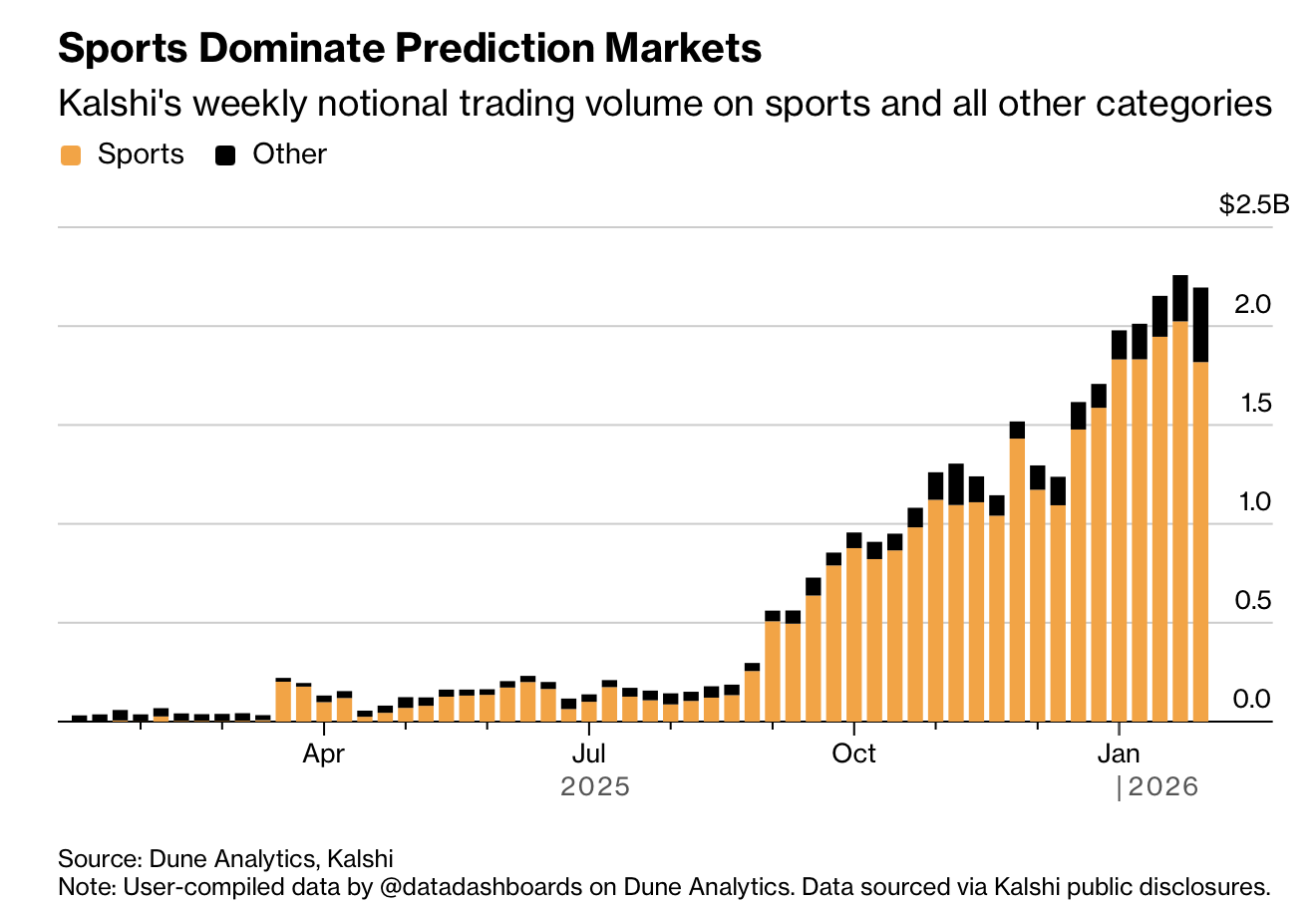

预测市场正在重塑职业博彩的运作方式。2026 年 1 月,Kalshi 的交易量接近 100 亿美元,其中超过 85 亿美元与体育赛事相关;其应用当月下载量达 300 万次,超过任何一家传统博彩应用的四倍。到目前为止,Kalshi 与 Polymarket 上与超级碗相关的合约交易额已超过 8 亿美元,而美国人在受监管博彩平台上对该赛事的投注预计约为 18 亿美元。相比之下,传统体育博彩在 1 月的投注规模去年约为 160 亿美元,显示预测市场正迅速分流资金。

结构差异改变了专业玩家的策略。传统博彩由庄家对赌并限制“高手”下注,而预测市场撮合“是/否”合约,允许交易者自行报价并充当做市商。以赔率为例,2 月 4 日在 FanDuel 上投注 100 美元支持爱国者队夺冠可获 294 美元回报,而在 Kalshi 以约 0.35 美元买入合约,若胜出回报约为 289 美元。过去三个月,一位职业玩家在 Kalshi 上交易超过 1.8 亿份合约,已实现超过 300 万美元利润,体现了高频与规模化策略的威力。

但竞争正在压缩优势。大型量化交易公司已入场,部分联盟在交易所的利润率约为 2%,低于在传统博彩中的 4% 至 5%。高风险亦随之而来:一次 PGA 巡回赛做市中,单一球员头寸一度暴露超过 15 万美元,最终对冲规模达 33 万美元。尽管目前大量“散户资金”仍提供套利空间,经验表明,随着市场成熟,利润率将继续下降,预测市场可能从“淘金热”演变为鲨鱼之间的博弈。

Prediction markets are reshaping how professional gamblers operate. In January 2026, Kalshi’s trading volume neared $10 billion, with more than $8.5 billion tied to sports; its app logged 3 million downloads that month, over four times any major sportsbook app. Super Bowl–linked contracts on Kalshi and Polymarket have already surpassed $800 million, versus about $1.8 billion expected to be wagered through regulated sportsbooks. By comparison, regulated sportsbooks handled roughly $16 billion in January last year, underscoring how rapidly prediction markets are siphoning activity.

Structural differences are driving strategic change. Sportsbooks take the other side of bets and limit sharps, while prediction markets match “yes/no” contracts and let traders post their own prices as market makers. On Feb. 4, a $100 bet on the Patriots via FanDuel at +194 would pay $294, while buying contracts on Kalshi at about $0.35 would return roughly $289 if they won. Over the past three months, one professional trader has moved millions into Kalshi, trading more than 180 million contracts and earning over $3 million, highlighting the scale advantages of exchange-style betting.

Competition is narrowing edges. Large quantitative firms have entered, and some syndicates report exchange profit margins around 2%, versus 4% to 5% at sportsbooks. Risks are also acute: in one PGA Tour market-making episode, exposure to a single player briefly exceeded $150,000 before reaching $330,000. While abundant retail flow still creates opportunities, history suggests margins will compress as markets mature, turning prediction markets from a gold rush into a contest primarily among sharks.