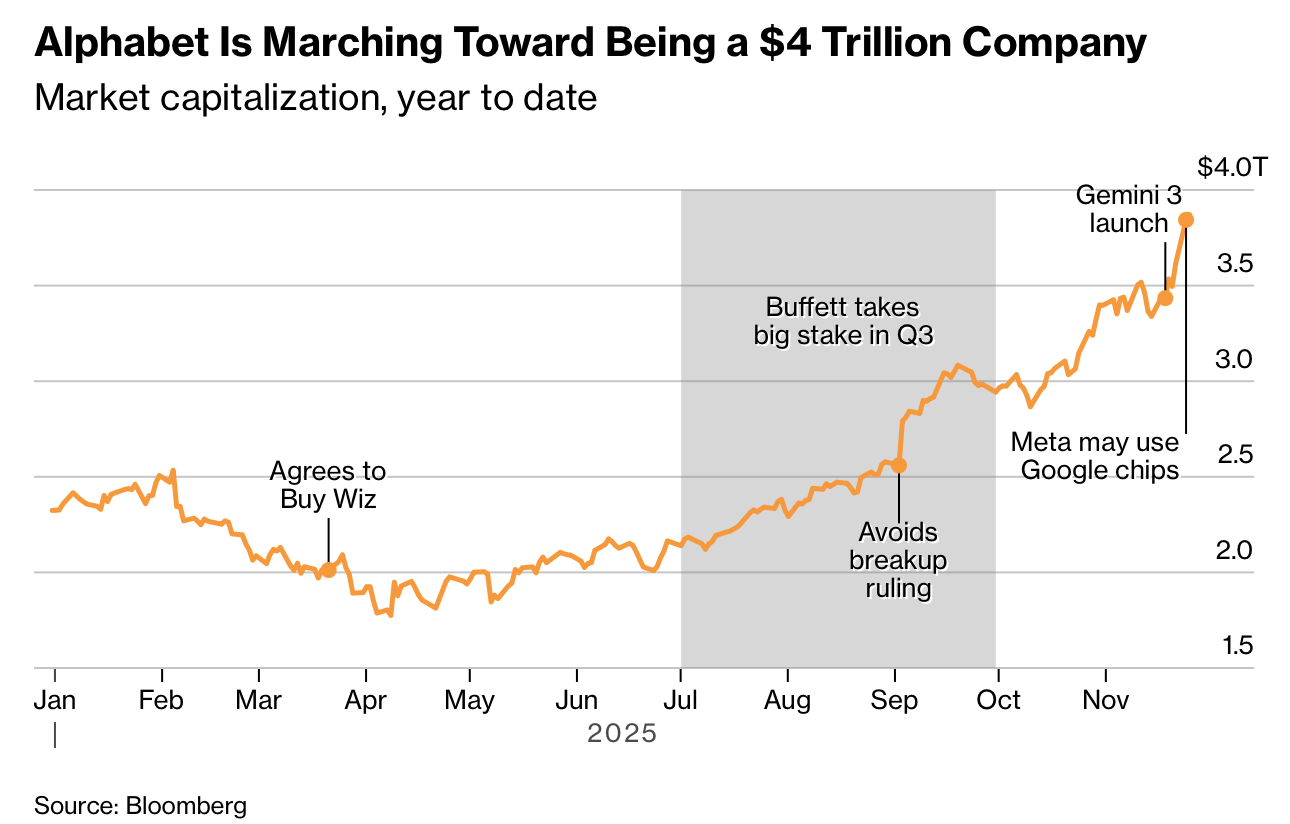

谷歌在 2024 年末至 2025 年间重获 AI 主导权,核心指标呈现强劲反转:Alphabet 股价自 10 月中旬以来推动市值增加近 1 万亿美元,并在本周上涨 1.5% 至 323.44 美元,使公司市值逼近 4 万亿美元。Gemini 3 Pro 登顶 LMArena 与 Humanity’s Last Exam 榜单,应用端累计用户 6.5 亿,但低于 ChatGPT 的每周 8 亿用户与月度 9,300 万下载(Gemini 为 7,300 万)。此外,谷歌云第三季度收入达 152 亿美元,同比增长 34%,仍低于竞争对手但处于加速阶段。公司 AI 芯片 TPU 需求攀升,Anthropic 计划使用多达 100 万颗 TPU,交易规模达数百亿美元;Meta 也在谈判中,市场视为谷歌技术成熟的信号。

市场反应呈明显分化:SoftBank 因担忧 Gemini 竞争而下跌 10%,Nvidia 下跌 2.6%(蒸发 1,150 亿美元市值)。谷歌“全栈”优势显现,包括自研 AI 应用、模型、云体系与芯片,并拥有来自搜索、Android 与 YouTube 的独占数据资源。监管风险亦有所缓解,美国反垄断案件未要求拆分公司。Waymo 扩展至高速路载客,显示非广告业务有进展。TPU 的高绑定性使其更适用于计算量巨大的客户,而 GPU 仍具更高灵活性。

内部策略重组也显著改变谷歌节奏。自 2023 年起,DeepMind 被整合为统一 AI 部门,在 Hassabis 领导下聚焦基础模型研发,并成功留住核心工程师。谷歌强化投资以缩小与 Microsoft、OpenAI、Anthropic 的差距。行业分析普遍认为谷歌已“完全醒来”,在全球 AI 竞争中的衰落叙事被数据全面驳斥。

Google regained AI momentum between late 2024 and 2025, with key metrics sharply reversing: Alphabet added nearly $1 trillion in market value since mid-October, and its stock rose 1.5% to $323.44 this week, pushing valuation near $4 trillion. Gemini 3 Pro topped LMArena and Humanity’s Last Exam rankings, while its app reached 650 million users — trailing ChatGPT’s 800 million weekly users and 93 million monthly downloads (Gemini at 73 million). Google Cloud posted Q3 revenue of $15.2 billion, up 34% year-on-year. Demand for Google’s TPUs surged, with Anthropic committing to up to 1 million TPUs in a deal worth tens of billions of dollars, and Meta reportedly exploring adoption, signaling confidence in Google’s maturing stack.

Market reactions diverged: SoftBank fell 10% on Gemini-related concerns, and Nvidia dropped 2.6% (erasing $115 billion in value). Google’s “full-stack” advantage — spanning applications, models, cloud architecture, chips and exclusive data from Search, Android and YouTube — has become more visible. Regulatory overhang eased when the US antitrust case stopped short of a breakup. Waymo’s expansion into freeways illustrates progress outside advertising. TPUs’ tight coupling with Google Cloud suits high-intensity compute clients, while GPUs remain more flexible.

Internal restructuring also reshaped execution. Since 2023, DeepMind was unified under Demis Hassabis to focus on foundational models and retain key engineers. Google increased investment to narrow gaps with Microsoft, OpenAI and Anthropic. Analysts widely conclude the firm is “fully awake,” and narrative of Google’s decline in the global AI race has been decisively contradicted by performance data.