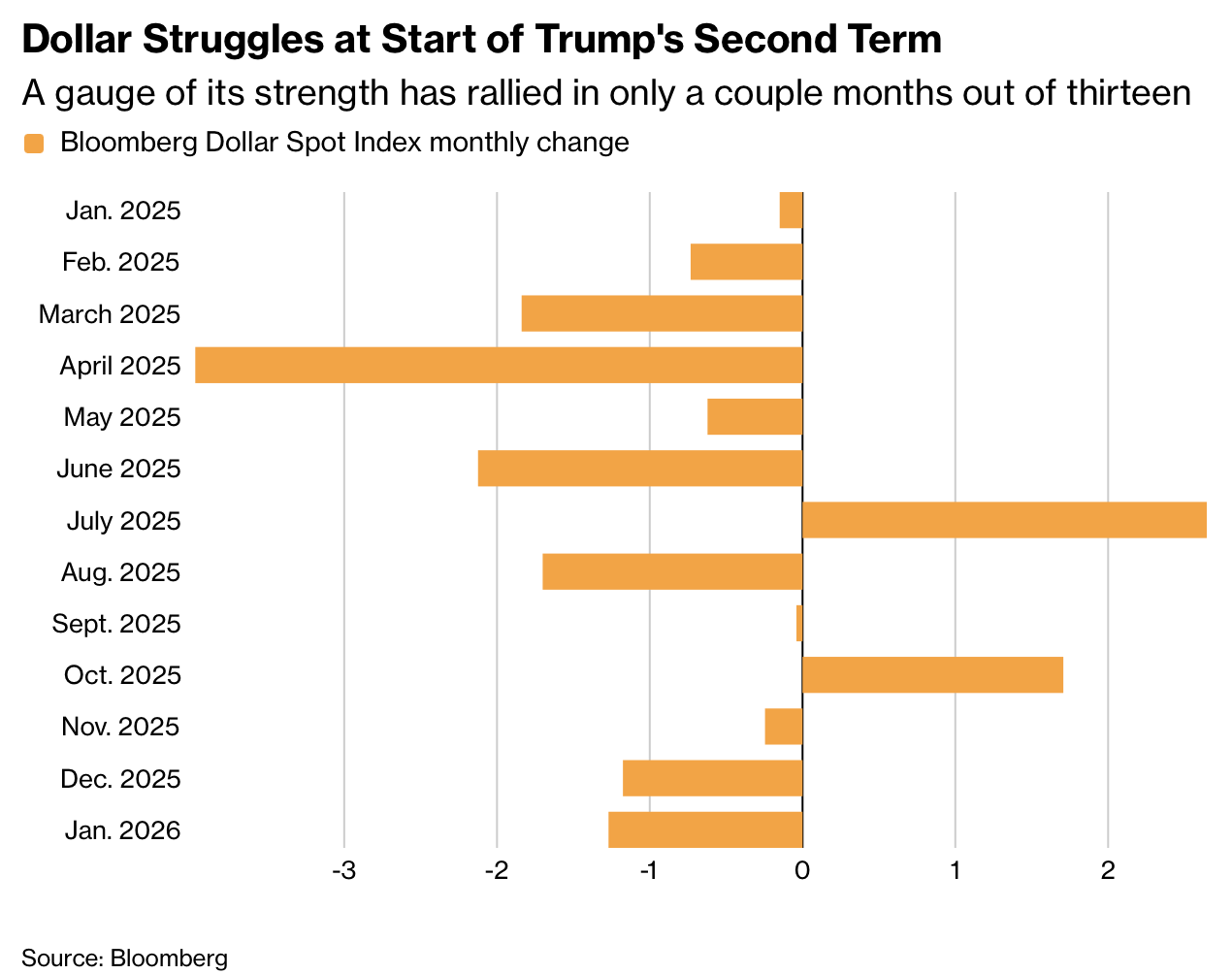

美元贬值担忧在 2026 年 1 月再度升温,特朗普第二任期内彭博美元现货指数累计下跌近 10%,跌至 2022 年以来最低水平。仅 1 月份美元就下跌 1.3%,为自去年 8 月以来最大月度跌幅。市场将其归因于关税威胁、对美联储降息施压以及对盟友和贸易体系的强硬立场,促使投资者削减美元敞口并加大对冲需求。美元走弱还伴随对“弱美元政策”的猜测,即政府至少不会阻止货币贬值以提升出口竞争力。

