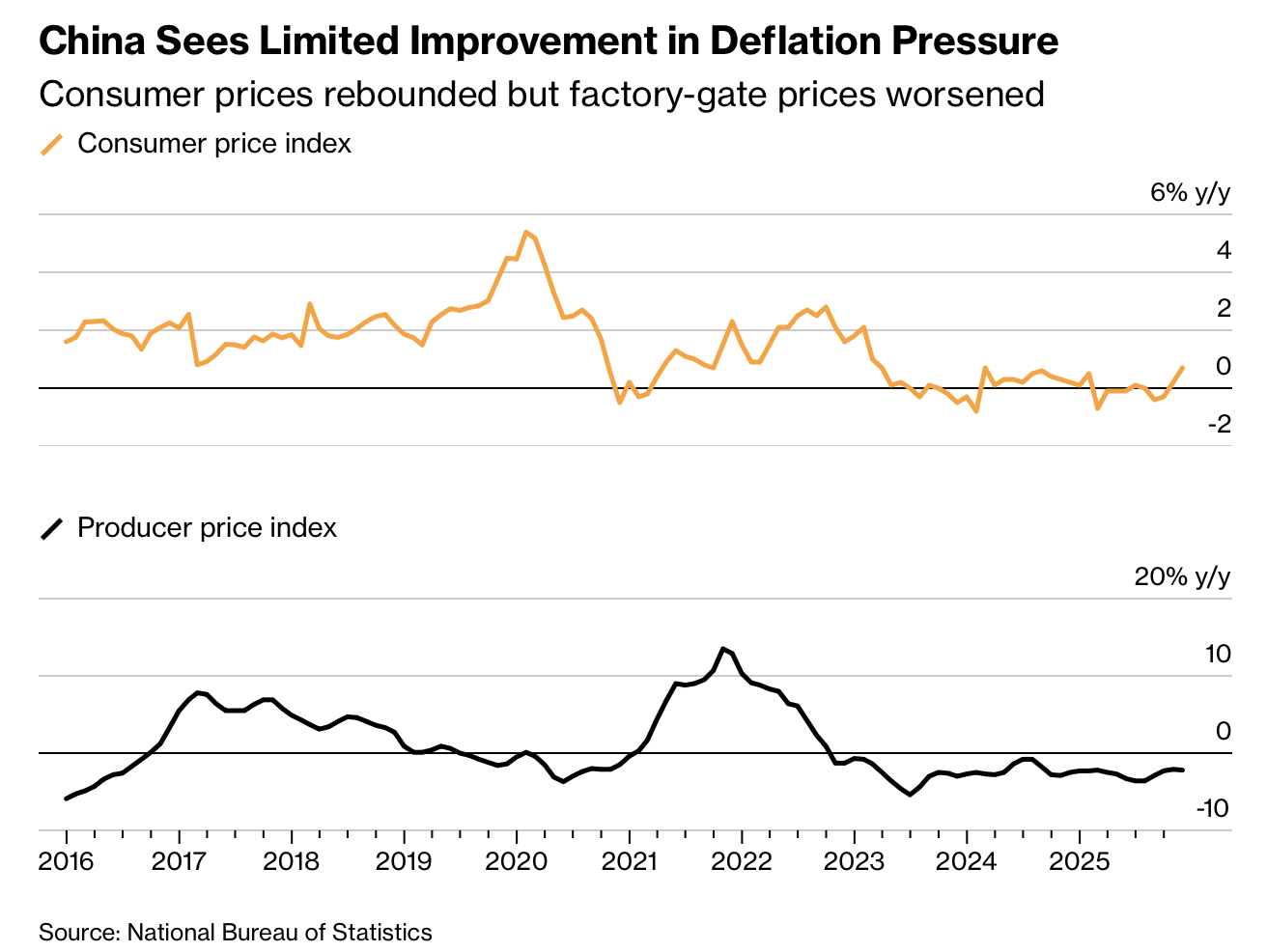

中国11月消费者物价指数(CPI)同比上升0.7%,创一年多来最快增速,并连续第二个月维持正值,但潜在通缩忧虑依然挥之不去。内核CPI停留在1.2%,结束此前连续六个月的加速上行;同时生产者出厂价格(PPI)下降2.2%,工厂门口通缩已连续持续38个月。国内生产总值平减指数预计将连续第三年下滑,为自上世纪70年代末市场化改革以来最长的一次。

