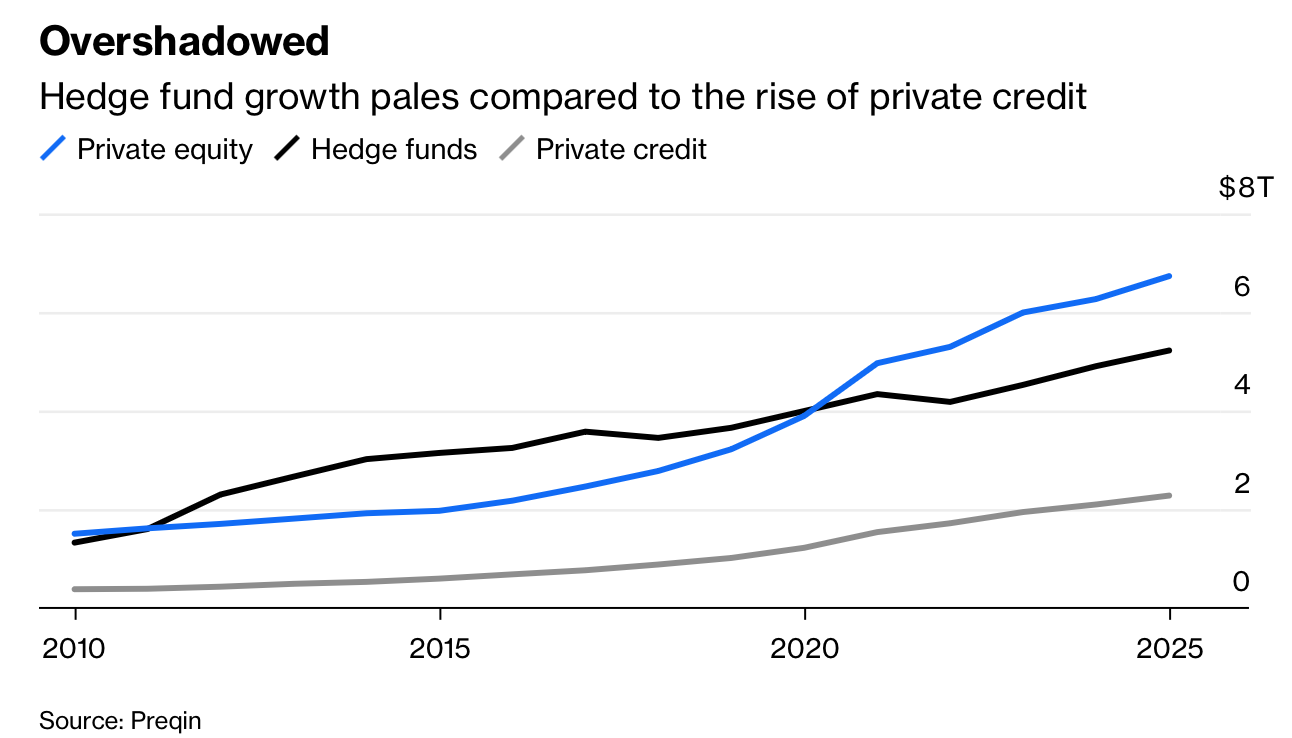

对冲基金行业规模约5万亿美元,在去年录得自全球金融危机以来的最佳回报。股市普涨推动股票策略,宏观策略受关税引发的波动提振,事件驱动策略受益于激进投资上升。相较之下,被宣传为更安全的私募信贷面临违约风险与监管担忧,私募股权仍受退出困难拖累。尽管业绩反弹,但行业是否已根本扭转仍存疑。

