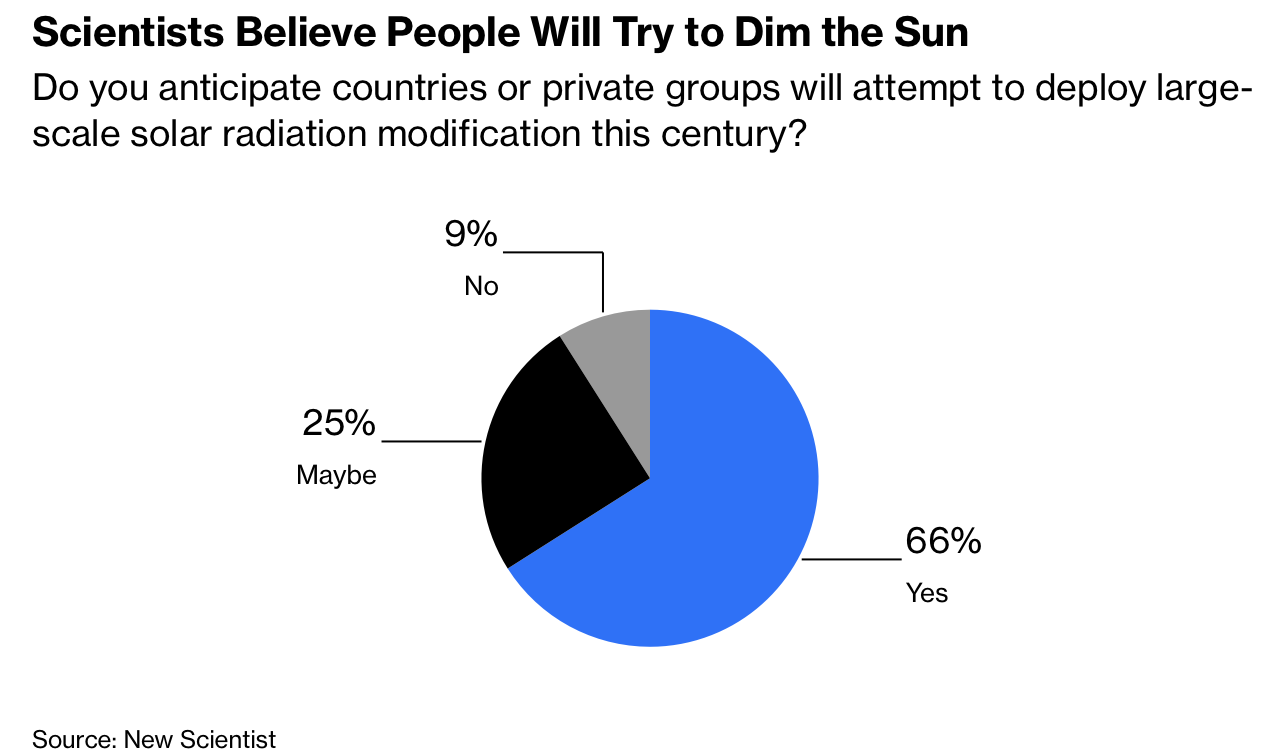

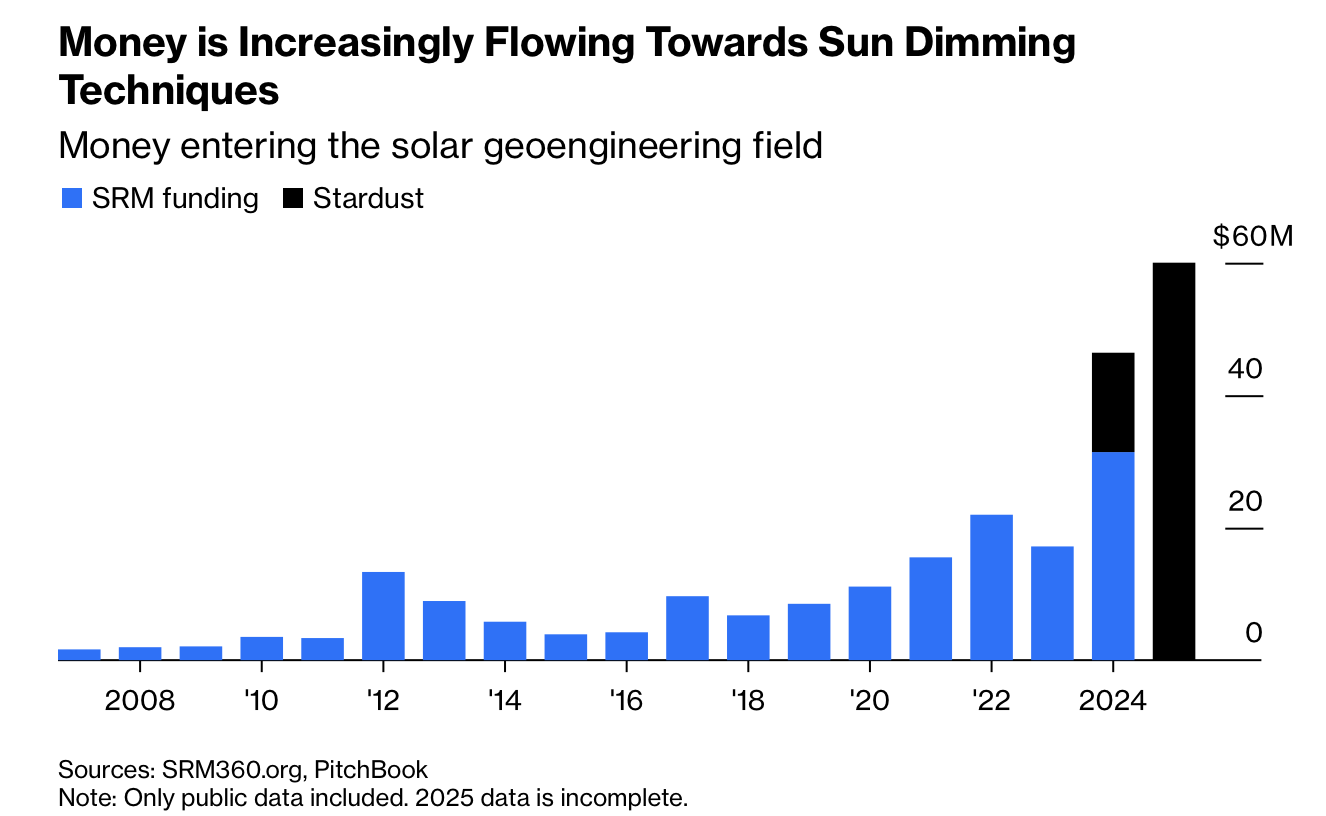

商业化太阳辐射管理(SRM)正从边缘走向资本中心:2007–2024 年商业地球工程总融资仅 1,760 万美元,而 2024 年一家美以初创公司 Stardust 即单独融资 6,000 万美元,占此前全行业融资的逾 3 倍。学界调查显示,仅 9% 的气候研究者认为 2100 年前不会尝试大规模 SRM,超过 50% 认为首次部署将来自“单一行动者”(企业、富豪或国家),反映对减排停滞的悲观情绪。SRM 只能暂时遮蔽升温效应,无法处理干旱、海洋酸化等问题,且终止时可能触发“终止冲击”,十年内急剧升温。

资本正涌入利润导向企业,包括实施平流层气溶胶注入(SAI)的 Stardust,其 5,680 万英镑公帑以外的民间融资来自 Chris Sacca、Agnelli 家族、Matt Cohler 等。公司声称研发“完全安全、惰性、可追踪”的新型粒子,但专家(如芝加哥大学 Keith)认为所谓惰性粒子“无稽之谈”,即便钻石在 50 公里高空也会改变化学结构。相较之下,两人团队 Make Sunsets 曾释放含硫气球出售“冷却额度”,引发墨西哥禁令与美国环保署关注。尽管 Stardust 承诺透明并发表同行评审论文,但 SRM 产品化固有激励会弱化风险披露。

SRM 可能需持续数百年才能维持效应,而美企平均寿命仅 15 年;任何企业倒闭、战争、制裁都可能导致 SRM 中断并引发灾难性快速增温。全球监管严重缺位:部分美国州因“化学尾迹”阴谋论禁止地球工程;墨西哥全面禁止试验;联合国《生物多样性公约》虽有暂停性条款,但美国未加入且条款不具法律效力;欧盟在 2023 年指出“全球治理框架不存在,也不知如何建立”。缺乏强监管下的高速商业化意味着 SRM 风险可能在治理之前爆发。

Record private investment is moving solar radiation management (SRM) from the scientific fringe into a commercial industry: between 2007 and 2024 commercial solar geoengineering raised only $17.6 million, yet in 2024 a single US-Israeli startup, Stardust, secured $60 million—over three times that prior total. A recent poll found only 9% of climate researchers believe large-scale SRM will not be attempted by 2100, while over half expect the first deployment to come from a lone “rogue actor” (a corporation, billionaire, or state), reflecting pessimism about emissions cuts. SRM can mask warming but cannot address drought or ocean acidification, and halting it risks “termination shock,” a rapid, decade-scale temperature spike.

Investment is flowing into profit-driven SRM ventures pursuing approaches like stratospheric aerosol injection (SAI). Stardust, backed by Chris Sacca, the Agnelli family, and Matt Cohler, claims to have invented a “safe, inert, trackable” particle—claims experts reject as impossible, noting even diamond alters chemistry at ~50 km altitude. Earlier startups such as Make Sunsets released sulfur balloons to sell “Cooling Credits,” prompting regulatory backlash in Mexico and attention from the US EPA. Though Stardust promises transparency and peer-reviewed publication, commercialization inherently incentivizes downplaying risks.

SRM would require reliability over centuries, while the average S&P 500 firm lasts only 15 years; wars, recessions, or sanctions could force abrupt cessation and catastrophic warming. Global governance is nearly absent: some US states banned geoengineering due to conspiracy theories; Mexico prohibits experiments; the UN Convention on Biological Diversity’s moratorium is nonbinding and unratified by the US; the EU concluded in 2023 that no global regulatory framework exists. Without rigorous oversight, rapid commercialization risks outpacing governance, increasing the likelihood of destabilizing or unilateral SRM deployment.