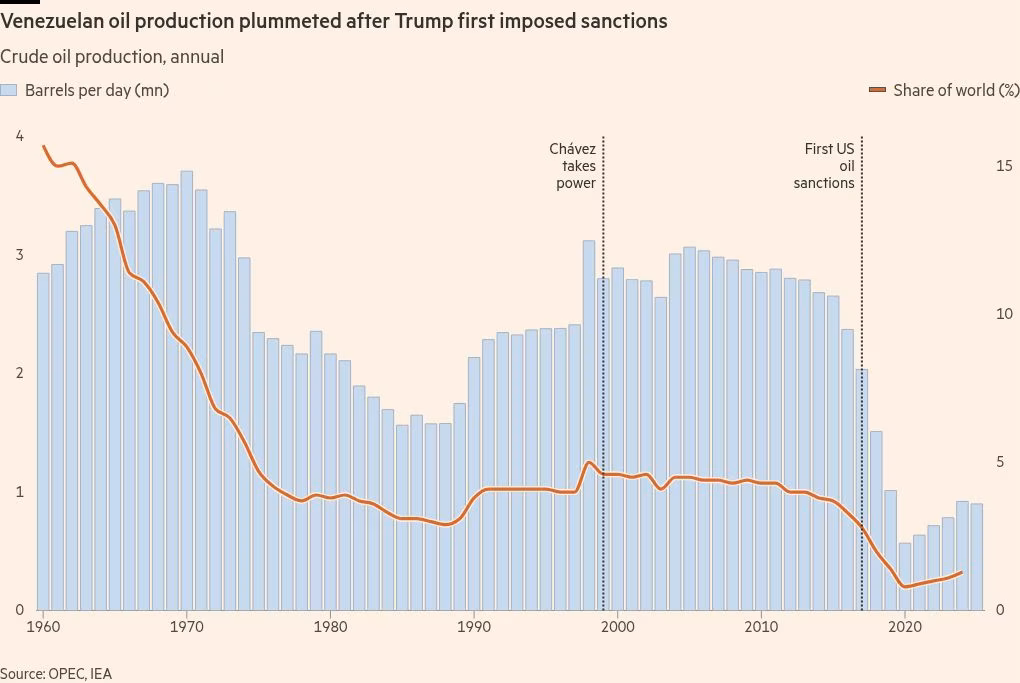

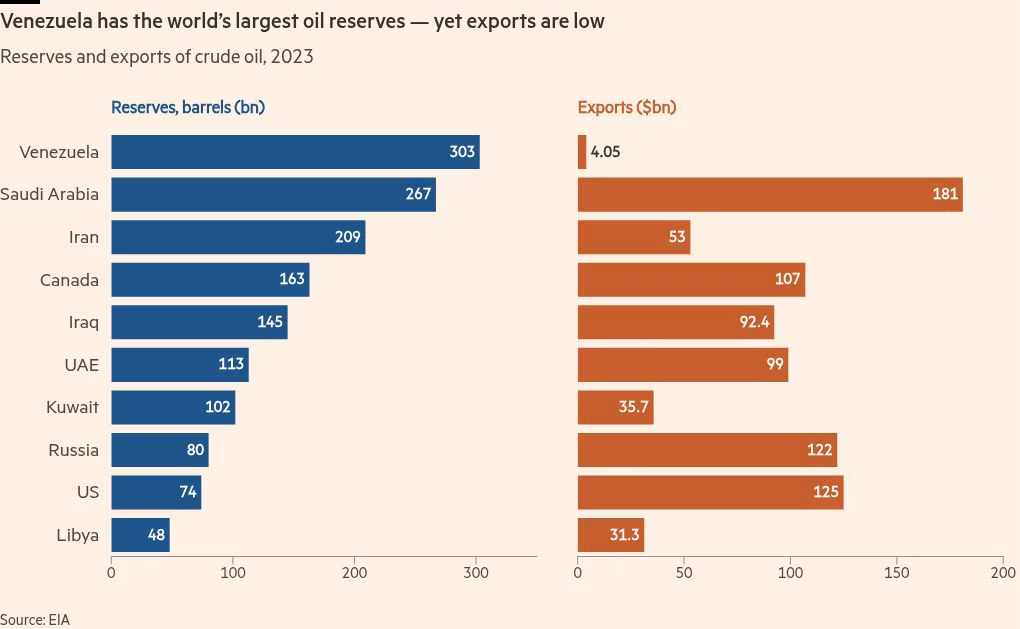

从整体趋势看,委内瑞拉拥有全球约17%的已证实原油储量,却从1970年代高峰日产逾350万桶下滑到如今不到当时的三分之一。卫星分析指多地出现腐蚀油罐、管线渗漏与设备「拆件维修」的迹象;估算显示全国约三分之一的储油能力目前停用,反映炼厂低负载、油罐停役与产量下滑。帕拉瓜纳半岛的阿穆艾/卡东炼厂曾被报导运转率低于20%,近两年又因火灾与停电中断。

成本与瓶颈同样呈数量级扩张:PDVSA外泄文件(2021)称管线50年未更新,恢复至高峰水准需约580亿美元;较新的估算把整体复苏成本抬升到1000亿美元或更高。供应链上,PDVSA(2023)报告指22艘油轮中逾半过度老化需大修或退役;部分管线已超过50年、频繁破裂。2019年全国大停电造成重油在奥里诺科带结泥并造成永久损害,估计对GDP打击约29亿美元。

Carabobo in the Orinoco belt was expected to produce 325,000 bpd this month (over one‑third of national output), but internal projections show output about one‑third below target. Engineers cite blockade-related supply and export constraints, yet also point to chronic underinvestment: no rigs for new wells and only one upgrader fully operational.

Despite holding ~17% of global proven crude reserves, Venezuela has fallen from a 1970s peak above 3.5 million bpd to less than one‑third of that today. Satellite analysis describes corroded tanks, leaking systems, and widespread degradation; roughly one‑third of storage capacity is estimated inactive. Major refineries have reportedly run below 20% capacity, with recent fire and blackout stoppages worsening reliability.

Rehabilitation costs have escalated: a leaked 2021 PDVSA document said pipelines hadn’t been updated in 50 years and estimated $58bn to return to peak output, while newer estimates put the gamble at $100bn+. Logistics are strained too: a 2023 PDVSA report said more than half of its 22 tankers needed repair or removal, and ageing pipelines (some 50+ years) frequently rupture. A 2019 nationwide blackout was linked to about a $2.9bn GDP hit.