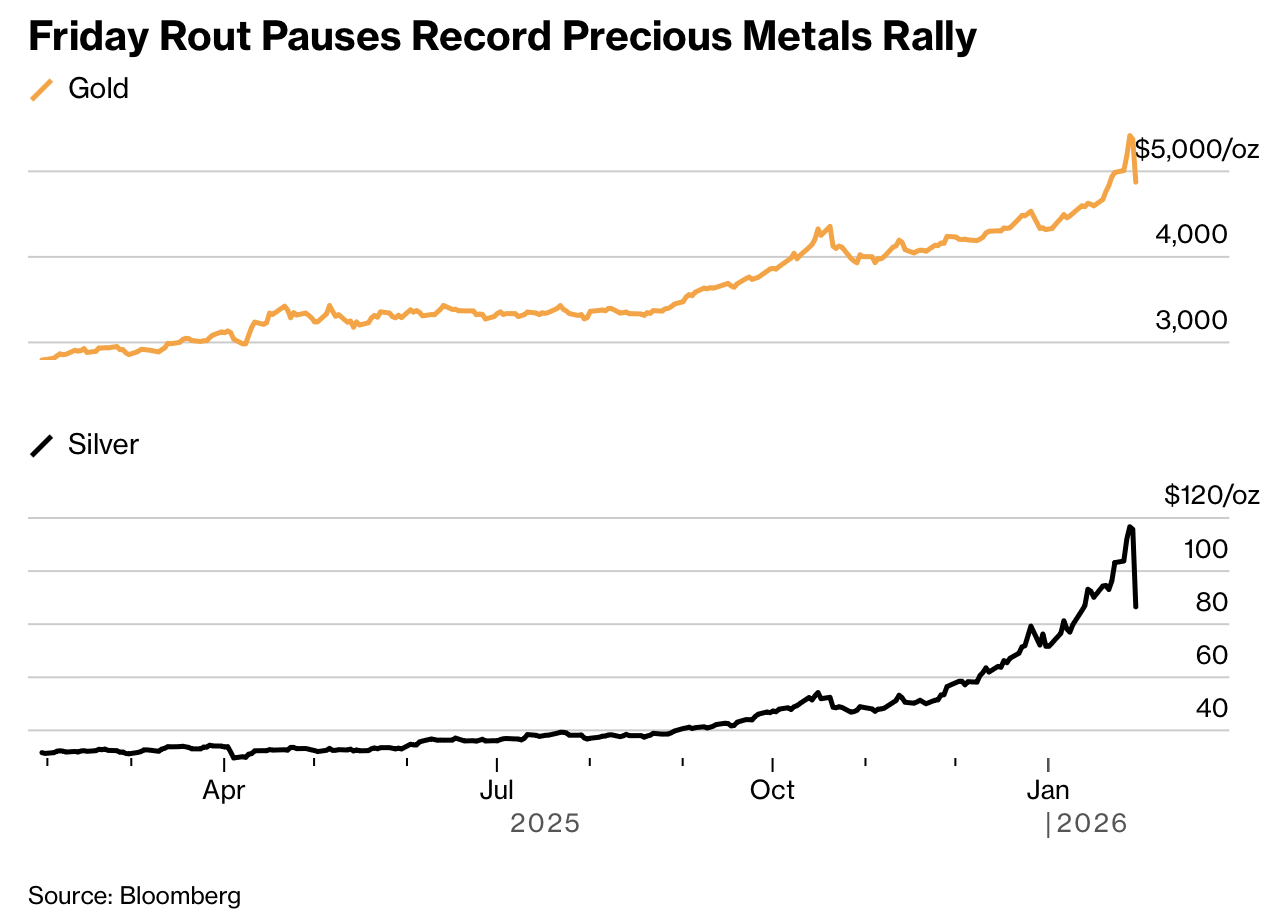

黄金和白银在 1 月 31 日出现历史性暴跌,逆转了过去一年推动价格创纪录上涨的强劲行情。黄金盘中跌幅超过 12%,跌破每盎司 5,000 美元,创下自 20 世纪 80 年代初以来最大单日跌幅。白银一度暴跌 36%,为有记录以来最大盘中跌幅。伦敦铜价下跌 3.4%,从前一日突破每吨 14,000 美元的历史高位回落。美元指数上涨 0.9%,此前一年中贵金属上涨与美元走弱形成强烈对比。