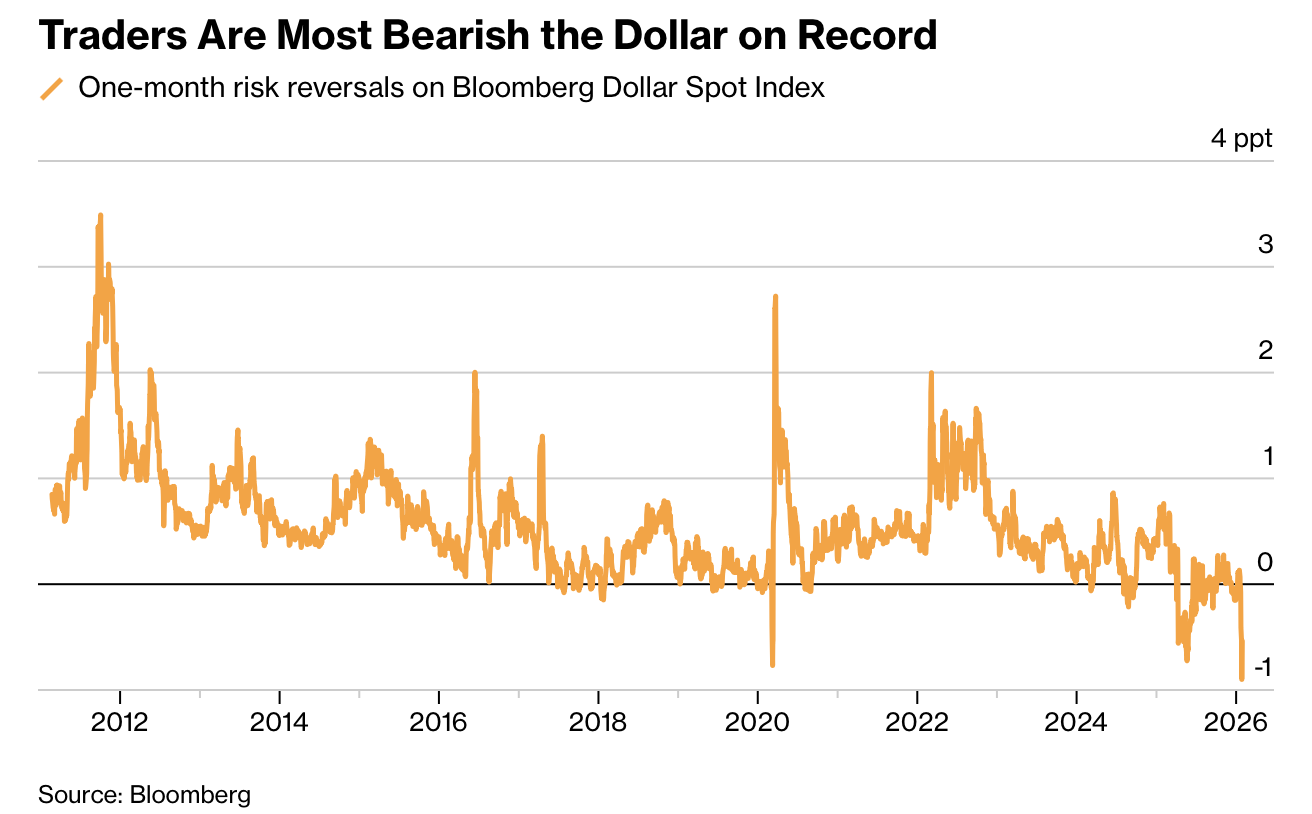

资金流向和相对表现强化了这一趋势。美国以外股市已明显跑赢,美国之外的 MSCI 指数去年上涨近 30%,几乎是标普 500 涨幅的两倍。新兴市场受益尤为明显,其股票指数 1 月上涨逾 8%,多数新兴市场货币对美元升值。与此同时,对美元下行的对冲成本升至彭博自 2011 年开始统计以来的最高水平,反映出未来 12 个月的普遍悲观预期。黄金作为替代储值资产,即便近期波动,整体仍大幅上涨。

