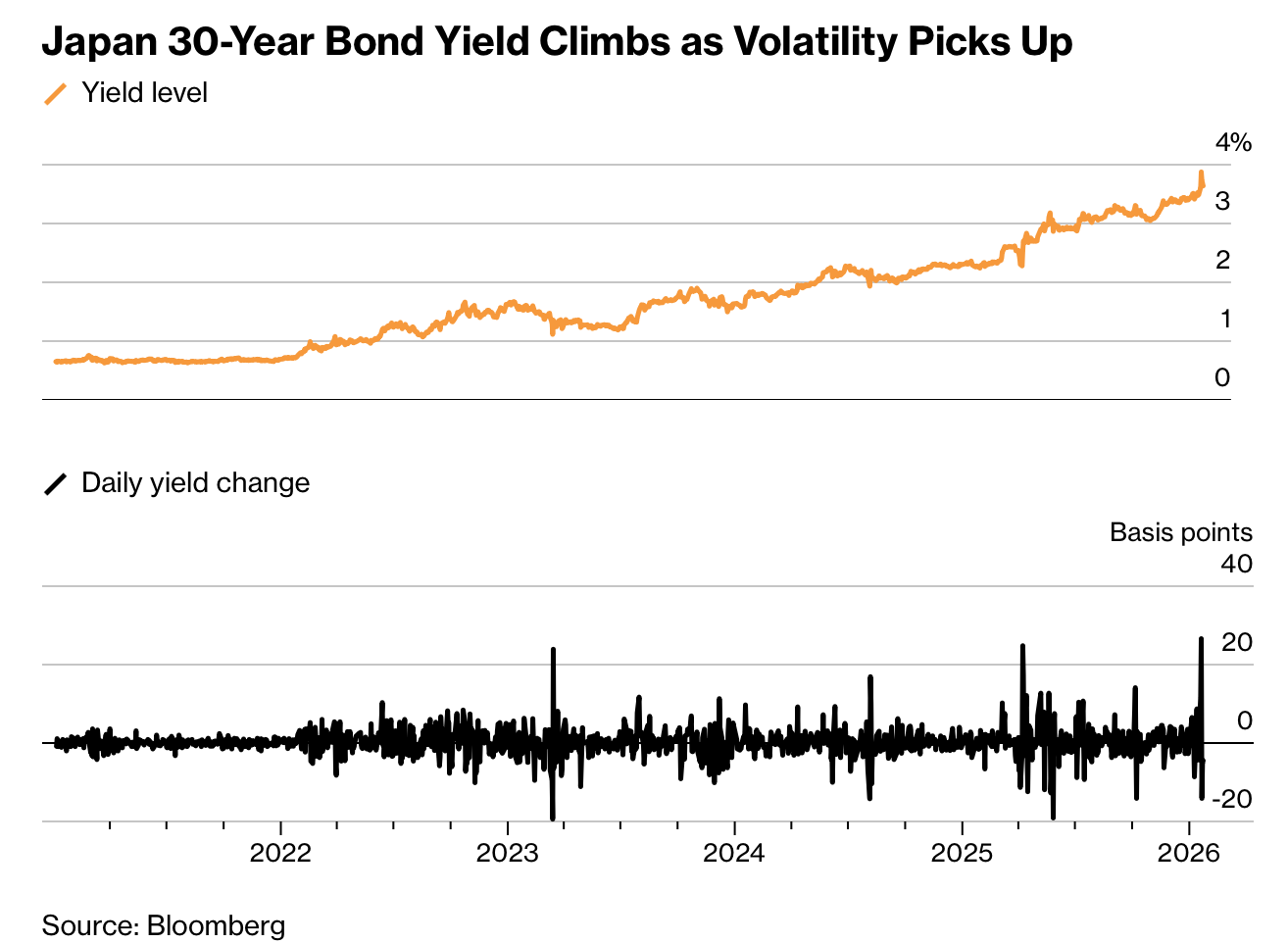

日本国债市场的剧烈抛售引发全球震荡,核心在于收益率的异常速度与幅度。单个交易日内收益率上升25个基点,超长期日本国债收益率突破4%,30年期收益率单日跳升逾25个基点,约为过去五年日均波动的8倍。此次动荡发生在日本通胀回归、财政刺激承诺扩大债务之际,并在2月8日提前大选前加剧不确定性,向美英德等主要市场传导上行压力。

