过去一年中至少出现十余家新创公司,试图搭乘Polymarket与Kalshi的增长,这两家预测市场在最近融资中合计估值达190亿美元,并在监管放松与体育博彩扩张背景下吸引机构与个人交易者。Polymarket投入逾100万美元、Kalshi投入200万美元建立“builders programs”,为新公司提供数据与种子资金。部分获胜者如Polyfund获得7,500美元;其他项目如Gondor在9月募集250万美元、估值达2,500万美元,其20岁的创始人计划让用户基于预测市场持仓进行借贷;Polysights通过链上数据提供“Insider Finder”监测大额地址行为;Kairos由22岁创始人运营,整合两个平台报价并开发自动化交易与对冲工具。

这些公司声称预测市场将为机构带来“下一次10倍增长”,并将赌约当作可类比衍生品,吸引对冲基金、加密公司与经纪商。创始人普遍极年轻,多数不到30岁,有的甚至未满20岁。Kalshi的加密负责人认为这将形成新的交易生态系统;前CFTC委员Giancarlo称其反映“更年轻、更民主的精神”。与此同时,存在重大消费者风险:行业基本无监管,部分公司计划允许客户用杠杆押注,体育博彩律师警告这将构成“噩梦式场景”,在州监管下绝不会被允许。

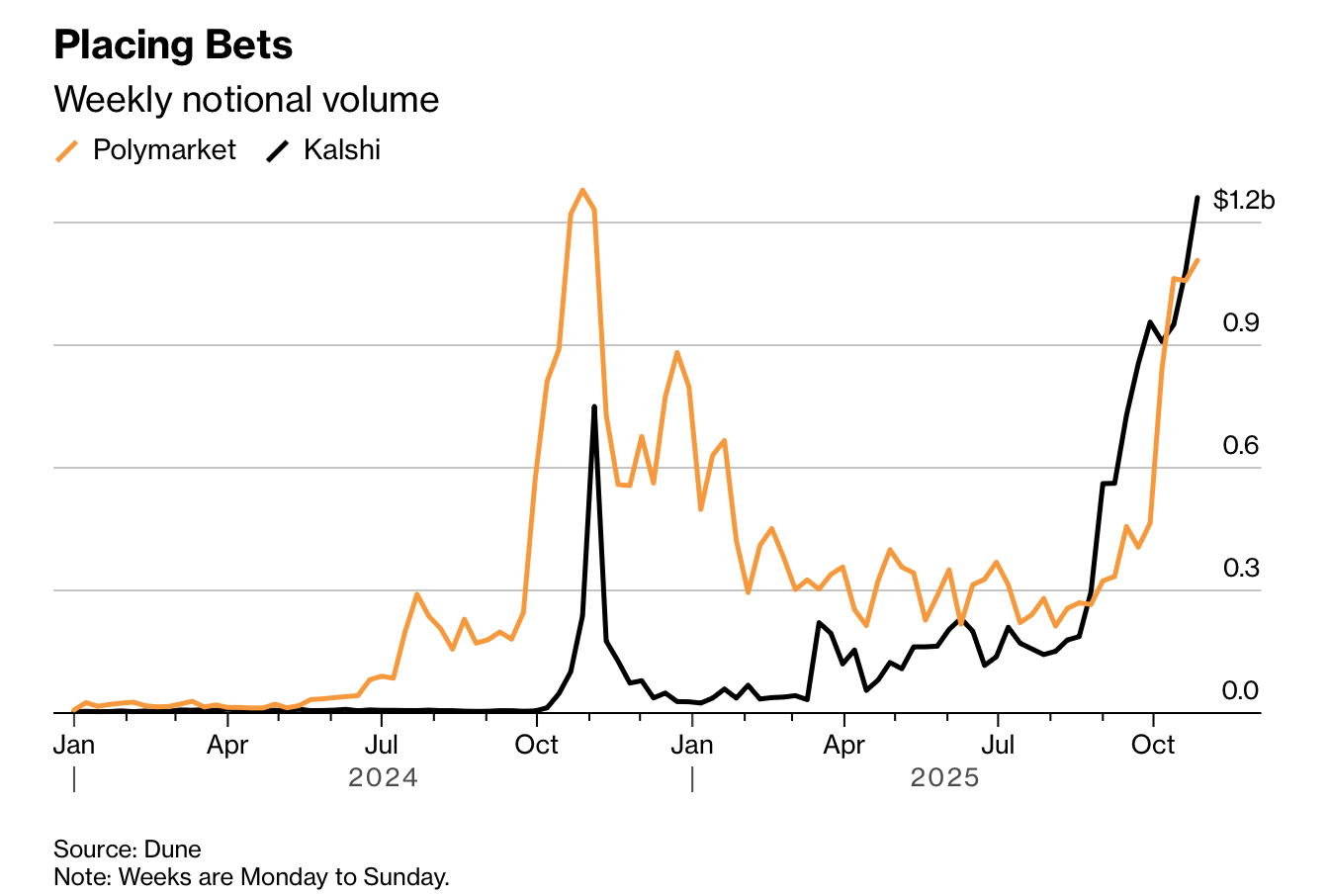

随着Truth Social计划进入博彩业务,机构开始关注预测市场在证券对冲中的应用,如用其模拟农产品期权式风险管理。预测市场交易量(周度名义规模)持续攀升,并推动相关周边工具需求。整体趋势显示:高速增长、极低监管、估值迅速扩张、创始人年轻化、机构参与增加,共同构成新博彩与预测市场赛道的核心特征。

Over the past year, at least a dozen startups have emerged to capitalize on the rise of Polymarket and Kalshi, whose latest venture rounds value them at a combined USD 19 billion amid deregulation and expanding sports betting. Polymarket has allocated over USD 1 million and Kalshi USD 2 million to “builders programs,” offering data access and seed funding. Winners such as Polyfund received USD 7,500; others, like Gondor, raised USD 2.5 million in September at a USD 25 million valuation under its 20-year-old founder to enable borrowing and lending against prediction-market portfolios. Polysights provides blockchain-based trade surveillance via its Insider Finder tool, while Kairos, run by a 22-year-old founder, aggregates prices across both platforms and develops automated trading and hedging tools.

These companies argue prediction markets could deliver “the next 10x” by positioning contracts as derivative-like instruments for hedge funds, crypto firms and brokerages. Founders are strikingly young—mostly under 30, with some not yet 20. Kalshi’s crypto head expects a new trading ecosystem; former CFTC commissioner Giancarlo says the movement reflects a “younger, more democratic ethos.” Yet major consumer risks loom: the sector operates with effectively no oversight, and some firms propose leveraged wagering, which sports-gaming attorney Daniel Wallach calls a regulatory “nightmare” that would be prohibited under state rules.

As Truth Social prepares to enter betting, institutions are exploring prediction markets for securities hedging, akin to agricultural-options risk management. Weekly notional volumes continue rising, fueling demand for auxiliary tools. The pattern is defined by rapid growth, minimal regulation, fast-climbing valuations, very young founders and increasing institutional interest—together forming the core dynamics of the new gambling and prediction-market sector.