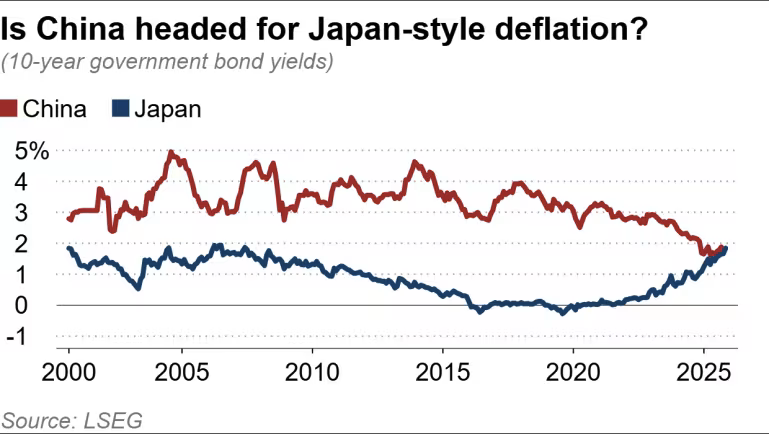

中国长期国债收益率首次跌破日本,同期日债 10 年期收益率一度升至约 1.84%,而中国维持在约 1.83%,并在 20 年与 30 年期限上出现类似倒挂,是自 2000 年有记录以来首次。此反转反映两国宏观路径分化:日本 CPI 年增率稳定在约 3%,而中国接近零,10 个月中有 6 个月同比下降,进入典型通缩区间。中国 2024 年 7 月新增贷款 20 年来首次低于还款额,呈现“资产负债表衰退”特征,同时房地产泡沫破裂与零疫情政策后遗症仍抑制需求。

在持续疲弱的需求背景下,中国央行自 2024 年 5 月将 7 天逆回购利率由 1.5% 下调至 1.4%,市场预期货币将维持宽松,长期收益率全年在 1.5% 至 1.9% 区间徘徊。对比历史,2000 年 9 月中国长期利率约 2.8%,2007 年 GDP 增速达 14% 时曾突破 5%。自 2010 年取代日本成为全球第二大经济体后,中国 GDP 增速从双位数下滑至当前约 5%,IMF 预估 2025 年 4.8%、2026 年 4.2%,反映潜在增长明显回落。持续的 37 个月 PPI 下降(10 月为 -2.1%)加剧企业间价格战,消费端普遍等待降价,进一步推动通缩风险。

中国政府拟在 2026 年启动的新五年计划强调扩大内需,但专家认为尚无有效应对需求疲弱的方案。若消费不能恢复,中国出口将以更低价格向全球释放过剩产能,影响美国、欧洲及新兴经济体产业安全。未来利率走向的关键在于中国能否避免通缩螺旋与成功刺激内需,而日本的利率前景则主要取决于高市早苗政府的财政政策与日本央行的紧缩节奏。

China’s long-term yields fell below Japan’s for the first time, with Japan’s 10-year yield briefly exceeding 1.84% while China’s hovered near 1.83%, matching similar inversions at 20- and 30-year maturities — the first on record since 2000. The shift reflects diverging macro paths: Japan’s CPI growth holds near 3%, while China’s approaches zero, with year-on-year declines in six of ten months through October. July 2024 saw new lending fall below repayments for the first time in 20 years, signaling a “balance-sheet recession,” compounded by the post-real-estate-bubble slump and zero-Covid aftereffects.

Amid weak demand, the PBOC cut the seven-day reverse repo rate from 1.5% to 1.4% in May 2024, anchoring expectations of prolonged accommodation and keeping long-term yields in the 1.5%–1.9% band. Historically, yields stood near 2.8% in 2000 and exceeded 5% in 2007 when GDP rose 14%. Since overtaking Japan in 2010, China’s growth has slid from double digits to ~5%, with IMF projections of 4.8% in 2025 and 4.2% in 2026. Producer prices have fallen for 37 consecutive months (-2.1% in October), escalating price competition as consumers delay purchases, deepening deflation risks.

China’s new five-year plan starting 2026 emphasizes boosting domestic demand, but analysts see no credible remedy for weak consumption. Failure to revive demand could push excess capacity abroad at low prices, pressuring industries in the US, Europe and emerging markets. China’s ability to avert a deflationary spiral will shape future rate trends, while Japan’s rates will hinge on Prime Minister Takaichi’s fiscal stance and the Bank of Japan’s policy trajectory.