对收益型投资人而言,透过短期美国公债取得逾5%轻松报酬的时代正随著联准会重启降息而告终,殖利率自疫情后高点回落。由 AI 乐观情绪与韧性的美国成长推动的股债全面上涨,压缩了收益,迫使投资组合在存续期间、流动性与风险之间做出权衡。

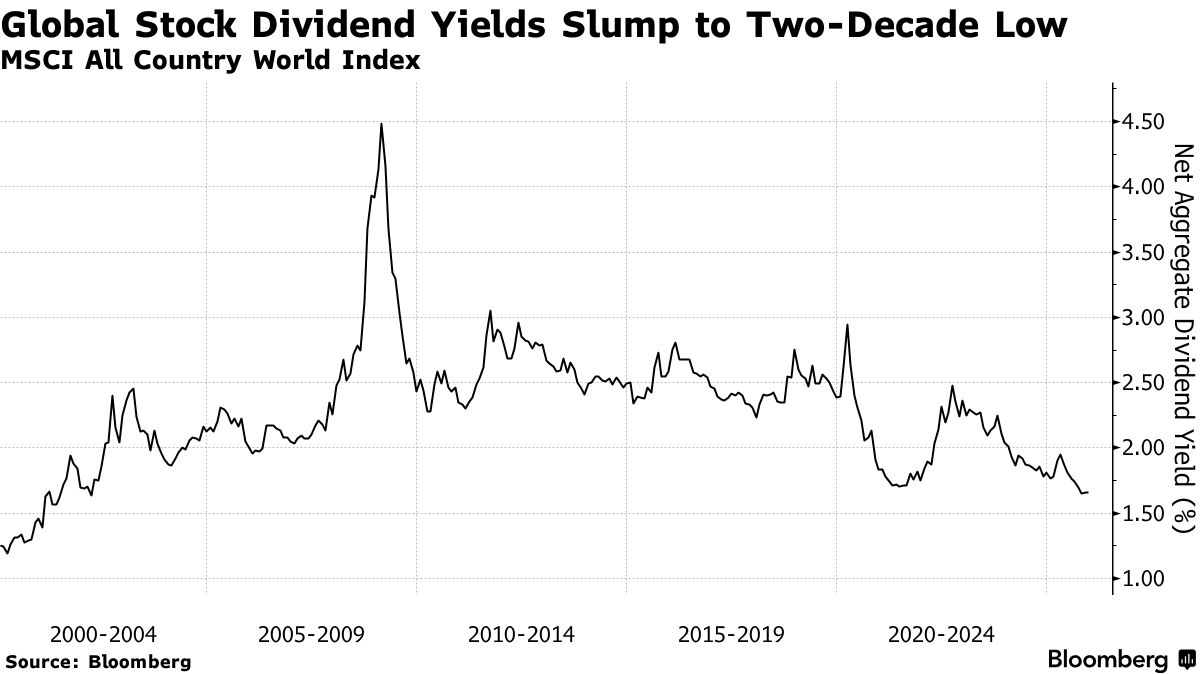

传统收益来源几乎不再提供缓冲。以 MSCI 世界所有国家指数衡量的全球股息率接近自 2002 年以来最低水准,而投资级信贷利差徘徊在多年代低点之上。较长天期美债殖利率虽升至数月高点,但内含显著的成长、通膨与财政风险,使进出时机与信念变得关键。

作为回应,退休基金、保险公司与资产管理机构正转向高风险或流动性较差资产,包括高收益债、新兴市场债、AAA CLO、证券化商品、私人信贷与灾难债券。私人信贷基金已吸收数千亿美元资金,而 2023 年成立的 Victory Pioneer CAT Bond Fund 规模已扩大至 16 亿美元,反映投资人为较薄的报酬被迫进一步拉长风险曲线。