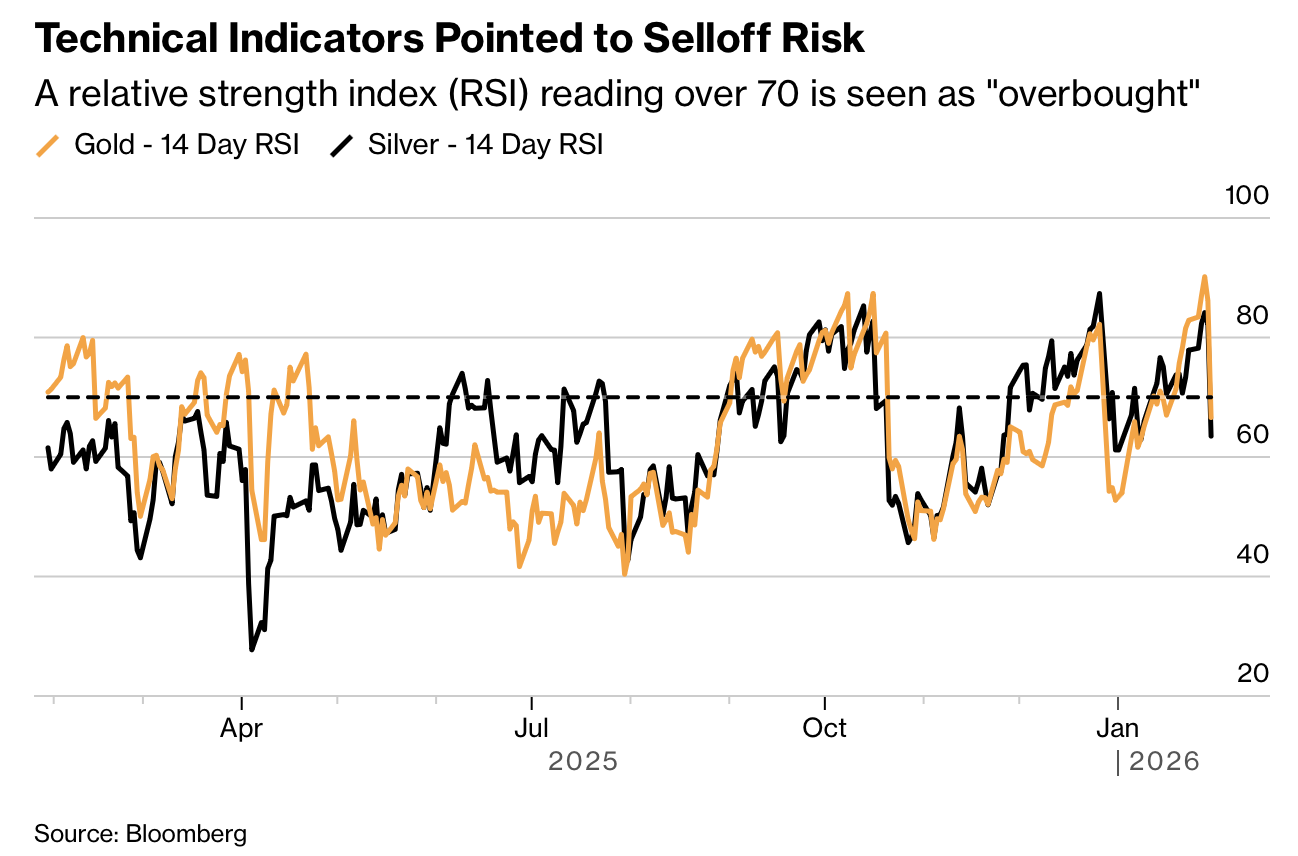

此次抛售的直接触发因素是美元反弹,原因是特朗普政府确认提名凯文·沃什为美联储主席。市场将其视为最强硬的通胀鹰派,强化了对更紧货币政策的预期,从而支撑美元并打压以美元计价的金属价格。此前黄金和白银在 1 月分别累计上涨 13% 和 19%,相对强弱指数显示黄金 RSI 达到 90,处于数十年来最高的超买水平,表明回调风险显著。

衍生品市场放大了价格波动。大量看涨期权和所谓的“伽马挤压”迫使交易商在价格上涨时买入、下跌时抛售,加剧了震荡。GLD ETF 在 465 美元和 455 美元存在大量到期仓位,Comex 在 5,300、5,200 和 5,100 美元也有集中头寸。尽管当日暴跌,金银本月仍录得两位数涨幅,显示趋势反转伴随极端波动而非需求消失。

Gold and silver suffered historic plunges on January 31, reversing a powerful rally that had driven prices to record highs over the past year. Gold fell more than 12% intraday, slumping below $5,000 an ounce in its biggest one-day drop since the early 1980s. Silver plunged as much as 36%, the largest intraday decline on record. Copper slid 3.4% in London, retreating after surging above $14,000 a ton a day earlier. The Bloomberg Dollar Spot Index gained 0.9%, contrasting sharply with the prior year’s metal gains alongside a weaker dollar.

The immediate trigger was a rebound in the dollar after the Trump administration confirmed the nomination of Kevin Warsh as Federal Reserve chair. Traders see him as the most hawkish inflation fighter, strengthening expectations for tighter monetary policy that supports the dollar and pressures dollar-priced metals. Before the rout, gold and silver had risen 13% and 19% respectively in January, while technical signals flashed warnings, with gold’s relative-strength index hitting 90, the highest level in decades and consistent with an overdue correction.

Derivatives markets amplified the move. Heavy call-option positioning and a so-called gamma squeeze forced dealers to buy as prices rose and sell as they fell, intensifying swings. Large option expiries clustered at $465 and $455 for the GLD ETF, and at $5,300, $5,200, and $5,100 on Comex. Despite the violent selloff, both metals still posted double-digit monthly gains, indicating a reversal marked by extreme volatility rather than a collapse in underlying demand.