冲击的量化外溢效应清晰。规模约7.3万亿美元的日本国债市场出现更频繁、更极端的波动;自日本央行于2024年3月结束负利率以来,已有9次单日亏损超过两倍标准差。上周一次抛售即抹去约410亿美元市值。高盛估算,每10个基点的“日本国债特有冲击”会推高美国等市场收益率约2至3个基点。外资在月度现券交易中的占比已升至约65%,显著高于2009年的12%,而仅需约1.7亿美元(30年期)与1.1亿美元(40年期)的成交就能触发广泛失序。

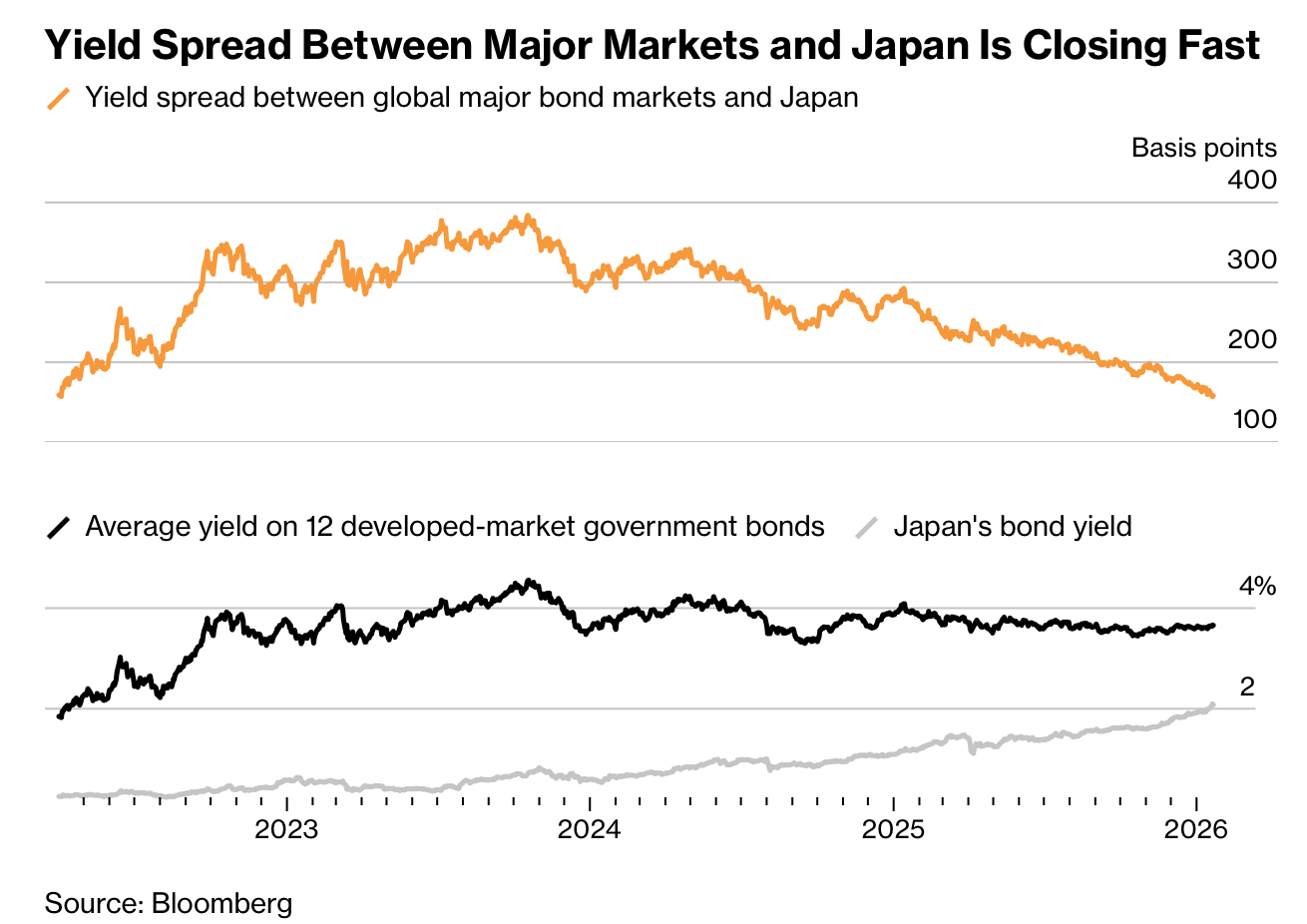

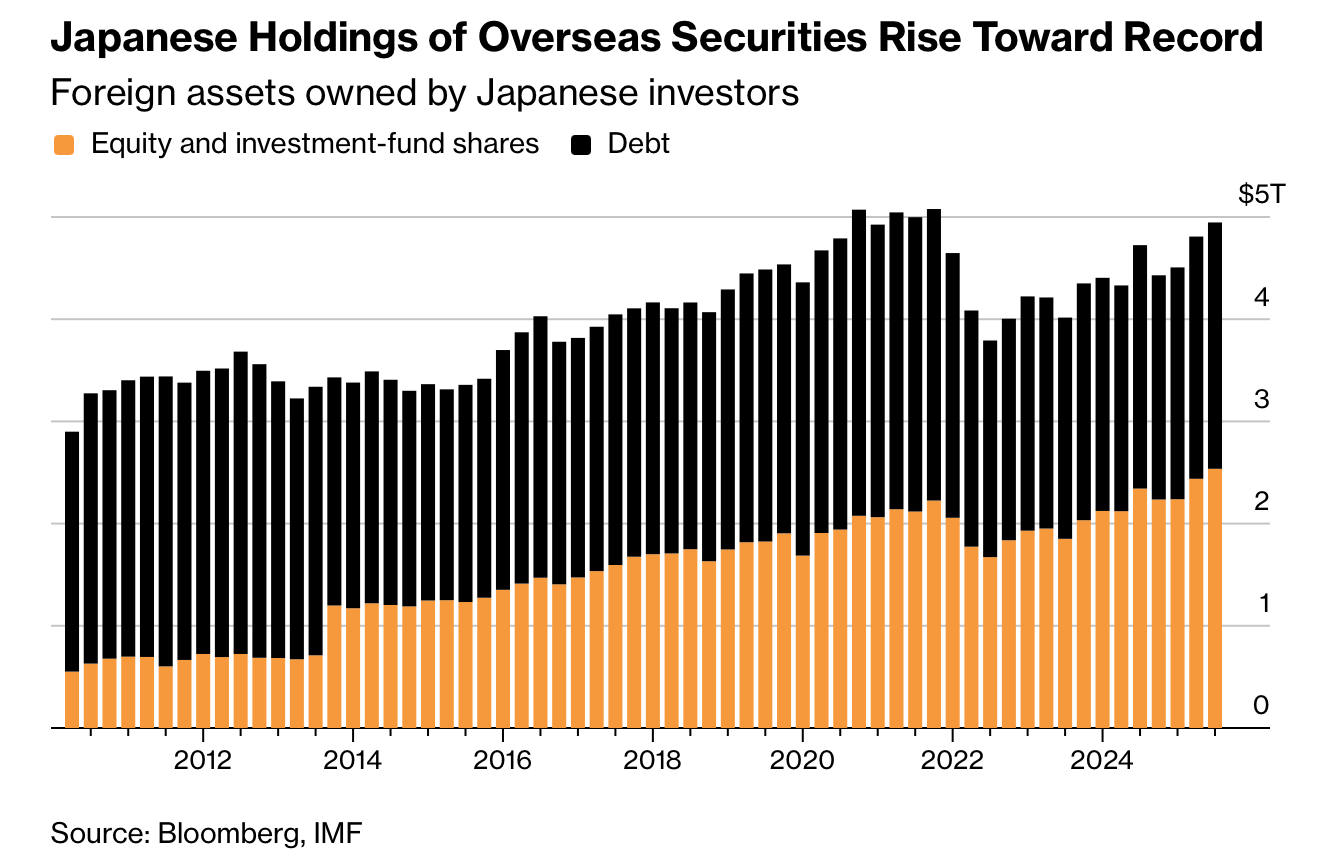

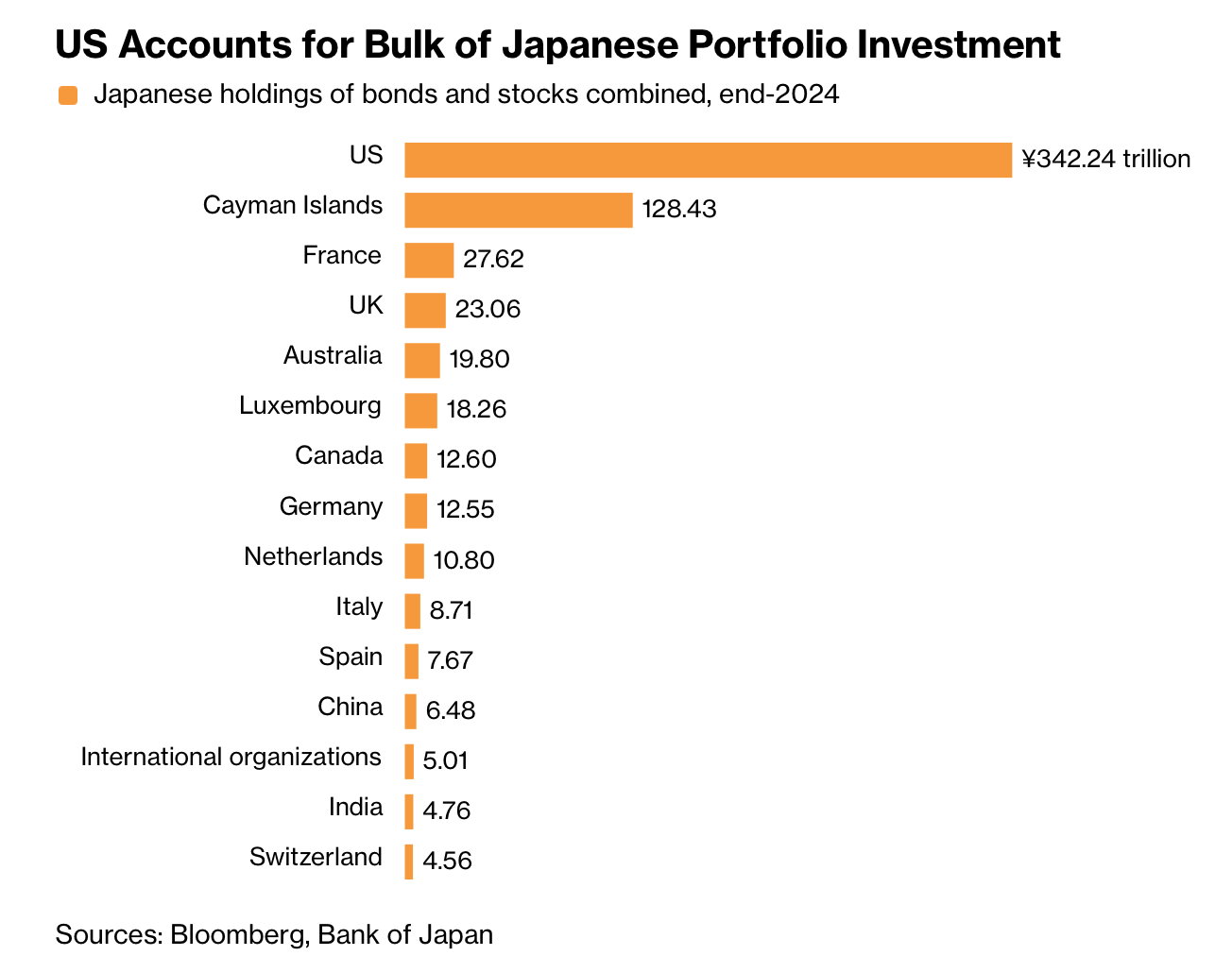

更长期的系统性风险在于资本回流与套息交易逆转。日本投资者在海外配置约5万亿美元资产,另有约4500亿美元套息交易以日元融资。若收益率继续上行,10年期或需再升1.25个百分点至3.5%,将提高本土资产吸引力并迫使回流;政府债务占GDP约230%加剧敏感性。寿险与大型银行已表态增配国债。若政策应对滞后,波动、回流与套息平仓可能叠加,形成对全球资产定价的“拐点”风险。

Japan’s government bond selloff has sent shockwaves globally, driven by the speed and scale of yield moves. Yields jumped 25 basis points in a single session, ultra-long JGBs pushed above 4%, and 