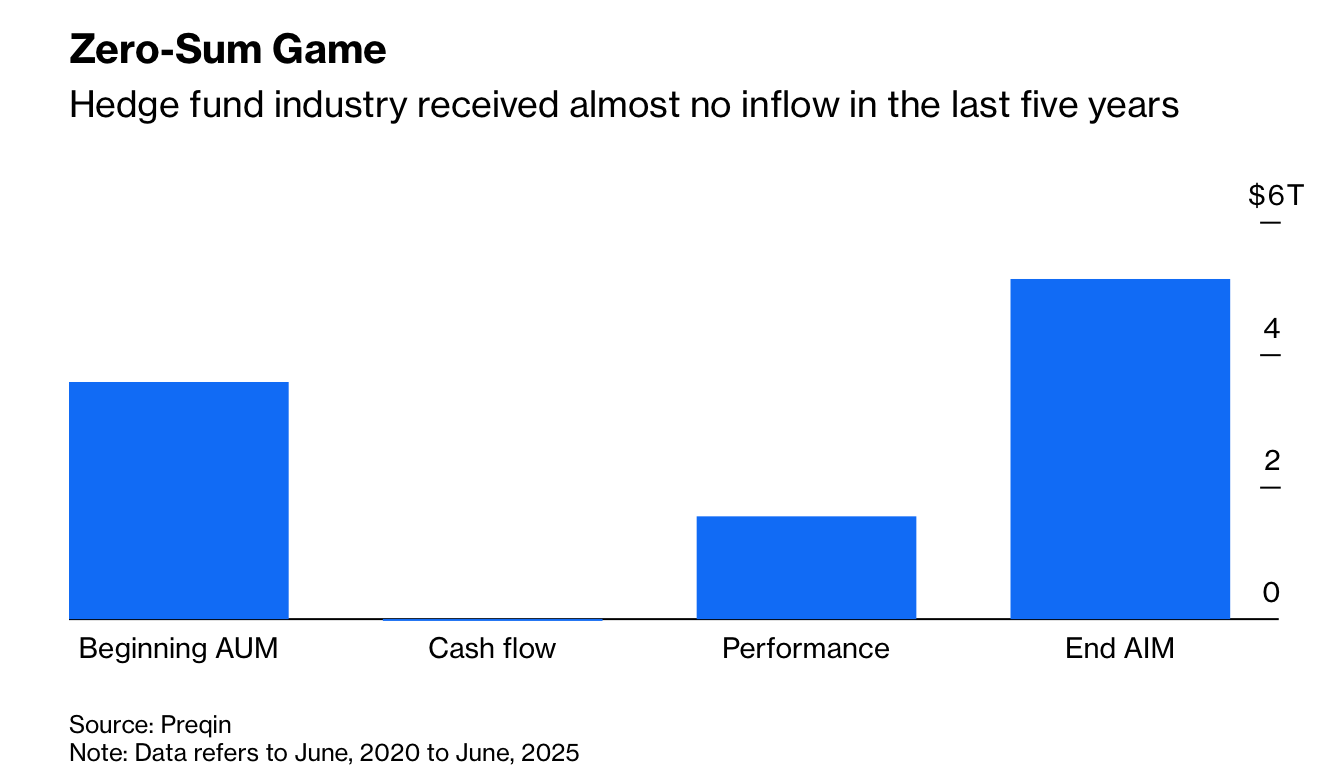

自2022年以来募资持续承压。新基金成立数量已连续四年下降,清算更频繁。过去截至2025年6月的五年间,行业资产管理规模增长几乎完全来自业绩而非净流入,意味着整体几乎没有新增资金,募资呈零和格局。多策略平台吸收了大部分资本,因其分散化结构与“更稳健回报”的形象而占优。