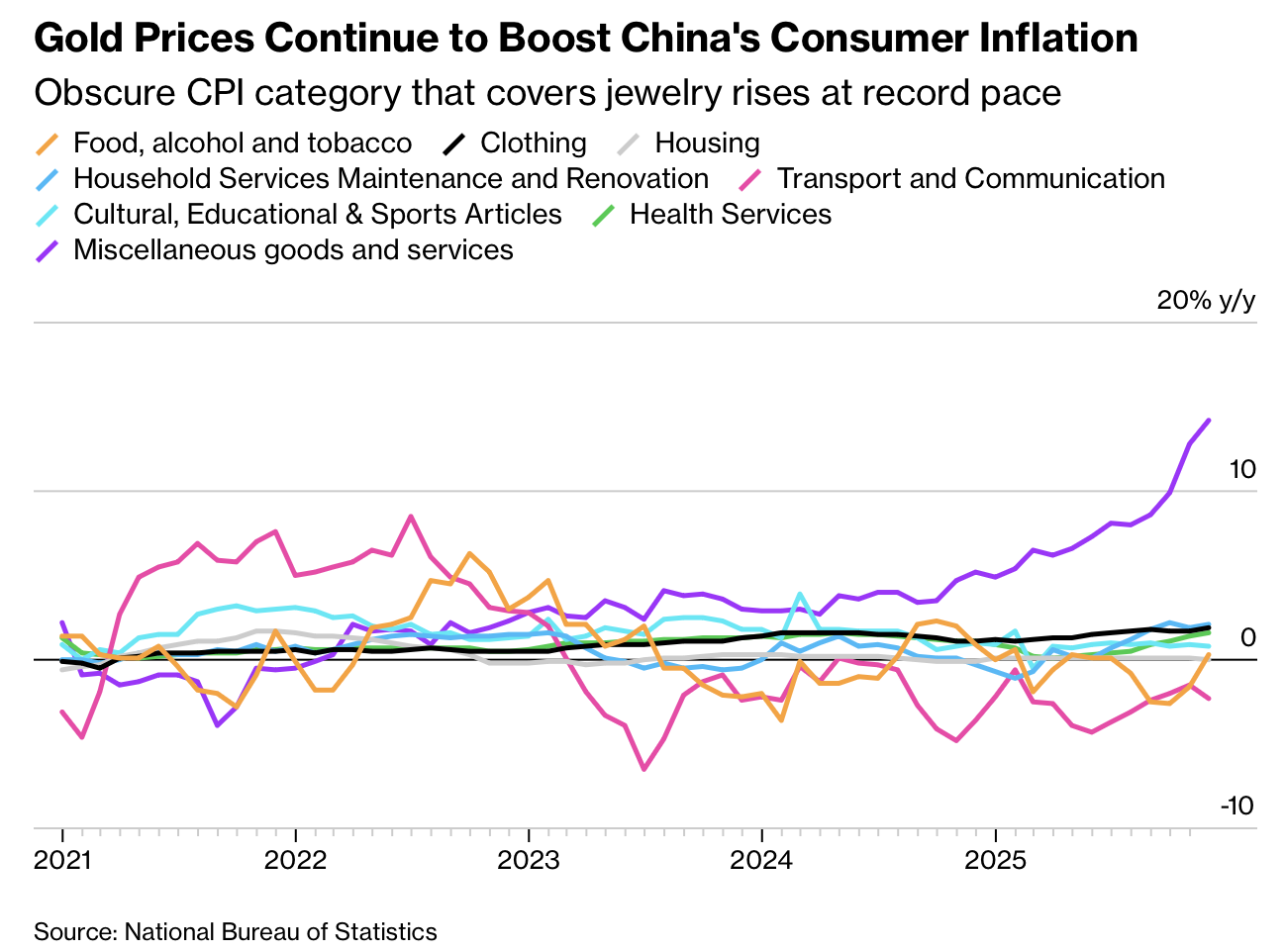

价格涨势高度不均衡。黄金首饰价格同比飙升58.4%,此前10月已上涨50.3%,推动CPI中其他用品和服务分项同比上升14.2%,创2016年有数据以来新高。食品价格自1月以来首次转为同比上涨,其中鲜菜价格跃升15%,肉类跌幅收窄;相较之下,非食品通胀回落至0.8%,受交通通信和住房成本走弱以及服务价格涨幅放缓拖累。