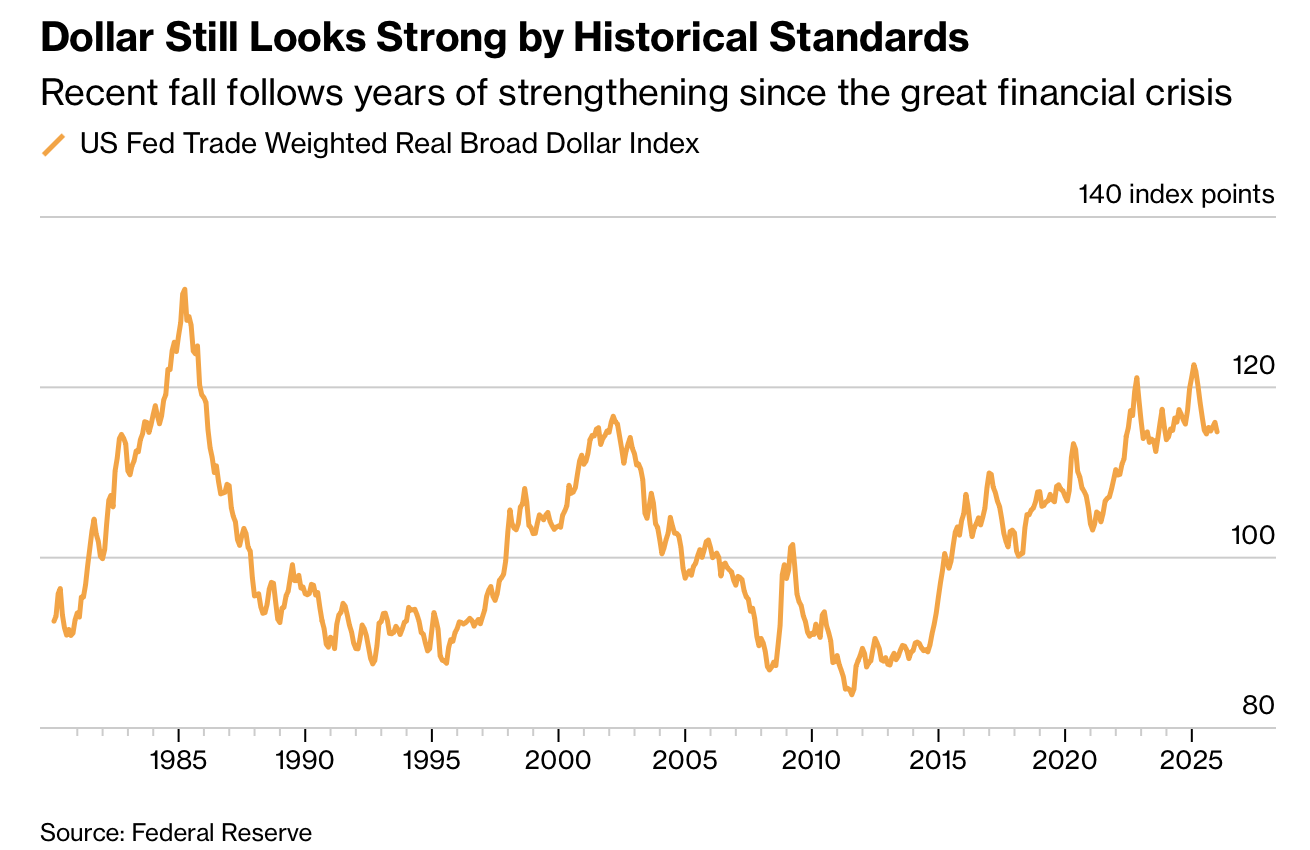

宏观约束仍然存在。美国约 1.8 万亿美元的年度预算赤字和接近 39 万亿美元的政府债务,使其高度依赖海外投资者购买国债。若信心流失,融资成本上升将冲击经济并抵消降息目标。历史经验显示,美元在 2017 年也曾下跌后回稳,部分分析认为当前更多是风险偏好正常化而非全面“抛售美国”。但整体来看,市场正逐步转向一个不再以美元为唯一核心的金融格局。

Dollar debasement fears flared again in January 2026, with the Bloomberg Dollar Spot Index down almost 10% during President Trump’s second term and at its weakest since 2022. The dollar fell 1.3% in January alone, its deepest monthly drop since last August. Investors cited renewed tariff threats, pressure on the Federal Reserve to cut rates, and confrontational trade and geopolitical policies, prompting reduced dollar exposure and heavier hedging. Speculation has grown that the administration may tolerate, or even prefer, a weaker currency to boost export competitiveness.

Capital flows and relative performance reinforce the shift. Equity markets outside the US have outperformed, with an MSCI index of non-US markets gaining almost 30% last year, nearly double the S&P 500’s rise. Emerging markets benefited most, as their stock index climbed more than 8% in January and most emerging currencies strengthened against the dollar. Hedging costs against dollar declines rose to the highest level since Bloomberg began tracking the data in 2011, reflecting widespread pessimism over the next 12 months. Gold, viewed as an alternative store of value, remains sharply higher despite recent volatility.

Structural constraints remain significant. The US runs an annual budget deficit of about $1.8 trillion and carries roughly $39 trillion in government debt, leaving it reliant on foreign buyers of Treasuries. A loss of confidence could force higher yields, undermining growth and lower-rate goals. Past episodes, including a dollar drop in 2017, eventually stabilized, leading some analysts to argue the move reflects normalization of risk appetite rather than a full “sell America” trade. Even so, markets appear to be adjusting toward a less dollar-centric global financial regime.