技术基础设施投资结构被量化为:约40%指向资料中心与网路设备、约60%指向伺服器,显示算力与硬体供应链为主要成本驱动。公司同时揭示多项采用与需求指标:其最新模型被导入各产品;应用程式活跃使用者至十二月累计7.5亿,较截至九月的三个月期间6.5亿增加1亿,约成长15.4%。云端业务未履约合约(待认列收入)年增逾2倍至2,400亿美元;企业版付费使用者在推出四个月后超过800万,呈现以企业需求推升的扩张曲线。

云端营收年增48%至177亿美元,高于市场预期的162亿美元,成为支出扩张的主要佐证。公司亦披露供应链与内部效率讯号:对外供应专用晶片数量上限达100万颗;内部以代理系统撰写约50%程式码。其他新事业部门第四季营收3.7亿美元且较去年下滑,同期营运亏损36亿美元,明显高于分析师预估的13亿美元;自动驾驶子公司完成160亿美元募资、估值1,260亿美元,母公司承担其中相当比例。研发费用年增42%(主因为人工智慧人才薪酬与自动驾驶支援);影音平台短影片日均观看量2,000亿次,且二○二五年广告与订阅收入合计超过600亿美元。

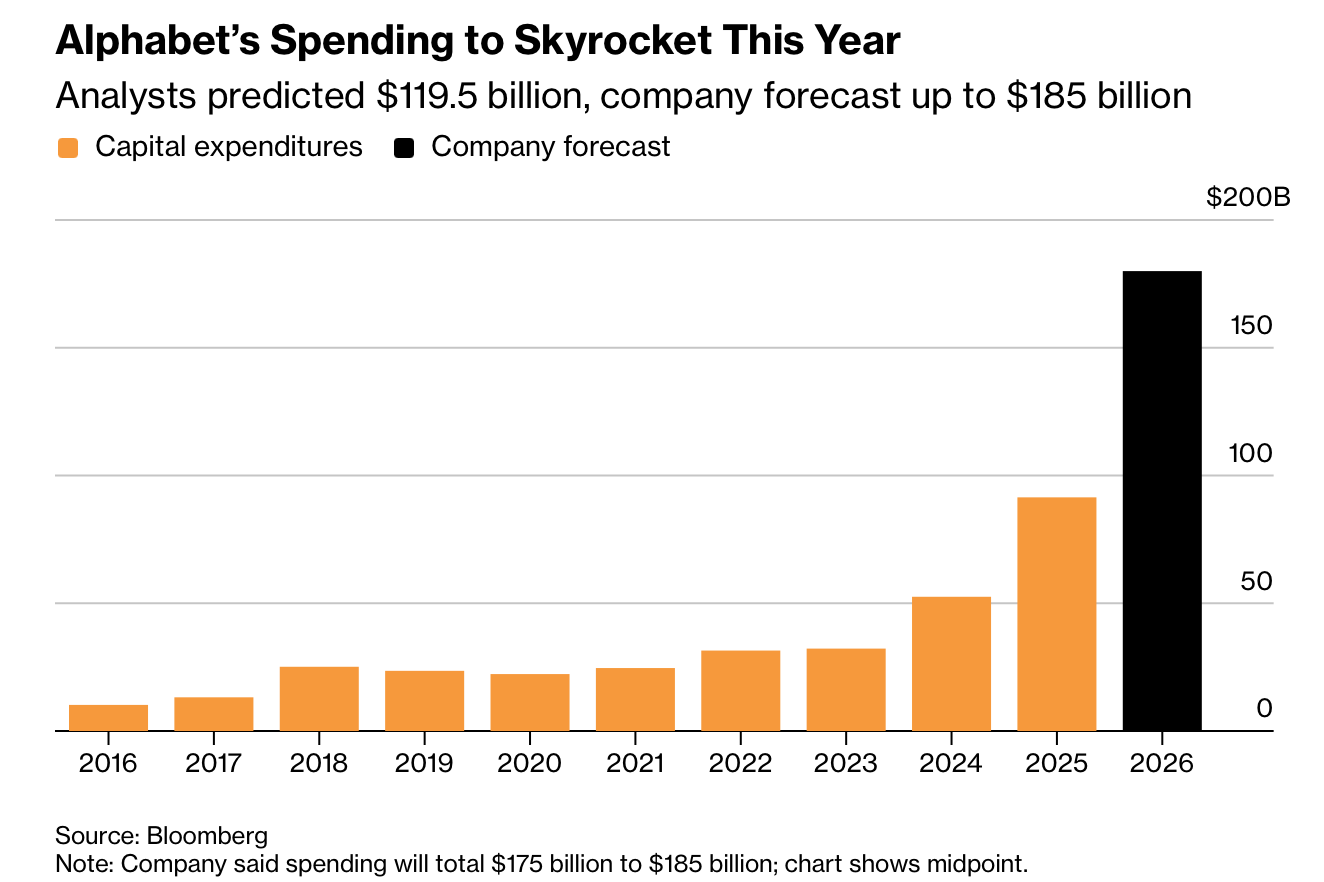

Alphabet, Google’s parent, said its 2026 capital expenditures may reach $185 billion, far above analysts’ $119.5 billion estimate and about double last year’s level, describing the move as a larger expansion on top of its combined spending from the past three years to support critical infrastructure such as data centers. Fourth-quarter revenue excluding partner payouts was $97.23 billion, beating market expectations, and management framed the surge in costs as “investment driving growth.” After the news, the stock fell 3.2% intraday to $322.52, its biggest single-day intraday drop since May, though it remains up nearly 70% from a year earlier.

The company quantified its technical infrastructure investment mix as roughly 40% for data centers and networking equipment and about 60% for servers, underscoring compute capacity and the hardware supply chain as the main cost drivers. It also highlighted adoption and demand indicators: its latest model (Gemini 3) is being integrated across products; the Gemini app reached 750 million active users through December versus 650 million in the three-month period ending in September, up 100 million or about 15.4%. Cloud backlog (contracted but unbooked revenue) more than doubled year over year to $240 billion, and Gemini Enterprise surpassed 8 million paid users just four months after launch, pointing to enterprise-led expansion.

Google Cloud revenue jumped 48% year over year to $17.7 billion, beating the $16.2 billion estimate and serving as a key justification for the spending ramp. Alphabet also pointed to supply chain and internal efficiency signals, including supplying up to one million specialized AI chips to Anthropic and having AI agents write about 50% of its own code. In Other Bets, fourth-quarter revenue was $370 million (down from last year) while operating loss widened to $3.6 billion versus analysts’ $1.3 billion forecast; Waymo completed a $16 billion funding round at a $126 billion valuation with Alphabet contributing a significant portion. R&D expenses rose 42% (driven by AI talent compensation and Waymo support), while YouTube Shorts averaged 200 billion daily views and YouTube ads plus subscriptions exceeded $60 billion in 2025.