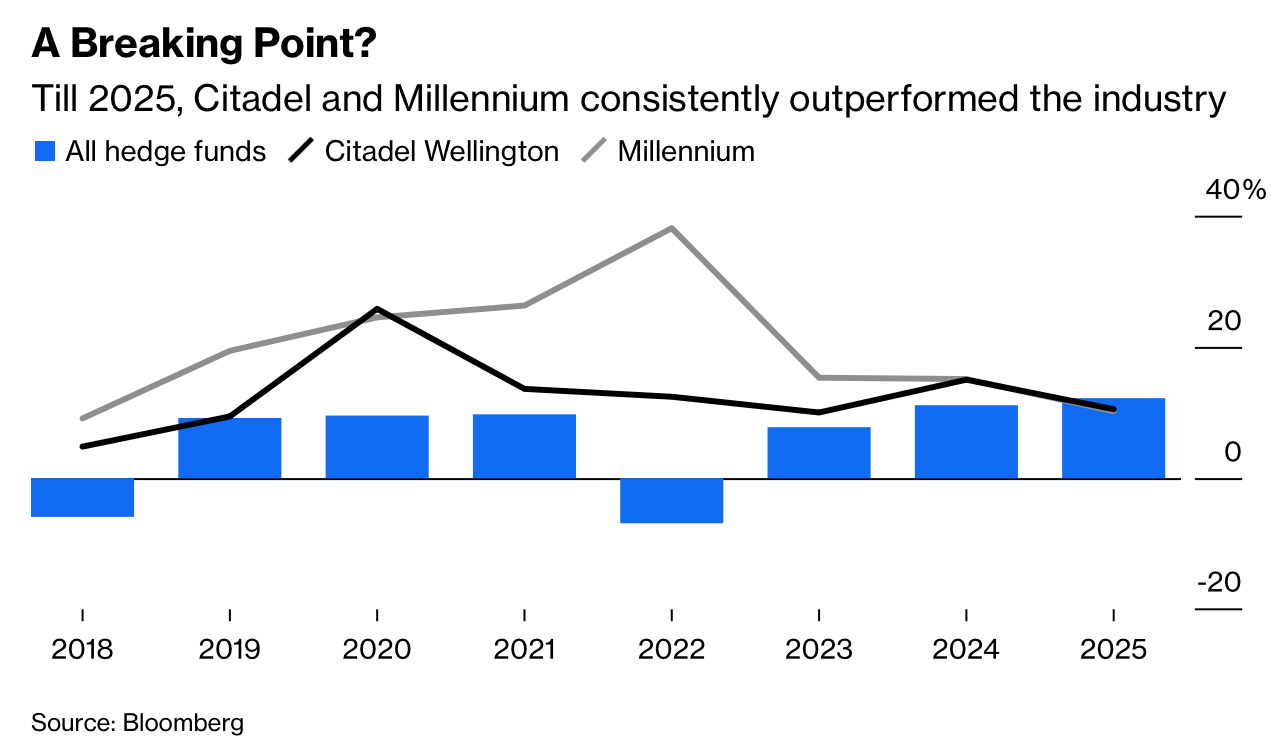

自2020年以来,头部多策略基金每年实现两位数回报,并在2022年行业整体为负时仍显著超额,但其领先优势在2025年减弱,促使部分资金流向精品基金,近期出现数个规模逾10亿美元的新基金。然而,这些流入仍有限。股票多头与多空策略在去年表现强劲,但杠杆上升引发挤空担忧,被大量做空股票的组合年初至今上涨18%。除非多策略模式的风险收益被打破,精品基金仍面临挑战。

The hedge fund industry, with about $5 trillion in assets, delivered its best returns since the Global Financial Crisis last year. A global equity rally lifted stock strategies, macro funds benefited from tariff-driven volatility, and event-driven strategies gained from rising activism. By contrast, private credit faced default and regulatory concerns, while private equity struggled with exits. Despite the rebound, it remains unclear whether the industry has structurally turned the corner.

Fundraising has been weak since 2022. New launches have declined for four consecutive years and liquidations have increased. In the five years to June 2025, growth in assets under management came almost entirely from performance rather than net inflows, implying virtually no new money and a zero-sum fundraising environment. Multistrategy platforms captured most capital, supported by diversification and a perception of safer, superior returns.

Since 2020, leading multistrategy funds posted double-digit annual returns and outperformed even in 2022, when the industry was negative, but their edge faded in 2025, prompting some capital to boutique funds, including several launches exceeding $1 billion. These inflows remain modest. Equity long and long-short funds performed well last year, yet rising leverage has raised short-squeeze risks, with a basket of heavily shorted stocks up 18% year to date. Unless the multistrategy risk-return profile is undermined, boutiques still face headwinds.