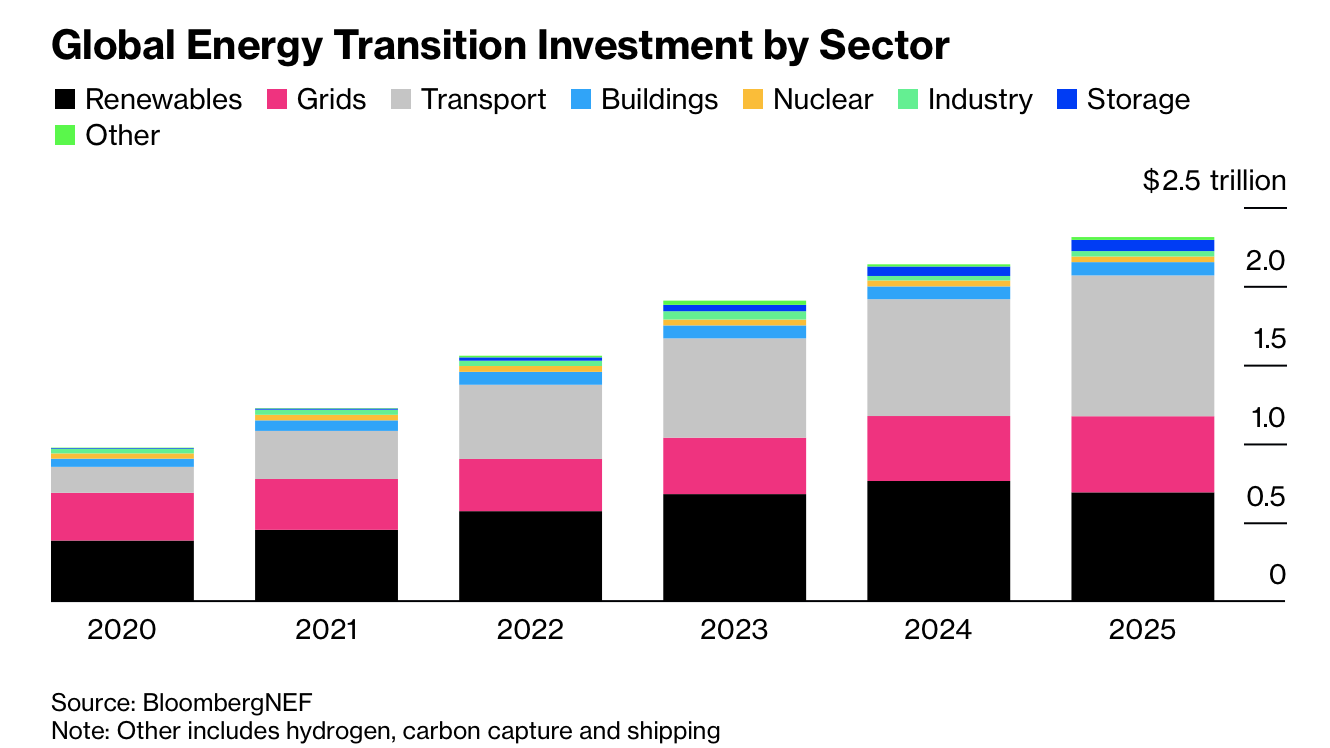

全球能源转型投资在去年达到创纪录的2.3万亿美元,同比增长8%,尽管面临政治与经济不确定性,清洁能源投入仍在扩大。其中约1.2万亿美元投向可再生能源和电网建设,8930亿美元用于电气化交通领域,包括电动车和充电基础设施,主要由亚洲和欧洲的强劲增长推动。

从区域看,亚太地区在2025年贡献了全球近一半的能源转型投资,中国、印度和日本居于前列。欧盟投资额为4550亿美元,同比大增18%。美国尽管政策支持放缓,仍实现3780亿美元的绿色投资,同比增长3.5%。与此同时,化石能源供应投资出现自2020年以来首次下降,主要因上游油气和化石发电支出减少。

尽管总量创新高,但资金增速与结构暴露出不足。2025年全球可再生能源投资同比下降9.5%,主要受中国监管改革影响,导致该国自2013年以来首次出现能源转型投资下滑。氢能与核能投资亦出现回落。整体来看,2025年是自2019年以来首次出现个位数增长,而要实现净零排放,彭博新能源财经估算未来十年年均投资需达到5.2万亿美元,当前水平仍明显不足。

Global investment in the energy transition reached a record $2.3 trillion last year, rising 8% despite political and economic uncertainty. About $1.2 trillion flowed into renewable energy and power grids, while $893 billion went to electrified transportation, including electric vehicles and charging infrastructure, driven largely by strong growth in Asia and Europe.

Regionally, Asia-Pacific accounted for nearly half of global energy transition spending in 2025, led by China, India, and Japan. The European Union invested $455 billion, an 18% year-on-year increase. The US saw $378 billion in green investment, up 3.5% despite weaker policy support. At the same time, global investment in fossil fuel supply fell for the first time since 2020, dragged down by declines in upstream oil and gas and fossil power generation.

Despite the record total, the pace and composition of funding raise concerns. Global renewable energy investment fell 9.5% year on year in 2025 due to regulatory reforms in China, marking its first energy transition investment decline since 2013. Investment in hydrogen and nuclear energy also slipped. Overall growth in 2025 was the first single-digit increase since 2019, well below the estimated $5.2 trillion per year needed through the rest of the decade to reach net-zero emissions.