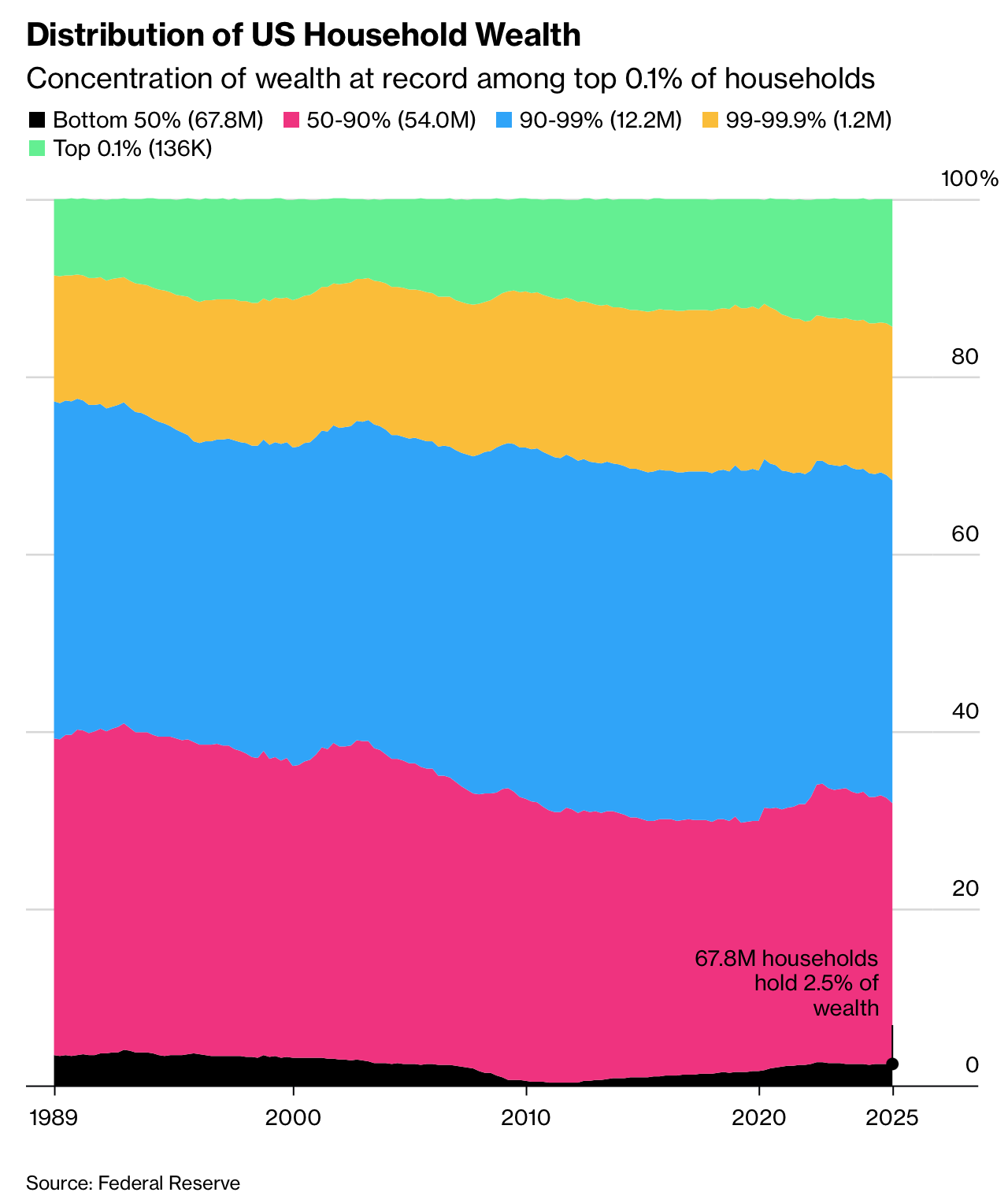

2025年,美国财富不平等显著加剧,富裕阶层大幅领先。根据Federal Reserve数据,2025年第三季度,最富有的1%家庭掌握了全国31.7%的财富,约合55万亿美元,几乎等同于底部90%家庭的总和。近几年在短暂趋稳后,不平等再度上升,主要由连续三年的股市大涨推动。由于高收入家庭资产更多配置于股票等金融资产,而中产和工薪阶层财富主要集中在房产,房价在疫情高峰后涨势明显落后,导致差距进一步扩大。

不平等的上升在最顶端尤为集中。数据显示,最富有的0.1%家庭在过去三年中财富增长约40%,是底部90%约20%增幅的两倍。联储自1989年以来的统计显示,前1%和前0.1%的财富占比均创历史新高;覆盖整个20世纪的学术估计表明,上一次出现类似集中度还是在20世纪40年代中期。全球层面,根据Bloomberg Billionaires Index,2025年全球最富有的500人一年内新增财富逾2万亿美元,本十年以来其总财富翻倍至近12万亿美元。

政策层面,分化引发了对财富税的讨论。例如加州拟通过公投对亿万富翁一次性征收5%的财富税。支持者认为这是遏制“新镀金时代”的转折点,反对者则警告资本和人才外流风险。学界亦存在分歧,有观点认为,与其直接追求降低不平等,不如聚焦改善生活水平、健康和机会本身。当前数据表明,股市与房市的分化仍在主导美国财富格局。

In 2025, US wealth inequality widened sharply, with the affluent pulling far ahead. According to data from the Federal Reserve, the top 1% of households held 31.7% of national wealth in the third quarter of 2025, about $55 trillion, nearly equal to the combined wealth of the bottom 90%. After leveling off in the late 2010s and early 2020s, inequality has risen again, driven mainly by three consecutive years of strong stock market gains. Wealthy households are more exposed to equities, while middle- and working-class families rely more on housing, whose price growth has lagged since the pandemic surge.

The gains are especially concentrated at the very top. The richest 0.1% increased their wealth by about 40% over three years, double the roughly 20% gain of the bottom 90%. Federal Reserve records since 1989 show both the top 1% and top 0.1% at all-time highs in wealth share; longer-run academic estimates suggest a comparable concentration last occurred in the mid-1940s. Globally, the Bloomberg Billionaires Index shows that the world’s 500 richest people added more than $2 trillion in 2025, with their total wealth doubling to nearly $12 trillion since the start of the decade.

These trends have fueled policy debate. Proposals such as a California ballot initiative to impose a one-time 5% wealth tax on billionaires aim to counter what some see as a new Gilded Age, while critics warn of capital flight and unintended consequences. Scholars also disagree on whether reducing inequality itself should be the goal, arguing instead for directly improving living standards, opportunity, and health. Current data underscore that divergence between stock and housing markets remains central to the US wealth divide.