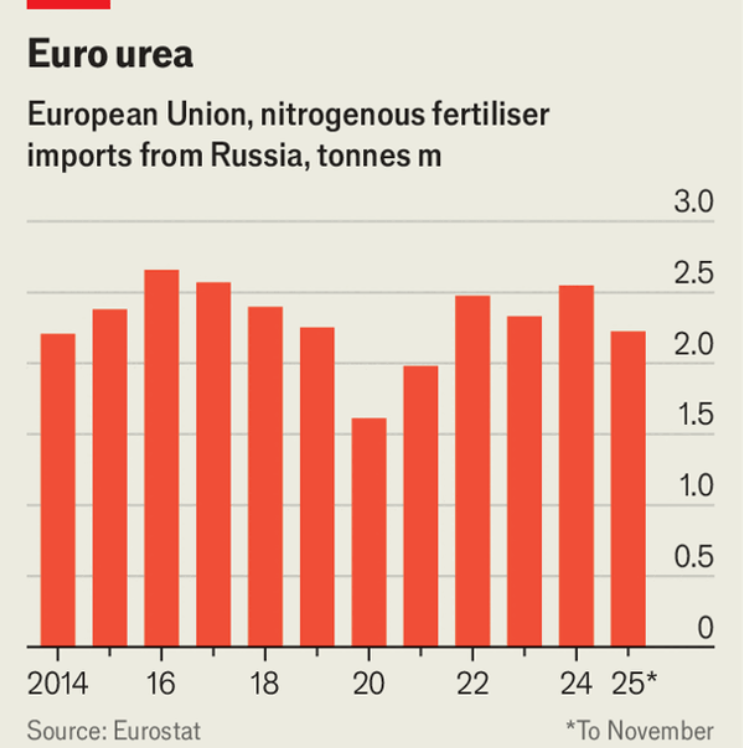

欧盟已大幅削减俄罗斯天然气进口,并于12月3日承诺在2027年9月前结束,但仍在购买俄罗斯化肥:2022年2月前俄罗斯约占欧洲农民购买化肥的30%,入侵后短暂下滑却在2025年第二季度回升到三分之一,且6月进口100万吨,为十年来最高单月。

俄罗斯以天然气制得的氢与氮合成氨并转化为最常用的含氮化肥,同时拥有磷和钾资源,整体产量约占全球化肥的五分之一;欧盟农民反对断供,因为化肥占其投入成本的15%–30%,而2020–25年成本显著上升、粮食与农产品价格下跌,并在2024年引发拖拉机抗议。

战前欧盟有120家化肥工厂并在2020年满足约70%的含氮化肥需求但依赖俄罗斯天然气或氨,入侵后产量下降70%且业内估计仅恢复了该能力的一半;对俄罗斯含氮化肥的关税去年7月从每吨€40起(对比税前$400–700),7月1日升至€60、2028年年中后升至€315,同时1月1日启动的碳边境调节机制可能抬高其他供应商价格,布鲁塞尔计划于12月18日再爆发抗议。

The EU has slashed imports of Russian natural gas and on December 3 committed to end them by September 2027, yet it still buys Russian fertiliser: before February 2022 Russia supplied about 30% of fertilisers purchased by European farmers, after a post‑invasion dip its share rebounded to one‑third by Q2 2025, and June imports hit 1 million tonnes, the highest monthly total in a decade.

Russia makes the most-used nitrogenous fertilisers by turning natural‑gas hydrogen plus nitrogen into ammonia, and it also has large phosphorus and potassium resources, producing about one‑fifth of the world’s fertiliser; EU farmers resist a cutoff because fertiliser is 15–30% of their input costs, which rose sharply in 2020–25 while grain and produce prices fell, culminating in 2024 tractor protests.

Before the invasion the EU had 120 fertiliser factories and met about 70% of nitrogenous demand in 2020 but relied on Russian gas or ammonia, then output fell 70% and only about half that capacity has returned; tariffs on Russian nitrogenous fertiliser started last July at €40 per tonne (vs $400–700 pre‑tariff), rise to €60 on July 1 and €315 after mid‑2028, while CBAM starting January 1 may push up other import prices, with another Brussels protest planned for December 18.

Source: Europe bans Russia’s gas exports, but still buys its gasbased fertiliser

Subtitle: The EU’s rising tariffs may not solve the problem

Dateline: 12月 11, 2025 06:00 上午