在内需疲弱、楼市压力与产能过剩背景下,通缩压力正在侵蚀企业利润和居民收入,即便政府试图整治无序价格竞争。PPI意外走弱后,国债收益率回吐涨幅、股市持续承压,投资者怀疑温和的CPI回升足以扭转增长与盈利前景。经济学家预期增速将进一步放缓,即便全年GDP仍可接近5%,并预计未来将有更多宽松举措,包括2026年约20个基点的政策利率下调。

China's November consumer price index (CPI) rose 0.7% year on year, the fastest pace in more than a year and the second consecutive positive reading, but underlying deflation concerns persist. Core CPI stayed at 1.2%, ending a six‑month run of acceleration, while producer prices fell 2.2%, extending factory‑gate deflation to a 38th straight month. The GDP deflator is on track to decline for a third consecutive year, the longest such stretch since market reforms began in the late 1970s.

Price gains are highly uneven. Gold jewelry prices surged 58.4% from a year earlier after a 50.3% rise in October, pushing the miscellaneous goods and services CPI category up 14.2%, a record since 2016. Food prices turned positive for the first time since January, driven by a 15% jump in fresh vegetables and smaller declines in meat, while non‑food inflation slipped to 0.8% as transport, communication and housing costs weakened and service inflation cooled.

Against a backdrop of weak domestic demand, housing stress and industrial overcapacity, deflationary pressure is eroding corporate profits and household incomes despite government efforts to curb disorderly price competition. Bond yields fell back after the PPI surprise and equities remained under pressure, as investors doubt that mild CPI gains can change the growth and earnings outlook. Economists expect further slowdown even as full‑year GDP still reaches about 5%, and foresee additional easing, including roughly 20 basis points of policy‑rate cuts in 2026.

价格涨势高度不均衡。黄金首饰价格同比飙升58.4%,此前10月已上涨50.3%,推动CPI中其他用品和服务分项同比上升14.2%,创2016年有数据以来新高。食品价格自1月以来首次转为同比上涨,其中鲜菜价格跃升15%,肉类跌幅收窄;相较之下,非食品通胀回落至0.8%,受交通通信和住房成本走弱以及服务价格涨幅放缓拖累。

在内需疲弱、楼市压力与产能过剩背景下,通缩压力正在侵蚀企业利润和居民收入,即便政府试图整治无序价格竞争。PPI意外走弱后,国债收益率回吐涨幅、股市持续承压,投资者怀疑温和的CPI回升足以扭转增长与盈利前景。经济学家预期增速将进一步放缓,即便全年GDP仍可接近5%,并预计未来将有更多宽松举措,包括2026年约20个基点的政策利率下调。

China's November consumer price index (CPI) rose 0.7% year on year, the fastest pace in more than a year and the second consecutive positive reading, but underlying deflation concerns persist. Core CPI stayed at 1.2%, ending a six‑month run of acceleration, while producer prices fell 2.2%, extending factory‑gate deflation to a 38th straight month. The GDP deflator is on track to decline for a third consecutive year, the longest such stretch since market reforms began in the late 1970s.

Price gains are highly uneven. Gold jewelry prices surged 58.4% from a year earlier after a 50.3% rise in October, pushing the miscellaneous goods and services CPI category up 14.2%, a record since 2016. Food prices turned positive for the first time since January, driven by a 15% jump in fresh vegetables and smaller declines in meat, while non‑food inflation slipped to 0.8% as transport, communication and housing costs weakened and service inflation cooled.

Against a backdrop of weak domestic demand, housing stress and industrial overcapacity, deflationary pressure is eroding corporate profits and household incomes despite government efforts to curb disorderly price competition. Bond yields fell back after the PPI surprise and equities remained under pressure, as investors doubt that mild CPI gains can change the growth and earnings outlook. Economists expect further slowdown even as full‑year GDP still reaches about 5%, and foresee additional easing, including roughly 20 basis points of policy‑rate cuts in 2026.