终端应用转向基础设施。投资者观点趋于一致:AI 并未降温,而是以更类似工业革命的方式重塑市场,其影响正通过资本开支与产业链向整个市场传导。

A year ago, DeepSeek’s low-cost AI model sparked panic, erasing $589 billion of Nvidia’s market value in a single day and dragging the S&P 500 down 1.5% and the Nasdaq 100 down 3%. Investors feared cheaper AI development would crush demand for premium chips. One year later, that shock appears overstated: Nvidia shares are up 58% since the selloff and were a major driver of the S&P 500’s gains in 2025.

A key concern was that hyperscalers would cut capital spending, but the opposite occurred. Bloomberg-compiled estimates show Meta, Microsoft, Amazon and Alphabet are expected to deploy roughly $475 billion in capital expenditures in 2026. That spending has broadened the AI trade beyond chipmakers. In 2025, memory stocks were the S&P 500’s top performers, while energy, utilities, materials and industrials also benefited from data center buildouts, trends that have continued into early 2026.

Structural shifts indicate AI investment is entering a diffusion phase. Nvidia’s GPUs still dominate, but custom and general-purpose chips are gaining ground, lifting shares of Alphabet, Broadcom, AMD and even Intel. Meanwhile, the Magnificent Seven group is down about 0.3% this year, signaling profit growth is rotating from end applications to infrastructure. Investor consensus is that AI momentum remains strong, increasingly resembling an industrial revolution whose impact is spreading across the entire market.