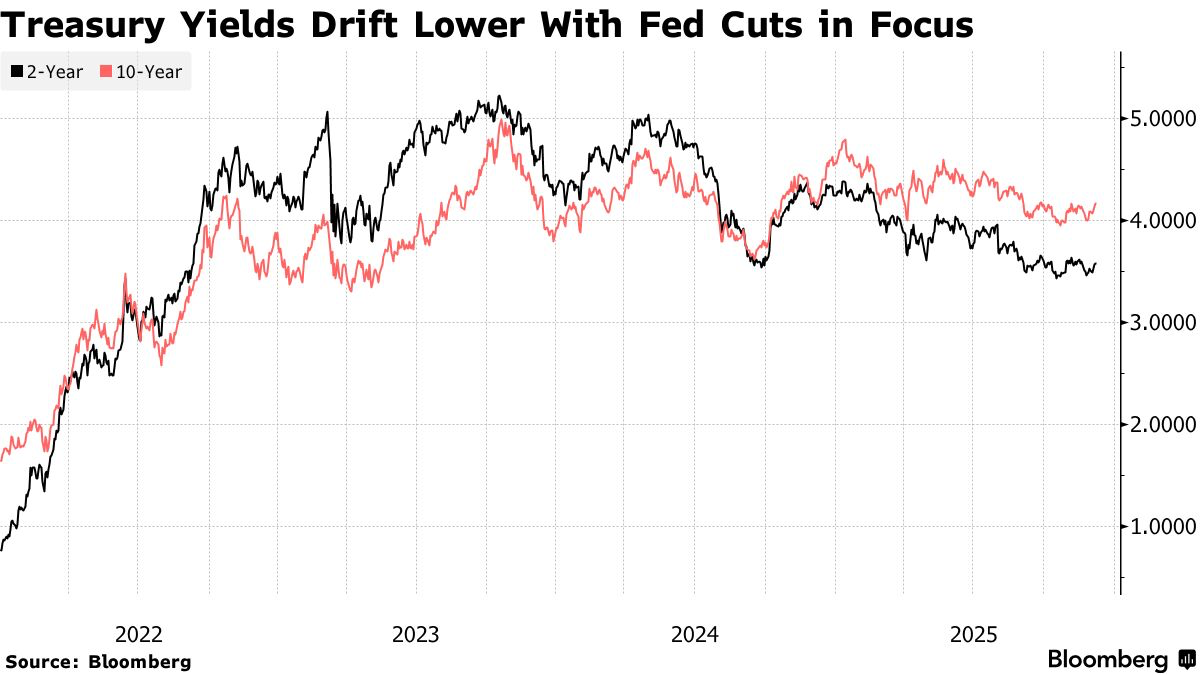

For income investors, the era of easy 5%+ returns from short-term US Treasuries is ending as the Fed resumes rate cuts, pulling yields down from post-pandemic highs. A broad rally in stocks and bonds, powered by AI optimism and resilient US growth, has compressed yields and forced portfolios to trade off duration, liquidity and risk.

Traditional income sources offer little cushion. Global equity dividend yields, measured by the MSCI All Country World Index, sit near their lowest levels since 2002, while investment‑grade credit spreads hover just above multi-decade lows. Longer-maturity Treasuries have risen to multi-month highs but embed significant growth, inflation and fiscal risk, making timing and conviction critical.

In response, pensions, insurers and asset managers are shifting toward higher-risk or less liquid assets, including high yield, emerging‑market debt, AAA CLOs, securitizations, private credit and catastrophe bonds. Private-credit funds already hold hundreds of billions of dollars, while the Victory Pioneer CAT Bond Fund, launched in 2023, has grown to $1.6 billion as investors move further out the risk curve for slimmer rewards.

传统收益来源几乎不再提供缓冲。以 MSCI 世界所有国家指数衡量的全球股息率接近自 2002 年以来最低水准,而投资级信贷利差徘徊在多年代低点之上。较长天期美债殖利率虽升至数月高点,但内含显著的成长、通膨与财政风险,使进出时机与信念变得关键。

作为回应,退休基金、保险公司与资产管理机构正转向高风险或流动性较差资产,包括高收益债、新兴市场债、AAA CLO、证券化商品、私人信贷与灾难债券。私人信贷基金已吸收数千亿美元资金,而 2023 年成立的 Victory Pioneer CAT Bond Fund 规模已扩大至 16 亿美元,反映投资人为较薄的报酬被迫进一步拉长风险曲线。

For income investors, the era of easy 5%+ returns from short-term US Treasuries is ending as the Fed resumes rate cuts, pulling yields down from post-pandemic highs. A broad rally in stocks and bonds, powered by AI optimism and resilient US growth, has compressed yields and forced portfolios to trade off duration, liquidity and risk.

Traditional income sources offer little cushion. Global equity dividend yields, measured by the MSCI All Country World Index, sit near their lowest levels since 2002, while investment‑grade credit spreads hover just above multi-decade lows. Longer-maturity Treasuries have risen to multi-month highs but embed significant growth, inflation and fiscal risk, making timing and conviction critical.

In response, pensions, insurers and asset managers are shifting toward higher-risk or less liquid assets, including high yield, emerging‑market debt, AAA CLOs, securitizations, private credit and catastrophe bonds. Private-credit funds already hold hundreds of billions of dollars, while the Victory Pioneer CAT Bond Fund, launched in 2023, has grown to $1.6 billion as investors move further out the risk curve for slimmer rewards.