韩国散户以创纪录规模转向股市,11月20日融资产余额达26.8万亿韩元(180亿美元),海外证券持有量在三季度末升至1.21万亿美元,均为历史新高。政府试图引导尤其是青年远离过热房地产,但首尔房价收入比在十年间几乎翻倍,2024年购房需投入约13.9年可支配收入,显著高于纽约的约9.7年。尽管政策施压,首尔公寓价格已连续44周上涨,使韩国央行在美国关税压力下仍维持紧缩倾向,以金融稳定优先。

受股市情绪提振,Kospi 年内上涨68%,在主要市场中居首;总统李在明甚至公开瞄准指数5,000点目标。传统“全租”(jeonse)体系因诈骗丑闻与融资环境变化而衰退,削弱了年轻家庭通过全租跳板进入购房的路径,促使更多人把资金转向股票等流动性更高的资产。典型案例显示,即便收入稳定的中产家庭也认为在首尔核心区购房“几乎不可能”,从而持续增加美股等海外资产配置。

房地产与资本市场的分化加剧代际不平衡:房价不可负担、风险偏好上升、住房选择受限导致不满情绪累积。监管机构已自12月15日起收紧杠杆产品销售。决策者警告房市已接近泡沫边缘,但青年群体认为反投机政策反而“压碎购房梦想”。结构性供需失衡持续推高价格,使财富积累途径从不动产转向高波动证券,进一步放大系统性风险。

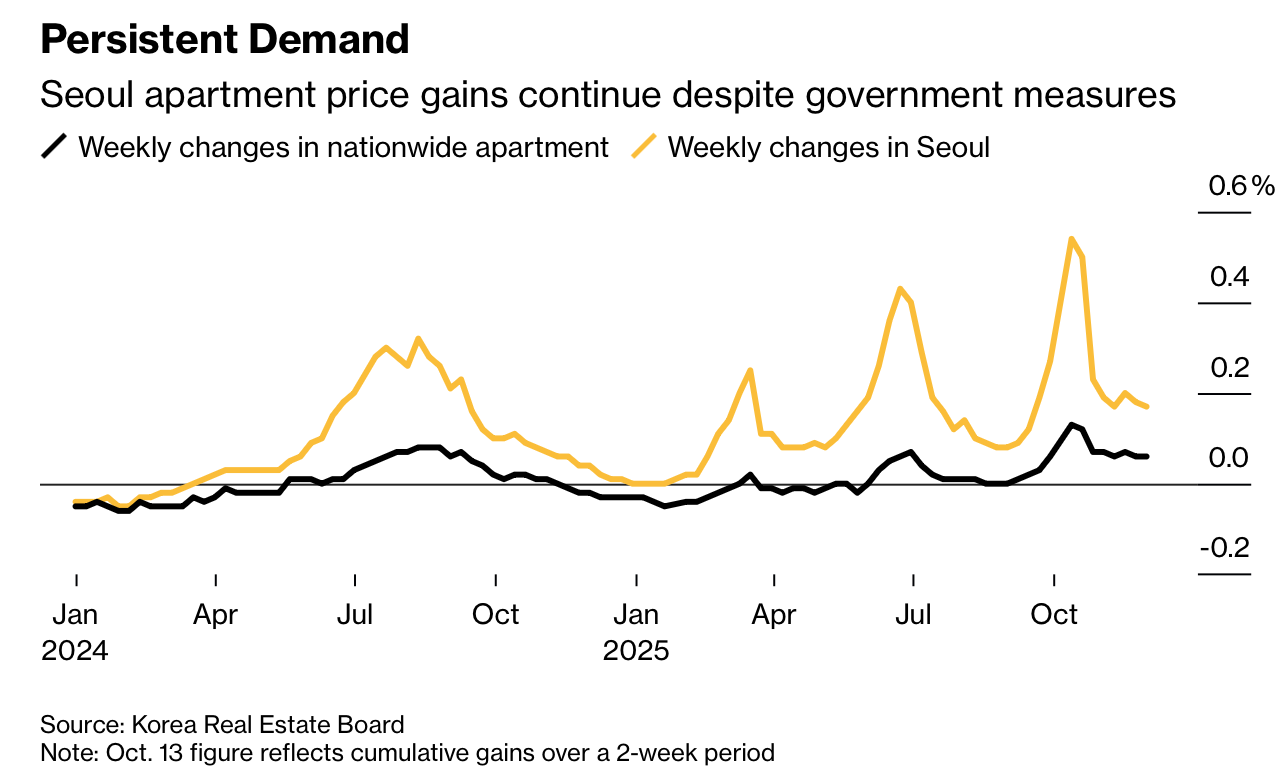

South Koreans are shifting into equities at record scale, with margin borrowing reaching an all-time high of 26.8 trillion won ($18 billion) on Nov. 20 and overseas securities holdings climbing to $1.21 trillion in Q3. Policymakers aim to steer especially younger generations away from overheating real estate, yet Seoul’s price-to-income ratio has nearly doubled in a decade, requiring 13.9 years of disposable income to buy a home in 2024 versus 9.7 years in New York. Despite interventions, Seoul apartment prices have risen for 44 consecutive weeks, prompting the Bank of Korea to prioritize financial stability over growth amid US tariff headwinds.

Retail enthusiasm has helped lift the Kospi 68% this year—the strongest among major global indices—as President Lee Jae Myung targets an index level of 5,000. The traditional jeonse lump-deposit rental system is collapsing under fraud scandals and structural shifts, removing a key stepping stone toward homeownership. As a result, even middle-income households increasingly deploy savings into domestic and US equities, viewing Seoul real estate as unattainable.

This widening divergence between asset classes is reshaping generational economics: housing affordability has eroded, risk-taking has risen, and policy measures have constrained rather than expanded young buyers’ options. Regulators will tighten rules on leveraged products from Dec. 15. Officials warn of a property bubble, while young Koreans argue anti-speculation policies have “crushed their dream” of owning a home. Structural supply-demand imbalances continue to inflate prices, pushing wealth-building away from property and into volatile financial markets.