30-year yields surged more than 25 basis points—about eight times the five-year average daily range. With inflation back and fiscal stimulus pledges expanding debt ahead of a Feb. 8 snap election, uncertainty has intensified and pushed rates higher across the US, UK, and Germany.

The quantified spillovers are stark. The roughly $7.3 trillion JGB market has seen more frequent extreme moves; since the BOJ ended negative rates in March 2024, there have been nine sessions with losses over two standard deviations. One selloff wiped out about $41 billion. Goldman Sachs estimates every 10 basis points of “idiosyncratic JGB shock” adds roughly 2–3 basis points to US and other yields. Foreigners now account for about 65% of monthly cash trading, up from 12% in 2009, and as little as $170 million (30-year) and $110 million (40-year) in trades can trigger broader dislocation.

Longer-term systemic risk centers on repatriation and carry-trade reversal. Japanese investors hold about $5 trillion abroad, while roughly $450 billion of carry trades are funded in yen. If yields keep rising—10-year yields may need another 1.25 percentage points to reach 3.5%—domestic assets become more attractive, pressuring global markets. Government debt near 230% of GDP heightens sensitivity. Insurers and major banks are signaling shifts back to JGBs. Delayed policy responses risk compounding volatility, repatriation, and carry unwinds into a global tipping point.