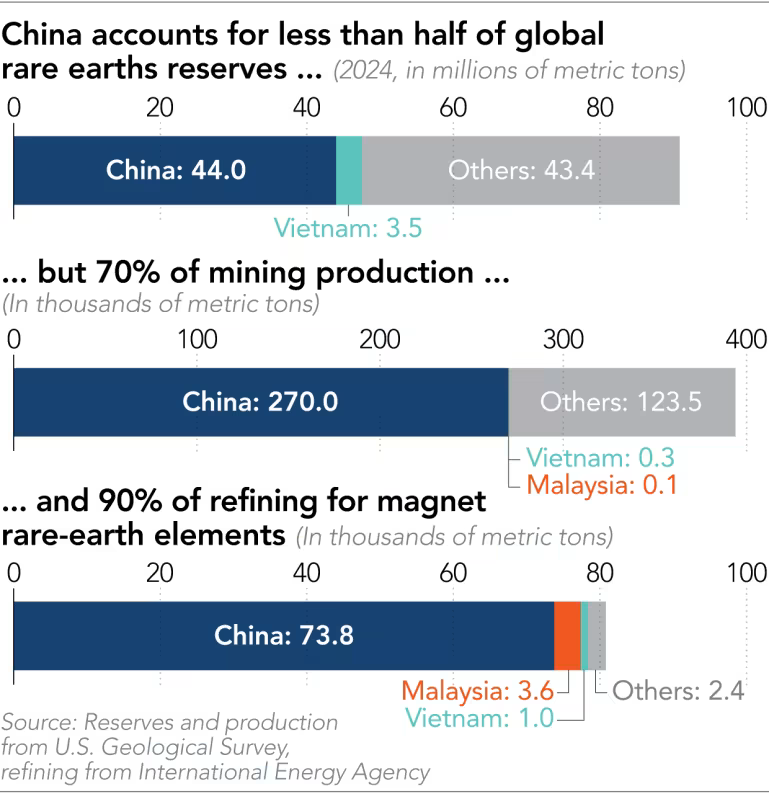

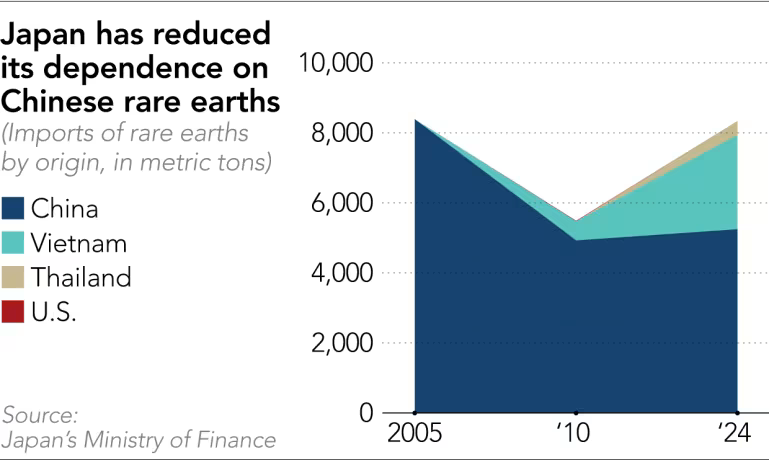

Japan is pursuing rare-earth supply chain “de-Chinafy” via Minamitorishima. A 200 m (original: 200 m) marine research vessel departed Shimizu Port, traveling about 2,000 km (original: 2,000 km) to a Pacific island, aiming to drill mud from 6,000 m (original: 6,000 m) below the seabed. Departure timing is just before 08:00 (UTC+8; original: just before 09:00 JST/UTC+9 on a mid-January morning). Rare earths are 17 metallic elements used across cars, smartphones, and missiles; China built dominance via investment and cost advantages, accounting for about 70% of global mine production and nearly 90% of refining capacity. An unofficial 2010 export ban on Japan pushed Tokyo to treat rare earths as supply security; that early preparation blunts exposure during a newer early-January round of export curbs.

Japan’s approach has four pillars: invest in alternative sources, build strategic stockpiles, support recycling, and develop products that reduce or eliminate rare-earth use. The Minamitorishima project, led by the University of Tokyo and JAMSTEC, tests collection equipment; local sediments hold high concentrations of six or more rare earths including dysprosium and neodymium, with analysts projecting commercial output as early as 2030. JOGMEC anchors supply-side action: a 2011 joint investment with Sojitz in Australia’s Lynas, feasibility work in Namibia, estimated stockpiles of six-to-12 months (original: six-to-12 months), and a French refining/recycling project with Iwatani. Corporate substitution is accelerating: Mitsuba replaced neodymium with ferrite for wiper motors after 2010, started mass production in 2023, won adoption by Honda Motor, Nissan Motor, and Volkswagen, is shifting about half its motors to rare-earth-free designs, and saw shares briefly reach 2,152 yen, more than double versus end-2025, about +20% year to date. Astemo announced in October a rare-earth-free EV drive system using two motors (ferrite magnets and iron), larger but with combined output 75% greater, targeting road deployment by 2030.

Results have limits: Japan cut dependence on Chinese rare earths to around 60% from nearly 90% in 2010, but export controls can still impose large losses. Nomura Research Institute economist Takahide Kiuchi estimates that three months of controls would cause about 660 billion yen (original: 660 billion yen; about $4.2 billion) in production reduction and total economic losses, lowering GDP by 0.11%; one year would raise losses to about 2.6 trillion yen (original: 2.6 trillion yen) and cut annual GDP by 0.43%. Wood Mackenzie notes most projects remain early-stage, making further near-term dependence reduction difficult; Project Blue research director David Merriman expects exposure to fall further as new feedstocks and products come online over 5 to 10 years (original: 5 to 10 years). Costs rise when diversifying: Mizuho Bank found Lynas’s Malaysia-refined rare earths cost about 1.5 times Chinese material, pressuring competitiveness, but the avoided downstream revenue disruption from supply shocks is treated as the higher-value offset.