这篇访谈描绘 AI 竞赛进入「超大交易」的新阶段:资金以数十亿美元规模涌向资料中心、互投与抢才。微软 AI 主管 Mustafa Suleyman 上任约 18 个月,曾共同创办 DeepMind(2014 年被 Google 收购)。他说代理式 AI(如 Copilot Actions)仍在「开发模式」,可自动操作浏览器但会出错;他预期在未来 6、12、最晚 18 个月内更可靠,并认为到明年节庆购物很可能可用自主代理完成。

他将「超智慧」定义为能学会任何新任务、且在所有任务上优于「全体人类总和」的系统;他主张「人本超智慧」并设下不可逾越的前提(对齐与可控是红线)。他指出微软约 50 年历史、以谨慎著称,且约 90% 的标普 500 企业依赖其邮件、作业系统与生产力工具;他预估在未来 5–10 年内,若系统出现自订目标、改写自身程式码与自主行动等能力,风险会显著上升,需更透明、审计与政府参与。

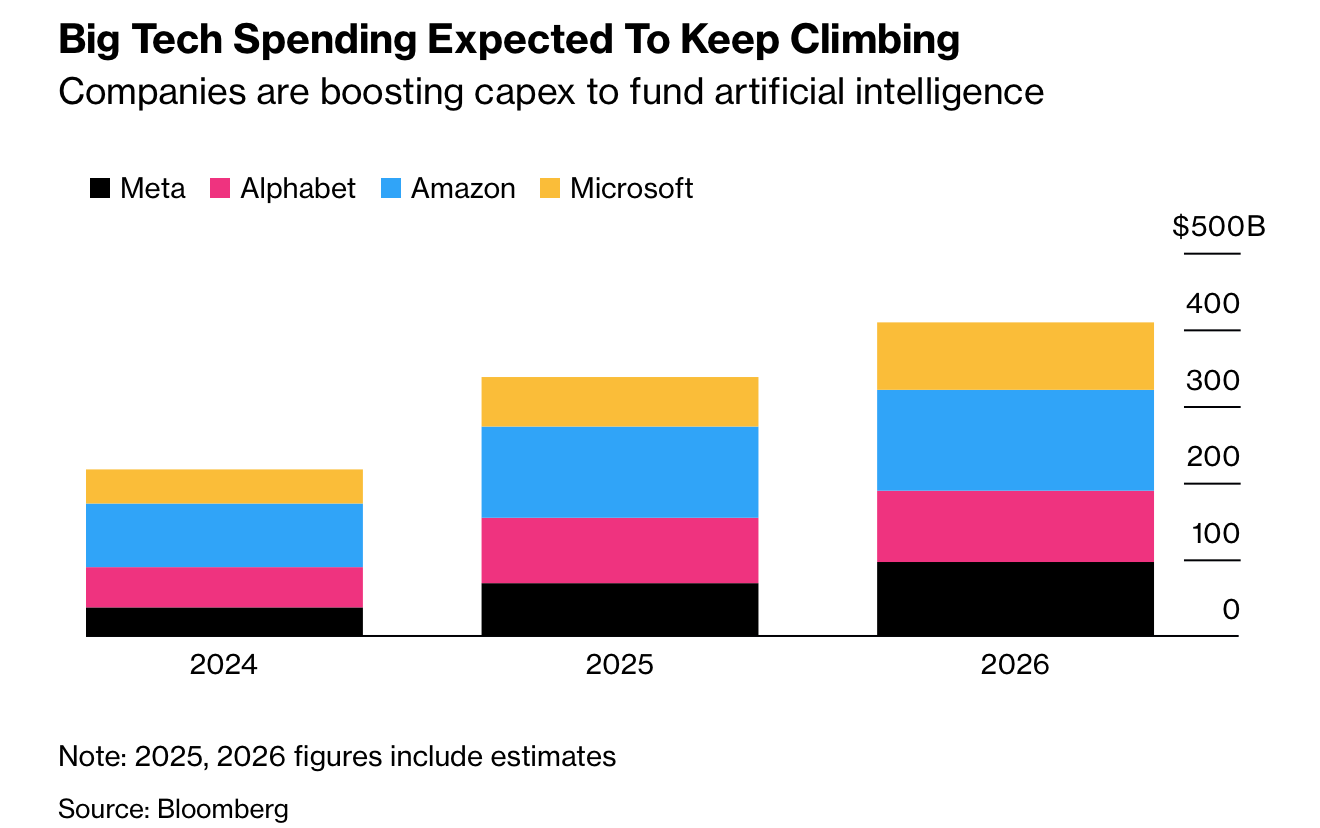

数字也用来勾勒产业赌注与成本曲线:他称 LLM/聊天机器人在 3 年内达到约 20 亿年度使用者;提到 OpenAI 在未来 5–10 年承诺约 1.5 兆美元兴建资料中心。微软仍可使用 OpenAI 模型授权至 2032 年,并以约 2800 亿美元营收支撑自研。竞争方面,他提到 Meta 的 2GW 资料中心、未来 3 年可能投入逾 6000 亿美元,而微软自称拥有约 33GW 算力;同时推理成本较两年前下降约 90%,加速普及。

The interview frames AI as entering an expensive “mega-deal” phase: billions into data centers, cross-investments, and a talent arms race. Microsoft AI chief Mustafa Suleyman (in the role ~18 months) says agentic tools like Copilot Actions can already execute browser tasks but remain error-prone and in “dev mode.” He expects reliability to improve within 6–12 months (worst case 18) and predicts consumers will likely use autonomous agents for holiday shopping by next year.

Suleyman defines “superintelligence” as a system that can learn any new task and outperform all humans combined at all tasks, arguing it raises containment and alignment risks. He promotes “humanist superintelligence” with red lines: do not proceed unless safety can be demonstrated. He links that stance to Microsoft’s ~50-year reputation and claims ~90% of the S&P 500 rely on Microsoft for email, operating systems, and productivity. He forecasts that within 5–10 years, capabilities like self-set goals, self-improving code, and autonomy could emerge, requiring audits, transparency, and government engagement.

He highlights where the numbers imply both abundance and pressure. LLMs and chatbots are described as the fastest-spreading tech: about 2 billion annual users in ~3 years. He cites OpenAI’s reported ~$1.5 trillion data-center commitments over 5–10 years, while Microsoft retains model licenses through 2032 and runs on about $280 billion in revenue. In competition, he references Meta building a 2-gigawatt data center and planning >$600 billion in spend over 3 years; Microsoft claims ~33 gigawatts of compute. He also notes inference costs have fallen ~90% versus two years ago.